-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

99percent

TSP Strategist

- Reaction score

- 5

Not wanting to spook anyone...but this is a little disconcerting.

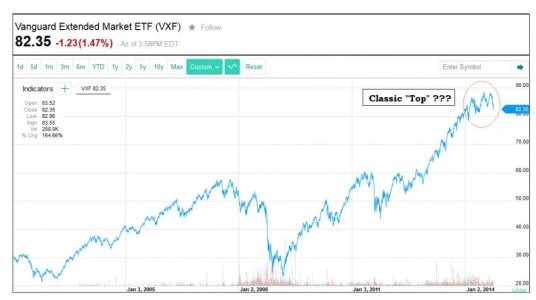

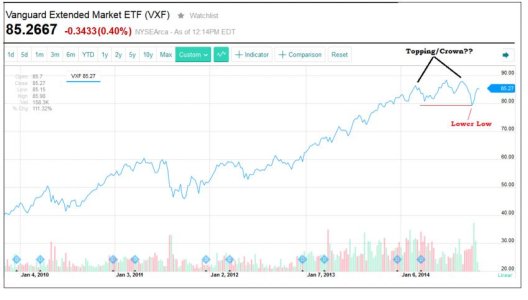

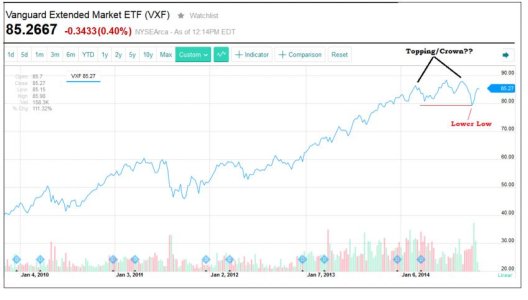

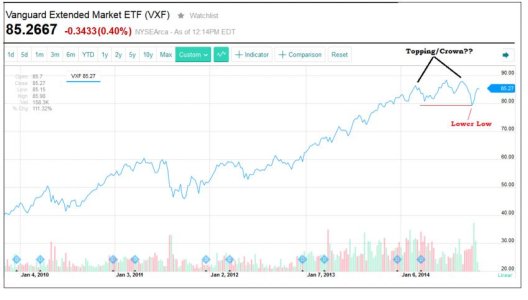

S-Fund long term chart going back about 12 years (using Vanguards Small Cap ETF)

View attachment 30435

Oh crap! Just went 100% S COB today. Yeah, I'm spooked!

Oh crap! Just went 100% S COB today. Yeah, I'm spooked!

This chart is scary. Does anyone know what the track record is for the phrase "sell Rosh Hashanah and buy Yom Kippur"?

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Not wanting to spook anyone...but this is a little disconcerting.

S-Fund long term chart going back about 12 years (using Vanguards Small Cap ETF)

View attachment 30435

Well, guess I should have listened to myself and the charts on the above post 17 days ago (lol).

Instead I got to ride over Niagara Falls in a barrel..but vowed a week ago to not sell during the free fall...instead wait for either "the bottom" or at least a Dead Cat Bounce.

So with the big surge (esp on the small caps) over the past 3 days, the question is...which one is it"?

There are some pro and con arguments regarding where we are. Some think that our Wed intra-day capitulation a few days ago suggest we've hit a bottom:

The bottom is in! Jon Najarian has 3 reasons to get back into the market

http://finance.yahoo.com/news/the-b...on-to-get-back-into-the-market-140521567.html

But others suggest we still have a ways to go. One is from Doug Kass (thanks to Mr Bowl):

7 Reasons a Recession's More Likely than You Think

Doug Kass: 7 Reasons a Recession's More Likely than You Think - TheStreet

Another was yesterday from Jeff Macke:

Stocks haven't bottomed yet

http://finance.yahoo.com/news/the-m...et-after-yesterday-s-wild-ride-113449111.html

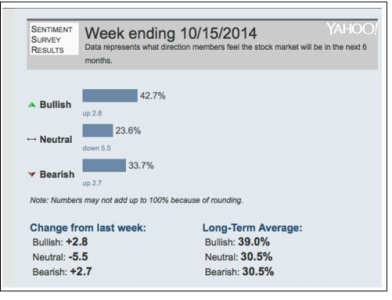

In it he pointed to the AAII Sentiment Survey ending week of Oct 15th that not only had an overly bullish sentiment but that it was an INCREASE in bullishness from the previous week. (below)

Not sure what our Sentiment survey said. If anyone has an "unofficial" number they might have seen a few hrs before the close of the survey, could you post it? Or if its the actual number maybe a PM would be better. Curious.

