-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Better watch out...the "Dumb Money" is going in.

Going in from 100% G into 50% I and 50% S COB Today.

Actually only plan on this being a 1-2 day move. I agree with Tom, John Ross, JTH & others that we are way over-extended & ready for a quick snap back.

But I think this will wait till early next week. And I don't think it will be very serious, maybe just a 2-3% correction, then up and away into the holiday season, as our overall economy is not only on solid ground but is starting to fire up on most cylinders, along with low oil prices acting like a broad based tax cut.

So hope to garner some quick gains, but also plan on using my 2nd IFT Fri morning to go into the F fund.

Jason had some good analysis on it here:

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk-588.html#post479474

Going in from 100% G into 50% I and 50% S COB Today.

Actually only plan on this being a 1-2 day move. I agree with Tom, John Ross, JTH & others that we are way over-extended & ready for a quick snap back.

But I think this will wait till early next week. And I don't think it will be very serious, maybe just a 2-3% correction, then up and away into the holiday season, as our overall economy is not only on solid ground but is starting to fire up on most cylinders, along with low oil prices acting like a broad based tax cut.

So hope to garner some quick gains, but also plan on using my 2nd IFT Fri morning to go into the F fund.

Jason had some good analysis on it here:

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk-588.html#post479474

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

A reason to continue to be optimistic.

The Federal Reserve isn't the deciding factor in our stock market anymore.

The deciding factors are growth and profits, and the U.S. has them in spades while everyone else doesn't.

Today's news U.S. GDP grew by 3.9%, the fastest back-to-back quarters in over three years,

That's proof the market's rally is backed by higher corporate profits and that consumers feel wealthier, more secure and confident.

The Federal Reserve isn't the deciding factor in our stock market anymore.

The deciding factors are growth and profits, and the U.S. has them in spades while everyone else doesn't.

Today's news U.S. GDP grew by 3.9%, the fastest back-to-back quarters in over three years,

That's proof the market's rally is backed by higher corporate profits and that consumers feel wealthier, more secure and confident.

Jim Cramer's 'Mad Money' Recap: Who Needs the Fed When U.S. Has Growth and Profits? - TheStreet

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

RIGHT! Interest rates!

Yes those too. As Cramer says, thanks largely now to the ECB, China and Japan who, because of their slowing economies, have lowered their rates, in many cases lower than ours in the US, and that (according to Cramer) helps keep our rates from going up, despite our strong quarterly GDP near 4%.

Gotta hand it to Bernanke, Geithner and Summers, they played it beautifully back in 2009-2010, despite shrill naysayers crying "runaway inflation and rising interest rates are right around the corner" and now we're reaping the rewards today, the strongest economy in the world right now

Oh yeah, who put that economic team together back in early 2009????

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Gotta hand it to Bernanke, Geithner and Summers...

Oh yeah, who put that economic team together back in early 2009????

time will tell,

interesting, there is minimal inflation now so yesterday's free money syndrom is a thing of the past. inflation is like global warming i think, a similar arguement, the sins of our past always come back to haunt us.

sure there is no global warming now, but there's gonna be because of all the evil petro we've burnt and there's no stopping it. inflation is the same way, with a lag time between execution and evidence. sure we've reduced the deficit lately (the money in excess of what we earn) each year. but we have also increased the national debt (the total amount we owe more than we have) to $17 trillion since 2009, a frightening amount.

but life is easy, it is not us that will have to pay for global warming, just like it is not us that will have to pay for the national debt, it is our children that will pay. fortunately the delay between action and result means a different party executive will be in control when it all blows up so we can blame it on them instead.

if you think racking up $17 trillion of permanent debt via expanded entitlements and free dollar printing will not result in inflation, then i say the earth is cooling right now and has nothing to do with hydrocarbon consumption in the past.

you can't have it both ways cuz.

(i didn't mean to inject politics into an individual thread where one promotes one politician and ignores facts at the expense of another party, i just responded to it).

