01/15/26

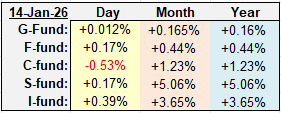

If you look at just the big three indices, it looked like a poor day for the stock market yesterday, but small caps and the I-fund actually gained ground on the day. Inflation data is cooling and that sent yields lower, helping the S-fun, but the chances of a rate cut in the coming months has been declining.

Reminder: I have some personal plans this week so the commentaries may be a little brief, and I may not respond to emails as quickly as I'd normally like to. I apologize for any inconvenience this may cause.

After Tuesday's cool CPI data, the PPI data came in better than expected on Wednesday. So while the large caps were rocked a bit yesterday, yields and the dollar fell, helping the case for small caps and international stocks.

The churning within the moving averages continues for the 10-year Treasury. Between the consolidating here and in the S&P 500, there is likely a big move coming in the near future.

There was a lot of red in the Dow, S&P 500, and Nasdaq yesterday, but look at the market breadth: Many more stocks were up than down on the day, even on the Nasdaq. And look at the new highs / new lows ratios.

The S&P 500 (C-fund) lost a half of a percent yesterday, meanwhile the Equal Weighted S&P 500 Index (same 500 stocks) was up 0.40%. That's very uncommon. The chart fell through some support yesterday, and if not for a late rebound, it could have closed below a couple of other key support lines. As I touched on yesterday, the inverted head and shoulders patterns are generally very bullish, but the longer it hangs around the previous highs, the more vulnerable it is to a Wyckoff distribution decline.

Here is a chart of the Wyckoff distribution pattern and you can see why that rising blue support line above needs to hold as the S&P trades in the "UTAD" area in Zone C.

Source: https://www.chartguys.com/chart-patterns/wyckoff-distribution

Oil had been spiking on the concerns that the US could get involved in the Iranian revolution. Yesterday President Trump downplayed that and oil backed off once again from the 200-day average. It's a little obscured on the left side of this chart, but the air strikes on Iran back in June was the last time oil moved meaningfully above that 200-day average, but it didn't last long. Otherwise the down trend has been resuming after that average gets tested.

Admin note: We plan to have annual subscription sale during the week of January 19 - 23. More details to follow but we did move upcoming expiring annual subscription dates out until that day so you can renew that week without a lapse. As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on another year to your current subscriptions at the sale price. Also, we are considering a price increase after the sale, so this will lock in the lower price. As you can imagine, the costs of doing business has gone up quite a bit in the last 20 years and the TSP Talk Plus and Revshark premium service prices have remained the same since the day they started. A cure for that would be more subscribers so, spread the word and we may leave prices alone. That's a bribe.

DWCPF (S-fund) rallied again despite the weakness in the larger indices. It has been holding its breakout area making its 4th consecutive close above the neckline of the inverted head and shoulders pattern. This looks good. The question is, can it hold if the S&P 500 does pullback?

The ACWX (I-fund index) had another great day as it continues to push the upper boundary of its rising trading channel. The dollar was down, and that could keep a pep in the step of this chart, but the open gaps below makes it look a little vulnerable in the short-term.

BND (bonds / F-fund) broke out above the late 2025 highs after the two days of weak inflation data. It is still in the area of resistance and the 10-year Yield is still oscillating between support and resistance as we await that resolution. Lower yields would help this breakout to the upside.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

If you look at just the big three indices, it looked like a poor day for the stock market yesterday, but small caps and the I-fund actually gained ground on the day. Inflation data is cooling and that sent yields lower, helping the S-fun, but the chances of a rate cut in the coming months has been declining.

| Daily TSP Funds Return More returns |

Reminder: I have some personal plans this week so the commentaries may be a little brief, and I may not respond to emails as quickly as I'd normally like to. I apologize for any inconvenience this may cause.

After Tuesday's cool CPI data, the PPI data came in better than expected on Wednesday. So while the large caps were rocked a bit yesterday, yields and the dollar fell, helping the case for small caps and international stocks.

The churning within the moving averages continues for the 10-year Treasury. Between the consolidating here and in the S&P 500, there is likely a big move coming in the near future.

There was a lot of red in the Dow, S&P 500, and Nasdaq yesterday, but look at the market breadth: Many more stocks were up than down on the day, even on the Nasdaq. And look at the new highs / new lows ratios.

The S&P 500 (C-fund) lost a half of a percent yesterday, meanwhile the Equal Weighted S&P 500 Index (same 500 stocks) was up 0.40%. That's very uncommon. The chart fell through some support yesterday, and if not for a late rebound, it could have closed below a couple of other key support lines. As I touched on yesterday, the inverted head and shoulders patterns are generally very bullish, but the longer it hangs around the previous highs, the more vulnerable it is to a Wyckoff distribution decline.

Here is a chart of the Wyckoff distribution pattern and you can see why that rising blue support line above needs to hold as the S&P trades in the "UTAD" area in Zone C.

Source: https://www.chartguys.com/chart-patterns/wyckoff-distribution

Oil had been spiking on the concerns that the US could get involved in the Iranian revolution. Yesterday President Trump downplayed that and oil backed off once again from the 200-day average. It's a little obscured on the left side of this chart, but the air strikes on Iran back in June was the last time oil moved meaningfully above that 200-day average, but it didn't last long. Otherwise the down trend has been resuming after that average gets tested.

Admin note: We plan to have annual subscription sale during the week of January 19 - 23. More details to follow but we did move upcoming expiring annual subscription dates out until that day so you can renew that week without a lapse. As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on another year to your current subscriptions at the sale price. Also, we are considering a price increase after the sale, so this will lock in the lower price. As you can imagine, the costs of doing business has gone up quite a bit in the last 20 years and the TSP Talk Plus and Revshark premium service prices have remained the same since the day they started. A cure for that would be more subscribers so, spread the word and we may leave prices alone. That's a bribe.

DWCPF (S-fund) rallied again despite the weakness in the larger indices. It has been holding its breakout area making its 4th consecutive close above the neckline of the inverted head and shoulders pattern. This looks good. The question is, can it hold if the S&P 500 does pullback?

The ACWX (I-fund index) had another great day as it continues to push the upper boundary of its rising trading channel. The dollar was down, and that could keep a pep in the step of this chart, but the open gaps below makes it look a little vulnerable in the short-term.

BND (bonds / F-fund) broke out above the late 2025 highs after the two days of weak inflation data. It is still in the area of resistance and the 10-year Yield is still oscillating between support and resistance as we await that resolution. Lower yields would help this breakout to the upside.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.