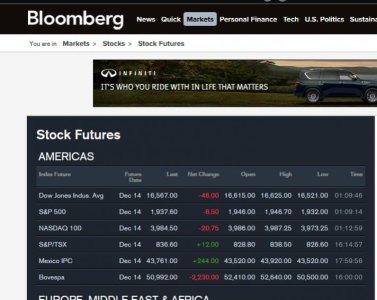

Anyway, I've sometimes noticed and read from others (maybe Tom's discussions) that once you fall below the 200 day EMA, it can initially act as resistance on your first push back upwards. Seems that's what happened here (S&P) below, as the S&P came within one point of the 200 Day EMA and turned tail like a scolded dog back to the 1886 level:

So bottom line, I locked in a 2-3% jump and bailed into the G. Am ready to jump right back in as early as Monday on a down day, but will see how early next week unfolds. Any Ebola, Putin, or negative QE news can fulfill this recent jump as a dead cat with another downward leg to go. But a further drop from here, similar to the initial fall (flag-pole effect) would make this a 13%-15% correction, maybe more than the current market should drop to, especially with sold jobs numbers recently (near quarter million new jobs and 5.9% unemployment). My bet is that we will retest the recent lows, and maybe drop a bit lower, and at that, barring catastrophic Ebola news, would make me buy in again. Did not want to be in equities Monday morning with all this volatility following a 2-3% uptick in past 3 trading days. Thats a big upward move, and when you are volatile, the next big move is often in the opposite direction. We'll see.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Not much time to expand much, but have jumped back all in...50% S and 50% C.

After the first surge off last weeks panic sell off I jumped out to lock in some gains and hedge against a Dead Cat Bounce. But Cramers take that last weeks Wednesday sell-off was to him, the bottom, seems to be coming true. To him, Ebola uncertainties were at least 50% responsible for the selloff, with Oil, Europe and China the other 50%. Now everything is stabilizing on that end, and because we have OVER-sold so much, the bounce back up is pretty furious, and todays action makes the charts NOT fit a Dead Cat Bounce pattern anymore.

Times like this there is never a good time to get in...so the quicker you decide to go in, the better. If not, there is always a move OUT we all have available, which would not be a wasted move given we're in the latter days of the month.

After the first surge off last weeks panic sell off I jumped out to lock in some gains and hedge against a Dead Cat Bounce. But Cramers take that last weeks Wednesday sell-off was to him, the bottom, seems to be coming true. To him, Ebola uncertainties were at least 50% responsible for the selloff, with Oil, Europe and China the other 50%. Now everything is stabilizing on that end, and because we have OVER-sold so much, the bounce back up is pretty furious, and todays action makes the charts NOT fit a Dead Cat Bounce pattern anymore.

Times like this there is never a good time to get in...so the quicker you decide to go in, the better. If not, there is always a move OUT we all have available, which would not be a wasted move given we're in the latter days of the month.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

S Fund up over 10% in 10 days?

Is it just me, or are we well into oversold territory and teetering for a short term sell-off???

Seems the main talking heads are crediting today's action with an "anticipated" Fed announcement tomorrow.

Runs the risk of a "buy the rumor...sell the news" even ifs the good news expected is announced.

And we're not even factoring in the "what if" something negative comes from the Fed tomorrow.

Anyone know what time the Fed Press Briefing is supposed to occur tomorrow?

Is it just me, or are we well into oversold territory and teetering for a short term sell-off???

Seems the main talking heads are crediting today's action with an "anticipated" Fed announcement tomorrow.

Runs the risk of a "buy the rumor...sell the news" even ifs the good news expected is announced.

