01/27/26

Stocks were mixed on Monday but you would never know it looking at the big three indices. The Dow gained over 300-points, while the S&P 500 and Nasdaq also gained about a half of a percent. Small caps lagged again, as the S-fund charts flirts with key support. The I-fund keeps its winning ways going and the dollar's weakness has been its catalyst.

Despite all the green in the major indices, the internal numbers were flat at best, and in the case of the Nasdaq, trading volume saw declining volume outnumber advancing volume by a 4 to 3 ratio.

Not that this means stocks are about to rollover, but being a very busy week, I think the buying was more tentative than the indices suggested.

And just a reminder of how busy this week will be: The Fed FOMC 2-day meeting starts today. We will get earnings from Magnificent 7 companies this week: Tesla, Meta, Microsoft, and Apple. We will get the PPI data (Producer Price Index) on Friday. And another government shutdown is looming at the end of the week.

The dollar gapped down yesterday, as it filled in an old open gap from October. There are a couple more open gaps below that, but now we have a couple overhead as well, so that could be a battle as it trades between the two sets of open gaps.

The 10-year Treasury Yield came down to test the top of its bull flag and the 200-day average. That is typically a good place for it to find support, but since we're taking about gaps, there is one (red) back inside the flag near 4.16%.

Back to the dollar's weakness - commodities tend to do well when the dollar is falling, and we saw that in the natural gas market recently, and of course gold and silver.

Silver hit another all time high yesterday after gapping up again. It did close well off the high of the day and the trading volume in SLV, the silver ETF, tells us that yesterday's peak may have some significance. I can't verify this but I heard there are approximately 500 million outstanding shares of SLV, and yesterday there were 380 millions shares traded.

The S&P 500 (C-fund) had a solid gain of 0.50% yesterday and it closed above a level that I was worried it may have trouble getting over - 6950, based on the Wyckoff Distribution pattern. That's not very scientific, and it is still in the area after retracing a bearish breakdown candlestick. It is making some bullish progress, but with plenty of catalysts this week, let's see how it survives this busy news week. Both the bulls and the bears have an opportunity here to make a stand.

The Nasdaq 100 chart is looking better as it retests the 25,800 area again. If it keeps knocking, eventually that door may open to retest the October highs.

What has been missing from the rally in stocks lately has been the Magnificent 7 trade, and yesterday the Mag 7 ETF made a move to try to break its recent downtrend. The Nasdaq will likely need these big tech companies to breakout before it hits any new high. It could happen but we may know more after the bell tomorrow when Tesla and Microsoft report earnings.

Trump announced an increase in South Korean tariffs yesterday, although it does not seem to include memory chips. The futures were not phased.

Additional TSP Fund Charts:

The DWCPF (S-fund) is finding support in the right place, but that open gap near 2525 looks enticing to the bears for a possible pullback. The recent weakness in small caps looks inviting and the 2600 area looks like possible firm support, but a move below that area would almost guarantee a move to that 2525 spot. That would hurt.

The ACWX (I-fund) made new highs again with that dollar plummeting. This is not super growth in the international markets. It's the prices going up because the dollar is going down. If the dollar goes up, this would likely pullback. Why would the dollar go up? Perhaps if the Fed is more hawkish in tomorrow's policy statement.

BND (bonds / F-fund) rallied again as the 10-year Treasury Yield pulled back to test support. If that yield holds at support, this could easily pull back again. The closer BND gets to the top of its trading channel and the old highs, the more risky this becomes in the short-term.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks were mixed on Monday but you would never know it looking at the big three indices. The Dow gained over 300-points, while the S&P 500 and Nasdaq also gained about a half of a percent. Small caps lagged again, as the S-fund charts flirts with key support. The I-fund keeps its winning ways going and the dollar's weakness has been its catalyst.

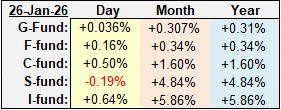

| Daily TSP Funds Return More returns |

Despite all the green in the major indices, the internal numbers were flat at best, and in the case of the Nasdaq, trading volume saw declining volume outnumber advancing volume by a 4 to 3 ratio.

Not that this means stocks are about to rollover, but being a very busy week, I think the buying was more tentative than the indices suggested.

And just a reminder of how busy this week will be: The Fed FOMC 2-day meeting starts today. We will get earnings from Magnificent 7 companies this week: Tesla, Meta, Microsoft, and Apple. We will get the PPI data (Producer Price Index) on Friday. And another government shutdown is looming at the end of the week.

The dollar gapped down yesterday, as it filled in an old open gap from October. There are a couple more open gaps below that, but now we have a couple overhead as well, so that could be a battle as it trades between the two sets of open gaps.

The 10-year Treasury Yield came down to test the top of its bull flag and the 200-day average. That is typically a good place for it to find support, but since we're taking about gaps, there is one (red) back inside the flag near 4.16%.

Back to the dollar's weakness - commodities tend to do well when the dollar is falling, and we saw that in the natural gas market recently, and of course gold and silver.

Silver hit another all time high yesterday after gapping up again. It did close well off the high of the day and the trading volume in SLV, the silver ETF, tells us that yesterday's peak may have some significance. I can't verify this but I heard there are approximately 500 million outstanding shares of SLV, and yesterday there were 380 millions shares traded.

The S&P 500 (C-fund) had a solid gain of 0.50% yesterday and it closed above a level that I was worried it may have trouble getting over - 6950, based on the Wyckoff Distribution pattern. That's not very scientific, and it is still in the area after retracing a bearish breakdown candlestick. It is making some bullish progress, but with plenty of catalysts this week, let's see how it survives this busy news week. Both the bulls and the bears have an opportunity here to make a stand.

The Nasdaq 100 chart is looking better as it retests the 25,800 area again. If it keeps knocking, eventually that door may open to retest the October highs.

What has been missing from the rally in stocks lately has been the Magnificent 7 trade, and yesterday the Mag 7 ETF made a move to try to break its recent downtrend. The Nasdaq will likely need these big tech companies to breakout before it hits any new high. It could happen but we may know more after the bell tomorrow when Tesla and Microsoft report earnings.

Trump announced an increase in South Korean tariffs yesterday, although it does not seem to include memory chips. The futures were not phased.

Additional TSP Fund Charts:

The DWCPF (S-fund) is finding support in the right place, but that open gap near 2525 looks enticing to the bears for a possible pullback. The recent weakness in small caps looks inviting and the 2600 area looks like possible firm support, but a move below that area would almost guarantee a move to that 2525 spot. That would hurt.

The ACWX (I-fund) made new highs again with that dollar plummeting. This is not super growth in the international markets. It's the prices going up because the dollar is going down. If the dollar goes up, this would likely pullback. Why would the dollar go up? Perhaps if the Fed is more hawkish in tomorrow's policy statement.

BND (bonds / F-fund) rallied again as the 10-year Treasury Yield pulled back to test support. If that yield holds at support, this could easily pull back again. The closer BND gets to the top of its trading channel and the old highs, the more risky this becomes in the short-term.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.