06/12/25

It was a news driven, choppy kind of day for the stock market that ended with the indices flat to down after an initial positive reaction to the cool inflation data, but some profit taking later on as the trade deal with China continued to evolve. The losses weren't exactly a sell the news reaction since it is not finalized, but after the S&P 500 was up 6 of the prior 7 days, taking something off the table seemed a reasonable response at some point, and I did some profit taking myself in our Plus ETF System.

(The most current commentary is always posted here: www.tsptalk.com/comments.php)

That said, we know there are dip buyers and underinvested folks out there looking to buy pullbacks, so I would expect any downside to be shallow in the short-term, barring any major shift in the economic or trade picture.

The S&P 500 was down 0.27% yesterday. The Equal Weighted S&P 500 was down 0.28%, and the S-fund's DWCPF was down 0.31%. That's basically all of the US stocks, so I thought it was interesting that the declining issues outnumbered the advancing issues, yet trading volume was positive, especially on the Nasdaq, even though the Nasdaq lagged the major indices on the downside.

The S&P 500 (C-fund) did give up half of Tuesday's gains yesterday but it is still comfortably above that old resistance line near 5980, which we think will try to hold as support now that the index is above it. As I mentioned yesterday, if 5980 breaks down, 5800 would be back in the picture and there's a small open gap in that same area as well. If 5890 holds, the old highs near 6150 are likely the next target.

The 10-year Treasury Yield created a negative outside reversal day as yesterday's high was higher than Tuesday's high, and yesterday's low was lower than Tuesday's low, and it closed well below Tuesday's low. This is good news for those looking for lower rates, however it did find support at the 50-day EMA and the ascending channel's support just below 4.45% looks firm.

Some follow up on the Dow Transportation Index, which was on the brink of a breakout above an inverted head and shoulders pattern, but it failed to breakout yesterday and fell sharply as the resistance held again, but it's probably just a matter of time before this sees 15,500+ again.

This morning we will get the PPI report (producer prices) which is equally important to the CPI inflation picture and could be a market mover if it misses estimates which are looking for a gain of 0.1% to 0.2% after being a surprising negative 0.5% last month.

The DWCPF (S-fund) has been pausing near the neckline of the inverted head and shoulders pattern. The 50-day EMA is making its way back above the 200-day average, which is a good sign for the intermediate-term, but it could mean it is overbought in the short-term. A little stalling here would not be terrible.

Here's a closer look and notice that yesterday's action in the S-fund actually created a negative outside reversal day.

The ACWX (I-fund) closed positive as the dollar fell again, and this index has only been down one day this month so far and the trend has been unrelenting.

BND (bonds / F-fund) busted through the top of its channel again. Will the fourth time be the charm? Support held at the 50-day EMA and a move above that prior peak could be changing the descending trend.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

It was a news driven, choppy kind of day for the stock market that ended with the indices flat to down after an initial positive reaction to the cool inflation data, but some profit taking later on as the trade deal with China continued to evolve. The losses weren't exactly a sell the news reaction since it is not finalized, but after the S&P 500 was up 6 of the prior 7 days, taking something off the table seemed a reasonable response at some point, and I did some profit taking myself in our Plus ETF System.

(The most current commentary is always posted here: www.tsptalk.com/comments.php)

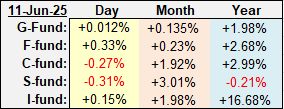

| Daily TSP Funds Return More returns |

That said, we know there are dip buyers and underinvested folks out there looking to buy pullbacks, so I would expect any downside to be shallow in the short-term, barring any major shift in the economic or trade picture.

The S&P 500 was down 0.27% yesterday. The Equal Weighted S&P 500 was down 0.28%, and the S-fund's DWCPF was down 0.31%. That's basically all of the US stocks, so I thought it was interesting that the declining issues outnumbered the advancing issues, yet trading volume was positive, especially on the Nasdaq, even though the Nasdaq lagged the major indices on the downside.

The S&P 500 (C-fund) did give up half of Tuesday's gains yesterday but it is still comfortably above that old resistance line near 5980, which we think will try to hold as support now that the index is above it. As I mentioned yesterday, if 5980 breaks down, 5800 would be back in the picture and there's a small open gap in that same area as well. If 5890 holds, the old highs near 6150 are likely the next target.

The 10-year Treasury Yield created a negative outside reversal day as yesterday's high was higher than Tuesday's high, and yesterday's low was lower than Tuesday's low, and it closed well below Tuesday's low. This is good news for those looking for lower rates, however it did find support at the 50-day EMA and the ascending channel's support just below 4.45% looks firm.

Some follow up on the Dow Transportation Index, which was on the brink of a breakout above an inverted head and shoulders pattern, but it failed to breakout yesterday and fell sharply as the resistance held again, but it's probably just a matter of time before this sees 15,500+ again.

This morning we will get the PPI report (producer prices) which is equally important to the CPI inflation picture and could be a market mover if it misses estimates which are looking for a gain of 0.1% to 0.2% after being a surprising negative 0.5% last month.

The DWCPF (S-fund) has been pausing near the neckline of the inverted head and shoulders pattern. The 50-day EMA is making its way back above the 200-day average, which is a good sign for the intermediate-term, but it could mean it is overbought in the short-term. A little stalling here would not be terrible.

Here's a closer look and notice that yesterday's action in the S-fund actually created a negative outside reversal day.

The ACWX (I-fund) closed positive as the dollar fell again, and this index has only been down one day this month so far and the trend has been unrelenting.

BND (bonds / F-fund) busted through the top of its channel again. Will the fourth time be the charm? Support held at the 50-day EMA and a move above that prior peak could be changing the descending trend.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.