And we're not even factoring in the "what if" something negative comes from the Fed tomorrow.

Anyone know what time the Fed Press Briefing is supposed to occur tomorrow?

Bquat

TSP Talk Royalty

- Reaction score

- 718

Don't you mean overbought?S Fund up over 10% in 10 days?

Is it just me, or are we well into oversold territory and teetering for a short term sell-off???

Seems the main talking heads are crediting today's action with an "anticipated" Fed announcement tomorrow.

Runs the risk of a "buy the rumor...sell the news" even ifs the good news expected is announced.

And we're not even factoring in the "what if" something negative comes from the Fed tomorrow.

Anyone know what time the Fed Press Briefing is supposed to occur tomorrow?

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

S Fund up over 10% in 10 days?

Is it just me, or are we well into oversold (correction...over-bought) territory and teetering for a short term sell-off???

Seems the main talking heads are crediting today's action with an "anticipated" Fed announcement tomorrow.

Runs the risk of a "buy the rumor...sell the news" even ifs the good news expected is announced.

And we're not even factoring in the "what if" something negative comes from the Fed tomorrow.

Anyone know what time the Fed Press Briefing is supposed to occur tomorrow?

Don't you mean overbought?

Thanks Bquat. Corrected in red.

Any opinions?

PLANO

TSP Pro

- Reaction score

- 79

Thanks Bquat. Corrected in red.

Any opinions?

I think Bquat was correct as well.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I know, thats why I corrected it.

PLANO

TSP Pro

- Reaction score

- 79

I know, thats why I corrected it.

You really don't get my goofy humor, do you.

Bquat

TSP Talk Royalty

- Reaction score

- 718

I don't think she'll say anything bad a week before elections. I think the end of QE is figured in already and investors are relieved with Ebola concerns dropping with nurse releases. If we weren't sove overbought and I had an IFT, I might have entered today. No I probably wouldn't have. All of my TA has been off since my exit as if the market is being bought up for the midterms. That's just paranoia on my behalf.:blink:Thanks Bquat. Corrected in red.

Any opinions?

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Exited COB Today into the G fund.

Reasons were being possibly overbought in the short term (Small caps up nearly 10% in 11 days) and ability to lock in recent gains and get back in after only 2 more trading days.

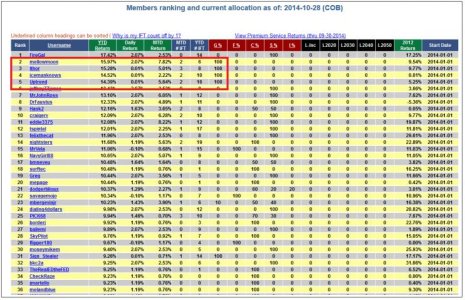

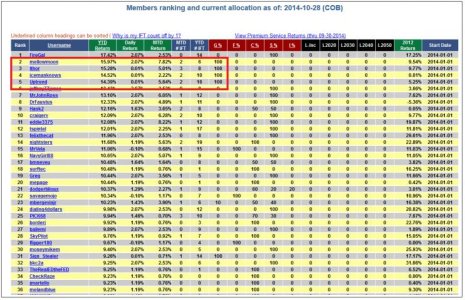

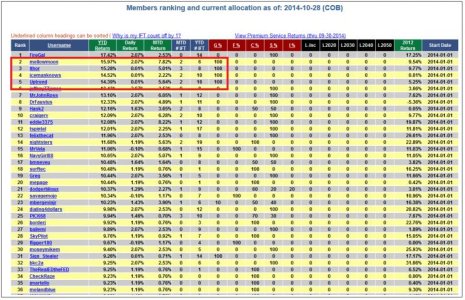

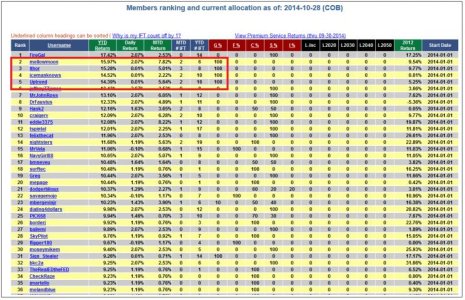

I also look at the Tracker this time of the year and the smart money tends to be a useable trend. I also look at the Tracker this time of the year and the smart money tends to be a useable trend. Noticed that most of the top 5 have also backed out into the G (below)