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

if you think racking up $17 trillion of permanent debt via expanded entitlements and free dollar printing will not result in inflation, then i say the earth is cooling right now and has nothing to do with hydrocarbon consumption in the past.

you can't have it both ways cuz.

(i didn't mean to inject politics into an individual thread where one promotes one politician and ignores facts at the expense of another party, i just responded to it).

Its OK Burro, politics and economics often go together.

But the TOTAL DEBT is not really relevant here. nearly 11 trillion of it already existed from Regan, both Bush's and to a smaller degree..Clinton. We only hear about it from one partisan side who does not want to acknowledge the latest trend in the DEFICIT.

Its the DEFICIT that has a much stronger effect on our economy, although yes a huge debt means a larger annual interest payment, but with rates so low, even that is largely irrelevant.

The big thing is that our DEFICIT has been steadily shrinking past 3 years, thanks to an improving economy and expiration of some Bush tax cuts. We actually would be near a balanced budget in 2-3 years if it weren't for the Baby Boomer entitlements increasing exponentially at the same time.

So we currently have the best of all worlds:

- Shrinking Deficit

- Accelerating GDP

- Lowering Unemployment Rate

- Strongest stock market in the world.

- Low Oil Prices (acting like an added tax cut)

- Minimal Inflation.

Stop listening to grumpy old talking heads on F-O-X just looking for something to complain about...because of all the above points "they did not make that". They actually tried to obstruct all of it...and scare us out of stocks and into gold, runaway inflation and the "2nd Shoe to Drop Depression". So ignore all those from now on.

Just sit back and enjoy the economic conditions we're in right now. They don't come around very often.

Happy Thaksgiving

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Better watch out...the "Dumb Money" is going in.

Going in from 100% G into 50% I and 50% S COB Today.

Actually only plan on this being a 1-2 day move. I agree with Tom, John Ross, JTH & others that we are way over-extended & ready for a quick snap back. It sometimes takes that long to verify, but when it does....

But I think this will wait till early next week. And I don't think it will be very serious, maybe just a 2-3% correction, then up and away into the holiday season, as our overall economy is not only on solid ground but is starting to fire up on most cylinders, along with low oil prices acting like a broad based tax cut.

So hope to garner some quick gains, but also plan on using my 2nd IFT Fri morning to go into the F fund.

Jason had some good analysis on it here:

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk-588.html#post479474

Going out.

Along with current rise of 10-12% in past 6 weeks and Toms analysis of poor seasonality of 1st week of Dec I will chose logic over greed and temptation of extending equity position into early December.

But will add that I think our overall outlook remains very good and I plan to buy back in after our first brief dip in Dec...and stay in for awhile.

I like our market leaders John Ross and FireGal rationale for the F fund...although as was pointed out by JTH, all funds have been positive or negative together for 9 moths in a row.

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk.html#post479351

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Stocks: What Do The Charts Say Now?

This was actually from about 9 days ago (Nov 21st)

This was actually from about 9 days ago (Nov 21st)

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

So far the move out of stocks and into the F-fund on the last trading day of November was the right move. Thanks to FireGal, JTH, Mr John Ross for advice.

But dilemma was when to get back in. Seasonality and sell-off coming off a peak helped spur stocks down this week, but good positive seasonality coming up and do not want to miss any of it.

The question to ponder is...are we there yet?

Not sure, but I felt that with our recent 5-8% downturn just 2 months ago it would be unlikely to get a sell off that steep again so soon and was looking for more of a 2-3% downturn to somewhere near the 50 day EMA or a little below. Well, we are there, and bloodletting days like this are the ones we're supposed to jump into, while all the weak hands get shaken out, as Jim Cramer likes to say.

But I've also promised myself that in times when I can only move into the market once but still have 2 moves, that I would move in incrementally on a big down day (as opposed to if we already bottomed and turned the upward corner).

