Originally Posted by

malyla

From JTH's thread

No money lost - just time.

A lot of us have goals for where we would like our ending balance at retirement to be to allows us that magical 60%-80% of salary so we can pay to live and enjoy our retirement. To reach that goal, a constant growth is required. If that growth is zero, then that year of zero growth did not contribute to reaching the final growth and you either get more aggressive, hope the market is like the 2003-2007 where 20% B&H growth was the norm, wait another year working to reach your goal, or retire with a lower payment.

Buy and Holders (B&H) went to zero growth over the last 10 years of the market. If you moved to safety in 2008, then you saved yourself time to retirement as you didn't go to zero growth. I lost all my profits in the 2001-2003 recession as I was a buy and holder. Looking at my retirement growth curve during that time had my balance decrease down to the contribution balance which said that I could have hid my money under a mattress (assuming the gov gave me the matching contributions) and been even. Maybe I had more shares for the 2003-2007 ride up (as I bought those shares as a B&H from 1990-2001) than I would have if I had just purchased them in 2003, but if I had been a swing trader back then and sold in 2001 to rebuy in 2003, I would be ahead on the growth curve instead of where I am now due to being a B&H. I lost time being a Buy & Holder. Swing trading does take time, but time spent now saves me time in meeting my retirement goal.

The weakness I see with DCA is that you have to be lucky to retire when the market is at the height to take full advantage of DCAing. If you are unlucky enough to retire when the market has a reset to decadal lows, then you have made no profits at best and lost some savings at worst.

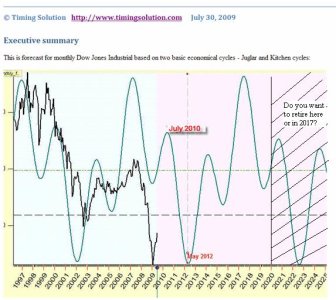

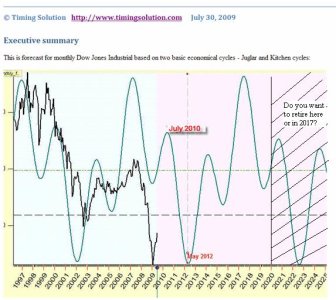

That was why I looked into the business cycle TA to see where the business cycle was predicted to be in 2020 to 2025. That wasn't giving me a warm fuzzy feeling so I changed to a trend/swing trading TA system and have heavily relied on the members of this board to learn how to do this type of trading to build my nest egg. My goal is to avoid loss, for loss takes 1.5% more time to recoop than no loss. Once again, it's a loss of time to your goal (10% growth curve for me).

There another problem with DCAing our TSP balance that everyone just ignores. It only works to accumulate shares if you never sell those shares. The moment you make an IFT, those shares in whatever fund you have are sold at that COB price and new shares are purchased in whatever fund you requested at those same COB prices. This resets the shares to the current price and you gain and lose depending on what price you originally bought those DCA'd shares at. If you bought at the bottom and sold at the top, hurrah, but if you bought all the way down and sold at the bottom, then you lost money at the time you made your latest IFT. So DCAing is at it's best only when you become a buy and holder at the bottom of a market low and ride it up to a market high. If you continue to be a pure B&H'er, then you risk riding and buying down the next market deflation. It's like buying a ticket on a roller coaster. You committed to staying for the whole ride, as a B&H, with all it's ups and downs and if you are lucky with the timing, you retire on a high market swing and rack in the retirement money. Alternately, if you want to retire but the market is at a low, you wait and retire later when the market swings up again. Time is a non-renewable resource.

I prefer a ride where I miss the water falls (canoeing/kayaking) by carrying my fund around them and getting back in the water for the gentler movements of the market (metaphor doesn't work that well as water still moves downhill and I'm looking for the uphill climb of the market, but you get my drift - miss the falls).

Not even Birchtree is a pure B&H. He does IFT at times (at least from his thread over the years) which locks in gains and losses of whatever DCAing was performed. Just some food for thought.