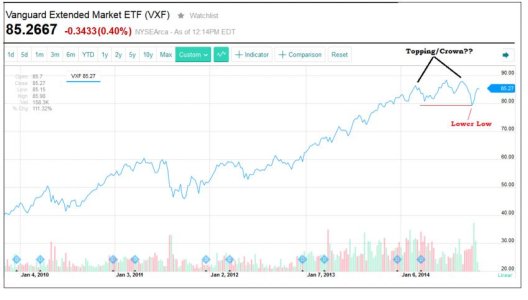

On the longer term view, its hard to avoid looking at the technical damage done in the past few months. This visible on all indices but most prominent in small caps (below) where an over extended upsurge has ended in what appears to be a volatile spiking top...along with a recent lower low.

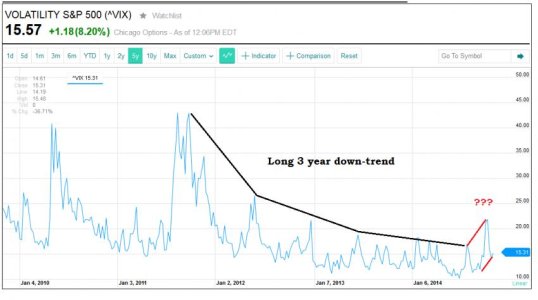

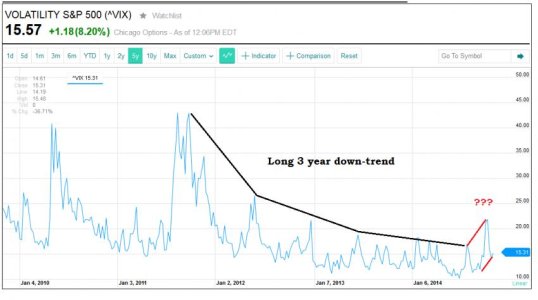

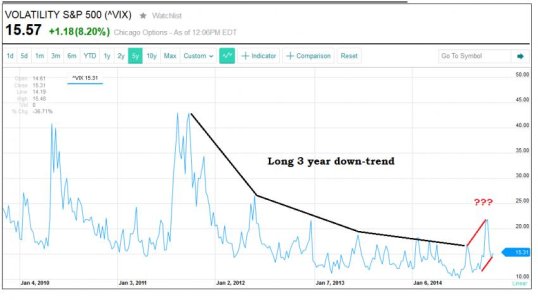

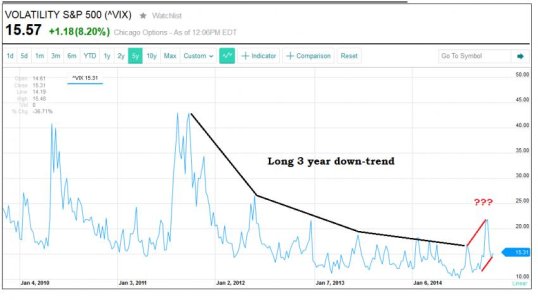

Speaking of volatility, the VIX has also changed course from the past few years, and NOT for the better. Its also up more than 8% today (not yet seen on charts)

Maybe these are all just aberration to be ignored...but I'll take that chance with 2 days left in the month before a fresh set of moves.

Fearing a "sell the news" short term event regardless of what Fed says...but with the Fed you never know.

Just hoping for an upward afternoon reversal to todays morning action after Fed announcement.

Reasons were being possibly overbought in the short term (Small caps up nearly 10% in 11 days) and ability to lock in recent gains and get back in after only 2 more trading days.

I also look at the Tracker this time of the year and the smart money tends to be a useable trend. I also look at the Tracker this time of the year and the smart money tends to be a useable trend. Noticed that most of the top 5 have also backed out into the G (below)

On the longer term view, its hard to avoid looking at the technical damage done in the past few months. This visible on all indices but most prominent in small caps (below) where an over extended upsurge has ended in what appears to be a volatile spiking top...along with a recent lower low.

