Boghie

Market Veteran

- Reaction score

- 363

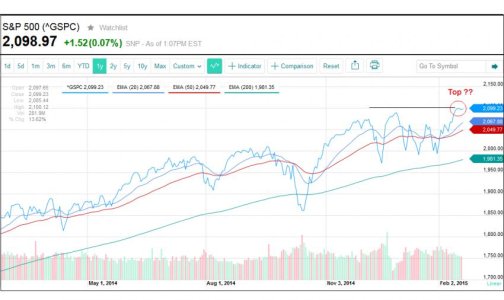

Here is the basis for changing my investment strategy this year (below).

In 4 of past 5 years the C or S fund (or combo of both) gets you into the top 10% of the tracker, with the S fund nearly winning outright once.

In the Bear year of 2011 you still would've finished in the top 3rd with the C fund, but more importantly if you recognized the Bear Market, then the F fund would put you near the top 10%.

View attachment 31882

So my NEW strategy is NOT to make a ton of IFT's. Its NOT just buy and hold, but hold for MUCH LONGER.

Of the several "tops" every year, 1 or 2 clearly telegraph themselves as crowns before dropping several percent. Catching just one and gaining at least 2-3% on the S or C funds then buying back in and sitting still for the rest of the year would allow you to to finish 2 to 3 percent ahead of the S or C funds. In 1 of the past 5 years you would finish number 1 and win the Tracker and in 3 other years you would finish in the top 3%

Ideally nailing the top 2 tops of the year could enable one to gain 4-8% on the stock funds and put you near the top every year of a Bull Market.

Question is...is this going to be a Bull Market?:notrust:

I'm having the same fault. Too much time in G/F... And, I always hold I - but, I always will...

Anyway, another way of thinking is not to bother trying to time tops and making quick trades to catch 5% or less moves but instead to avoid the obvious market dumps. That way you are in for a bull but bail on corrections. I am going for a bit more risk in my normal allocations and will just watch for moves <7%.