So with that I shifted from my 100% F position (which should bag a big day & put me positive this month) into 50% S & 50% G COB Tdy.

Will see what Monday brings after long weekend.

Of note, given today's free falling, VIX was only mildly upset...actually going down with the market this morning, before turning upward a little. Avg so far is near zero.

Normally on days like this the VIX is up near 10%. Another factor that pushed me to go in, but I can't quantify it attm.

But dilemma was when to get back in. Seasonality and sell-off coming off a peak helped spur stocks down this week, but good positive seasonality coming up and do not want to miss any of it.

The question to ponder is...are we there yet?

Not sure, but I felt that with our recent 5-8% downturn just 2 months ago it would be unlikely to get a sell off that steep again so soon and was looking for more of a 2-3% downturn to somewhere near the 50 day EMA or a little below. Well, we are there, and bloodletting days like this are the ones we're supposed to jump into, while all the weak hands get shaken out, as Jim Cramer likes to say.

But I've also promised myself that in times when I can only move into the market once but still have 2 moves, that I would move in incrementally on a big down day (as opposed to if we already bottomed and turned the upward corner).

So with that I shifted from my 100% F position (which should bag a big day & put me positive this month) into 50% S & 50% G COB Tdy.

Will see what Monday brings after long weekend.

Of note, given today's free falling, VIX was only mildly upset...actually going down with the market this morning, before turning upward a little. Avg so far is near zero.

Normally on days like this the VIX is up near 10%. Another factor that pushed me to go in, but I can't quantify it attm.

JTH

TSP Legend

- Reaction score

- 1,147

So far the move out of stocks and into the F-fund on the last trading day of November was the right move. Thanks to FireGal, JTH, Mr John Ross for advice.

But dilemma was when to get back in. Seasonality and sell-off coming off a peak helped spur stocks down this week, but good positive seasonality coming up and do not want to miss any of it.

The question to ponder is...are we there yet?

Not sure, but I felt that with our recent 5-8% downturn just 2 months ago it would be unlikely to get a sell off that steep again so soon and was looking for more of a 2-3% downturn to somewhere near the 50 day EMA or a little below. Well, we are there, and bloodletting days like this are the ones we're supposed to jump into, while all the weak hands get shaken out, as Jim Cramer likes to say.

But I've also promised myself that in times when I can only move into the market once but still have 2 moves, that I would move in incrementally on a big down day (as opposed to if we already bottomed and turned the upward corner).

So with that I shifted from my 100% F position (which should bag a big day & put me positive this month) into 50% S & 50% G COB Tdy.

Will see what Monday brings after long weekend.

Of note, given today's free falling, VIX was only mildly upset...actually going down with the market this morning, before turning upward a little. Avg so far is near zero.

Normally on days like this the VIX is up near 10%. Another factor that pushed me to go in, but I can't quantify it attm.

View attachment 31546

Agreed, it was tempting to take an entry into stocks today and would have been even more tempting if I had been in the F-Fund.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

After using 1st IFT to exit F and go 50% into S COB last Fri (12th) I'm using 2nd IFT to put the rest into stocks, namely C Fund.

Didn't make the decision until a few min before deadline, but anytime you drop to the 200 day EMA (S-Fund), you really can't go wrong by going in.

From Tom's Daily Briefing (below)

Seasonality is quite good for the rest of the year and did not want to miss that opportunity.

Again, why redraw charts when Tom does such a nice job (below)

However, still many things can go wrong, and if falling oil along with a European (and Asian) recession pulls us down, then perhaps today is just part of a "Dead Cat Bounce" before much lower Low's...signaling the end of our glorious 5 1/2 year run?

Few bull runs have lasted this long.

But so far, anyone making that bet since March 2009 has lost...so with that in mind, and the blood-letting we saw the past few days, I'll go with the old FDR adage of "The Only Thing We Have to Fear, Is Fear Itself".

Didn't make the decision until a few min before deadline, but anytime you drop to the 200 day EMA (S-Fund), you really can't go wrong by going in.

