InsaneZane1

Investor

- Reaction score

- 2

Mild to moderate gains in all indexes this morning.

S&P Dow Jones Indices » Dow Jones Total Stock Market Indices » Overview

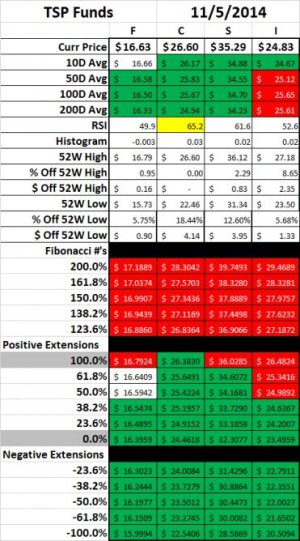

Micros and Growth stocks are weakest, which tells me the gains we are seeing this morning are possibly more of a weak, dead cat bounce then the start of the next leg up. I'd rather my own account head north again, but I still think the 10-day averages would be a good time for people who are sitting on the sidelines to target for entry points.

Jobs report = 230K actual vs 220K estimate = good news

ISM Services = 57.1 = "okay" (not bad at all, but not great either)

Looks like healthcare and geopolitics (fear of ISIS, ebola, etc.) caused consumers to close their wallets a bit. Considering that, the result seems to be artificially low. I would expect that next month's report will be better, barring additional bad news/concerns.

Don't get me wrong. I'm a fundamentals/technicals investor, and the fundamentals (earnings reports) alone give good reason to expect higher share prices over the next quarter. But the technicals half of me says it's not yet an ideal time to move back in just yet.

S&P Dow Jones Indices » Dow Jones Total Stock Market Indices » Overview

Micros and Growth stocks are weakest, which tells me the gains we are seeing this morning are possibly more of a weak, dead cat bounce then the start of the next leg up. I'd rather my own account head north again, but I still think the 10-day averages would be a good time for people who are sitting on the sidelines to target for entry points.

Jobs report = 230K actual vs 220K estimate = good news

ISM Services = 57.1 = "okay" (not bad at all, but not great either)

Looks like healthcare and geopolitics (fear of ISIS, ebola, etc.) caused consumers to close their wallets a bit. Considering that, the result seems to be artificially low. I would expect that next month's report will be better, barring additional bad news/concerns.

Don't get me wrong. I'm a fundamentals/technicals investor, and the fundamentals (earnings reports) alone give good reason to expect higher share prices over the next quarter. But the technicals half of me says it's not yet an ideal time to move back in just yet.