01/30/26

Stocks nearly completed a round trip day as the S&P 500 battled back from an early 107-point loss, to end the day down just 9-points. We saw two Mag 7 stocks move 10% on the day; Microsoft was down 10%, and Meta was up 10%. After hours Apple added to the bullish case with blow out earnings. The dollar and yields stabilized a bit.

Microsoft's loss yesterday accounted for a market cap loss of about $350 billion. There are only about 25 companies in the US that even have a market cap of $350 billion or more, so yesterday they lost the entire value of companies like Coca Cola, Chevron, Netflix, IBM, and McDonalds.

Apple came out with very good earnings after the bell, but they were having trouble holding onto a 1% gain after hours. That may be enough to gap up the indices since Apple is the 3rd largest company right now, with a market cap of $3.8 trillion, and in early trading after hours it had broken above its descending resistance line, but it was slipping as the evening wore on.

Yesterday's massive positive reversal in the S&P 500 usually means gains the following day, or at least in early trading. But the rare huge reversal was only temporary after prior similar reversals. Obviously the dip buyers were not hiding and it all seemed to start when the 50-day moving average was successfully tested.

That was almost perfect bullish technical action, but we still had a failed breakout after Wednesday's new high. The reversal was so big that I wanted to highlight it here showing that we do tend to see some upside after these, but it doesn't always hold. Apple may help, assuming their gains hold into today.

The I-fund did something recently that it hasn't done in more than a decade. Whether we look at the current ACWX, which seems to be the closest match we have to our new I-fund, or the EFA, which was the old I-fund, the ratio between them and the S&P 500 just moved above its 200-day moving average for the first time in a long, long time. We have seen several attempts at crossing, but it is finally above it now. ACWX was created in 2011.

Here is the EFA / S&P 500 ratio, which also crossed above its average for the first time since 2010. EFA has been around since 2001, right about the time the US dollar peaked, and look at what was going on back then. It spent years outperforming the S&P 500 and above its 200-day average, and that was because of the dollar's weakness during that time.

Since then the dollar has been mostly moving higher, but that trend may be close to changing. A move in the US dollar down to 95, and certainly below 90, could be a signal that last year's big gains in the I-fund, as well as in this year's early trading, could be around a while.

We will get the PPI wholesale prices report this morning (Friday.)

Additional TSP Fund Charts:

The DWCPF (S-fund) tested the 50-day moving average and reversed higher. You can't complain about that, but as I mentioned above, there has been a recent tendency for charts to come back down and revisit the downside after a big positive reversal. The gap near 2525 remains open, but that's the only real negative I can see here.

ACWX (I fund) made another new intraday high yesterday, but it closed just below Tuesday's closing price. It had a positive reversal day as well, suggesting higher prices in the short-term, but it also seems extended with plenty of open gaps below.

BND (bonds / F-fund) also had a nice positive round trip day as it closed positive after a very negative morning. It's in a very short-term down trend, but still trending higher within the ascending channel.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks nearly completed a round trip day as the S&P 500 battled back from an early 107-point loss, to end the day down just 9-points. We saw two Mag 7 stocks move 10% on the day; Microsoft was down 10%, and Meta was up 10%. After hours Apple added to the bullish case with blow out earnings. The dollar and yields stabilized a bit.

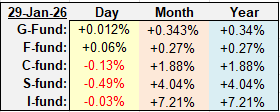

| Daily TSP Funds Return More returns |

Microsoft's loss yesterday accounted for a market cap loss of about $350 billion. There are only about 25 companies in the US that even have a market cap of $350 billion or more, so yesterday they lost the entire value of companies like Coca Cola, Chevron, Netflix, IBM, and McDonalds.

Apple came out with very good earnings after the bell, but they were having trouble holding onto a 1% gain after hours. That may be enough to gap up the indices since Apple is the 3rd largest company right now, with a market cap of $3.8 trillion, and in early trading after hours it had broken above its descending resistance line, but it was slipping as the evening wore on.

Yesterday's massive positive reversal in the S&P 500 usually means gains the following day, or at least in early trading. But the rare huge reversal was only temporary after prior similar reversals. Obviously the dip buyers were not hiding and it all seemed to start when the 50-day moving average was successfully tested.

That was almost perfect bullish technical action, but we still had a failed breakout after Wednesday's new high. The reversal was so big that I wanted to highlight it here showing that we do tend to see some upside after these, but it doesn't always hold. Apple may help, assuming their gains hold into today.

The I-fund did something recently that it hasn't done in more than a decade. Whether we look at the current ACWX, which seems to be the closest match we have to our new I-fund, or the EFA, which was the old I-fund, the ratio between them and the S&P 500 just moved above its 200-day moving average for the first time in a long, long time. We have seen several attempts at crossing, but it is finally above it now. ACWX was created in 2011.

Here is the EFA / S&P 500 ratio, which also crossed above its average for the first time since 2010. EFA has been around since 2001, right about the time the US dollar peaked, and look at what was going on back then. It spent years outperforming the S&P 500 and above its 200-day average, and that was because of the dollar's weakness during that time.

Since then the dollar has been mostly moving higher, but that trend may be close to changing. A move in the US dollar down to 95, and certainly below 90, could be a signal that last year's big gains in the I-fund, as well as in this year's early trading, could be around a while.

We will get the PPI wholesale prices report this morning (Friday.)

Additional TSP Fund Charts:

The DWCPF (S-fund) tested the 50-day moving average and reversed higher. You can't complain about that, but as I mentioned above, there has been a recent tendency for charts to come back down and revisit the downside after a big positive reversal. The gap near 2525 remains open, but that's the only real negative I can see here.

ACWX (I fund) made another new intraday high yesterday, but it closed just below Tuesday's closing price. It had a positive reversal day as well, suggesting higher prices in the short-term, but it also seems extended with plenty of open gaps below.

BND (bonds / F-fund) also had a nice positive round trip day as it closed positive after a very negative morning. It's in a very short-term down trend, but still trending higher within the ascending channel.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.