FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

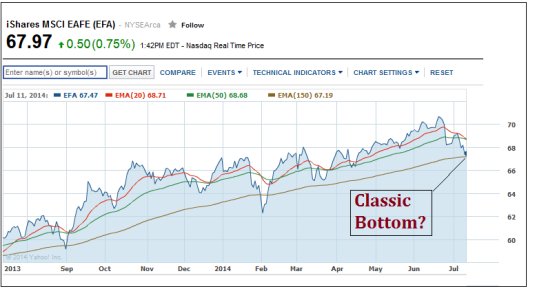

This drop might be as good (or bad) as it gets these days. Going in 50 S and 50 I.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

This drop might be as good (or bad) as it gets these days. Going in 50 S and 50 I.

I wish I had waited until today like you, but I got to eat yesterday's loss instead :blink:

Can't ever time things to the exact day. Just have to be "in the ballpark".

I'm always complaining about the deadline. I would even like if you had an hour to cancel an IFT.Given the weakness in small caps recently I was going to change my allocation from 50-S and 50-I into all I Fund.

However after hitting the IFT button on the TSP.gov website at 858 am Pacific Time (1158 am Eastern time; 2 minutes to spare) I wondered if I should wait a day or 2 and let the S fund come back up from a somewhat oversold position.

I saw the official time on my cell phone go from 900 (Pacific time) to 901. I hit the "cancel transaction" button anyway, figuring I had nothing to lose if it was too late. I was sure that I missed it, but upon further review (and a follow-up call to TSP) they told me that my 901 am cancellation would be honored.

So go figure.

I only wish we could make an IFT purchase that late (or even later in the day). That would eliminate a lot of anguish on those reversal days.

so I plan on returning back to stocks shortly (maybe Tue-Wed next week).

I hate doing that right before a Holiday but I was considering the same thing due to the new month being underway after the weekend.

QUOTE=WorkFE;468175]I hate doing that right before a Holiday but I was considering the same thing due to the new month being underway after the weekend.

It wont be another ten days on (maybe Tue-Wed next week)

That's my thinking. If I did not want to play the weekend it would be a 2-3 day play only. Also, what are the TSP hours for next friday (29th).

Thats a good question. On some holidays trading closes early. The nice thing for us is that we can make a trade right up against the closing price instead of having a few hrs to get a surprise reversal. I don't normally remember TSP being closed all day a day before Labor Day. Have seen that on some major holidays like X-Mas and Good Friday I think.

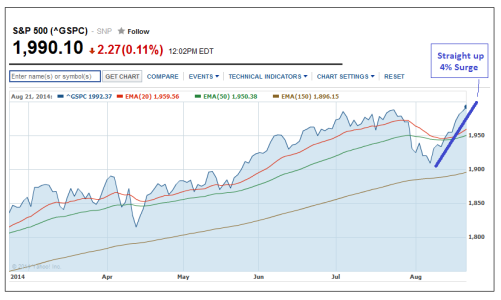

...we still have some upside, perhaps to the 2030-2050 range on the S&P (below).

View attachment 30108