From Tom's Daily Briefing (below)

Seasonality is quite good for the rest of the year and did not want to miss that opportunity.

Again, why redraw charts when Tom does such a nice job (below)

However, still many things can go wrong, and if falling oil along with a European (and Asian) recession pulls us down, then perhaps today is just part of a "Dead Cat Bounce" before much lower Low's...signaling the end of our glorious 5 1/2 year run?

Few bull runs have lasted this long.

But so far, anyone making that bet since March 2009 has lost...so with that in mind, and the blood-letting we saw the past few days, I'll go with the old FDR adage of "The Only Thing We Have to Fear, Is Fear Itself".

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Latest downturn has been blamed squarely on falling oil.

But...a guest analyst on Mad Money said that we will soon see a disconnect from "Falling Oil" and "Falling Stock Prices".

With all the stock indices pushing upward over 2% today while oil dropped near 3%, could we already be there?

Also an interesting look at recent "corrections" tied to the VIX (below).

If we assume the same overall economic environment the past 2 years (up and away) then average the last 3 BEFORE this latest one...avg comes out to near 25 on the VIX.

If so, that calls the bottom of the current one (25.2).

But...a guest analyst on Mad Money said that we will soon see a disconnect from "Falling Oil" and "Falling Stock Prices".

With all the stock indices pushing upward over 2% today while oil dropped near 3%, could we already be there?

Also an interesting look at recent "corrections" tied to the VIX (below).

If we assume the same overall economic environment the past 2 years (up and away) then average the last 3 BEFORE this latest one...avg comes out to near 25 on the VIX.

If so, that calls the bottom of the current one (25.2).

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Was today the reversal day to our brief downturn?

Some things indicate this might be so.

Despite surging quickly downward, indices bounced back strongly in the afternoon, nearly breaking even by COB. (See S Fund below).

Also the VIX actually finished strongly down...more than - 7%

Also, looking at the longer range chart S&P chart there are some other things to note:

- Average time between the bottom of a decent market drop and subsequent peak is about 4-6 weeks. Our last bottom was mid Dec, so probably too soon for a top.

- Longer term peak trend-line (orange) suggests an upcoming high near 2110 by mid January (star), up about 2.5% from now.

- So far short 2-3 day downturn hanging near 20 day EMA which is often where minor downturns bottom.

- 2 different trend-lines for market bottoms (black lines) depending on preferred time line suggest where a drop from Jan peak might go, but will focus on that later if peak price is achieved.

So right now, will remain fully invested.

I plan on incorporating a different market philosophy this year:

- In a bull market, stay fully invested 80% of the time.

- Plan exits to cash only 1-2% above previous market highs, and at least 1 month past recent market low.

- Instead of trying to time a market bottom exactly "catching a falling knife", phase into it with 2 IFT's. This worked well this past mid Dec drop.

- IF we change into a Bear Market (esp if FED rings in New Year with talk of higher rates), be prepared to change tactics.

Good Luck to all in 2015.

Some things indicate this might be so.

Despite surging quickly downward, indices bounced back strongly in the afternoon, nearly breaking even by COB. (See S Fund below).

Also the VIX actually finished strongly down...more than - 7%

Also, looking at the longer range chart S&P chart there are some other things to note:

- Average time between the bottom of a decent market drop and subsequent peak is about 4-6 weeks. Our last bottom was mid Dec, so probably too soon for a top.

- Longer term peak trend-line (orange) suggests an upcoming high near 2110 by mid January (star), up about 2.5% from now.

- So far short 2-3 day downturn hanging near 20 day EMA which is often where minor downturns bottom.

- 2 different trend-lines for market bottoms (black lines) depending on preferred time line suggest where a drop from Jan peak might go, but will focus on that later if peak price is achieved.

So right now, will remain fully invested.

I plan on incorporating a different market philosophy this year:

- In a bull market, stay fully invested 80% of the time.