Speaking of volatility, the VIX has also changed course from the past few years, and NOT for the better. Its also up more than 8% today (not yet seen on charts)

Maybe these are all just aberration to be ignored...but I'll take that chance with 2 days left in the month before a fresh set of moves.

Fearing a "sell the news" short term event regardless of what Fed says...but with the Fed you never know.

Just hoping for an upward afternoon reversal to todays morning action after Fed announcement.

Last edited by a moderator:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I will exit from 50% S and 50% C into 100% G COB today.

Reasons were multiple, one being the feeling things were over-bought in the short term,particularly small caps up 10% in 11 trading days (albiet up from a deep bottom).

Might not have exited if we were earlier in a new month but with only 2 trading days left before a fresh set of moves, risk of missing a ton of upside is minimal.

This time of year, the smart money at the top of the yearly Tracker can be a good indicator. Just noticed that 4 of our top 5 have shifted over to the -G- (below).

And in the longer term...I cannot overlook the technical damage that has been done over the past 3 months, especially evident in the -S- Fund (below).

After a 40% run-up in about 14 months, the small caps have leveled into a high volatility, crownish looking pattern that scarily resembles a top. The "lower low" we recently achieved is another worrisome trend breaker to keep in mind.

Speaking about volatility, the VIX, after a steady 3-4 year glide, has suddenly changed direction in the past few months, and NOT for the better (below).

And thats NOT even counting the 8% upward gain the VIX was making early today.

Also uncertain about Fed announcement. Seems that whenever good news is assumed ahead of time, we get a run-up before the Fed announcement then its typically either "sell the good news" or "really sell fast the bad news". Hope I'm not a day late (and a dollar short) on this one.:worried:

Reasons were multiple, one being the feeling things were over-bought in the short term,particularly small caps up 10% in 11 trading days (albiet up from a deep bottom).

Might not have exited if we were earlier in a new month but with only 2 trading days left before a fresh set of moves, risk of missing a ton of upside is minimal.

This time of year, the smart money at the top of the yearly Tracker can be a good indicator. Just noticed that 4 of our top 5 have shifted over to the -G- (below).

And in the longer term...I cannot overlook the technical damage that has been done over the past 3 months, especially evident in the -S- Fund (below).

After a 40% run-up in about 14 months, the small caps have leveled into a high volatility, crownish looking pattern that scarily resembles a top. The "lower low" we recently achieved is another worrisome trend breaker to keep in mind.

Speaking about volatility, the VIX, after a steady 3-4 year glide, has suddenly changed direction in the past few months, and NOT for the better (below).

And thats NOT even counting the 8% upward gain the VIX was making early today.

Also uncertain about Fed announcement. Seems that whenever good news is assumed ahead of time, we get a run-up before the Fed announcement then its typically either "sell the good news" or "really sell fast the bad news". Hope I'm not a day late (and a dollar short) on this one.:worried:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Looking for an entry back into equities, but wit our recent runup we've garnered some overly bullish readings on several surveys.

Our own "Sentiment Survey" went overly bullish late last week (61% Bull vs 26% bear) which is a strong "sell signal". The strongest one this year.

A similar reading in late July set us up for a 3-5% dip.

Also the larger scale AAII Sentiment (graph and story link below) and reached very high bullish levels not seen in 4 years (preceding a 12-18% drop in the indices).

Sell Low, Buy High: Individual Investors Love Stocks Again | Tumblr Blog - Yahoo Finance

So will sit tight for now and avoid temptation...my nemesis this year which has often made me "buy high".

Our own "Sentiment Survey" went overly bullish late last week (61% Bull vs 26% bear) which is a strong "sell signal". The strongest one this year.

A similar reading in late July set us up for a 3-5% dip.

Also the larger scale AAII Sentiment (graph and story link below) and reached very high bullish levels not seen in 4 years (preceding a 12-18% drop in the indices).

Sell Low, Buy High: Individual Investors Love Stocks Again | Tumblr Blog - Yahoo Finance

So will sit tight for now and avoid temptation...my nemesis this year which has often made me "buy high".

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 116