- Plan exits to cash only 1-2% above previous market highs, and at least 1 month past recent market low.

- Instead of trying to time a market bottom exactly "catching a falling knife", phase into it with 2 IFT's. This worked well this past mid Dec drop.

- IF we change into a Bear Market (esp if FED rings in New Year with talk of higher rates), be prepared to change tactics.

Good Luck to all in 2015.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

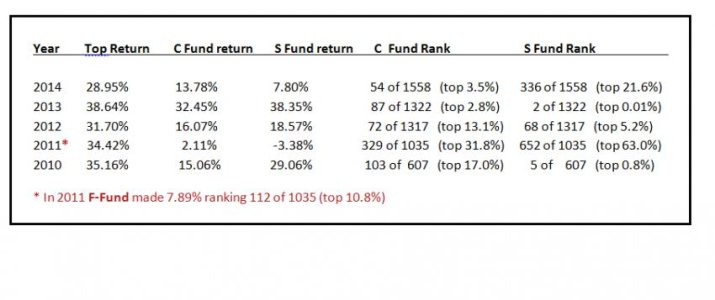

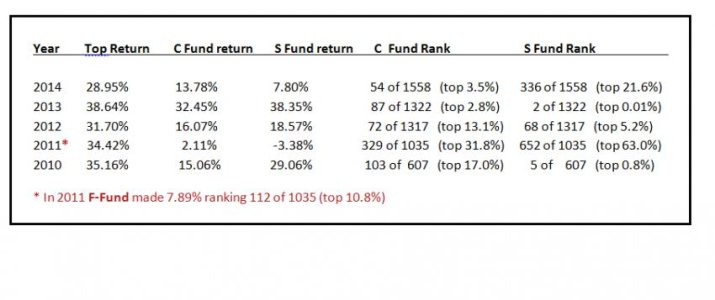

Here is the basis for changing my investment strategy this year (below).

In 4 of past 5 years the C or S fund (or combo of both) gets you into the top 10% of the tracker, with the S fund nearly winning outright once.

In the Bear year of 2011 you still would've finished in the top 3rd with the C fund, but more importantly if you recognized the Bear Market, then the F fund would put you near the top 10%.

So my NEW strategy is NOT to make a ton of IFT's. Its NOT just buy and hold, but hold for MUCH LONGER.

Of the several "tops" every year, 1 or 2 clearly telegraph themselves as crowns before dropping several percent. Catching just one and gaining at least 2-3% on the S or C funds then buying back in and sitting still for the rest of the year would allow you to to finish 2 to 3 percent ahead of the S or C funds. In 1 of the past 5 years you would finish number 1 and win the Tracker and in 3 other years you would finish in the top 3%

Ideally nailing the top 2 tops of the year could enable one to gain 4-8% on the stock funds and put you near the top every year of a Bull Market.

Question is...is this going to be a Bull Market?:notrust:

In 4 of past 5 years the C or S fund (or combo of both) gets you into the top 10% of the tracker, with the S fund nearly winning outright once.

In the Bear year of 2011 you still would've finished in the top 3rd with the C fund, but more importantly if you recognized the Bear Market, then the F fund would put you near the top 10%.

So my NEW strategy is NOT to make a ton of IFT's. Its NOT just buy and hold, but hold for MUCH LONGER.

Of the several "tops" every year, 1 or 2 clearly telegraph themselves as crowns before dropping several percent. Catching just one and gaining at least 2-3% on the S or C funds then buying back in and sitting still for the rest of the year would allow you to to finish 2 to 3 percent ahead of the S or C funds. In 1 of the past 5 years you would finish number 1 and win the Tracker and in 3 other years you would finish in the top 3%

Ideally nailing the top 2 tops of the year could enable one to gain 4-8% on the stock funds and put you near the top every year of a Bull Market.

Question is...is this going to be a Bull Market?:notrust:

Similar threads

- Replies

- 0

- Views

- 115