FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

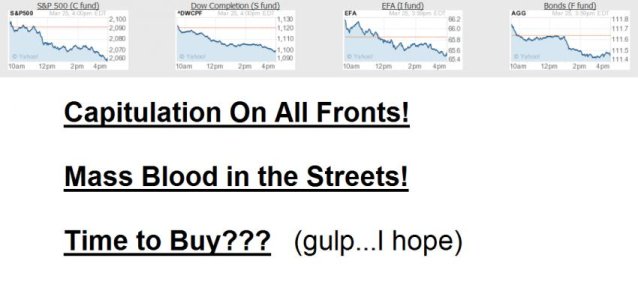

This may hurt in the short term if Fed does what it is likely to do (hint that rates will be going up sooner rather than later), but decided to remain IN PLACE ( in mixed S, C, I).

One of the big reasons stocks are going up is that China's premier stated China will do whatever it needs to do (more stimulus, etc) to lead the worlds economy, sending Shanghai Index up over 2% today. I heard this on CNBC a few minutes before logging in to flee to the G fund.

So overall, there is not a clear sign to sell. Wish I had gotten up a little earlier today to grab some more analysis.

But my new system was to sell only at new, well established highs...so if the market corrects in the short term, then I guess I'll correct with it.

If we surge to new highs in the coming days, I'll make myself a promise to not get too greedy and be a little quicker with the trigger finger.

One of the big reasons stocks are going up is that China's premier stated China will do whatever it needs to do (more stimulus, etc) to lead the worlds economy, sending Shanghai Index up over 2% today. I heard this on CNBC a few minutes before logging in to flee to the G fund.

So overall, there is not a clear sign to sell. Wish I had gotten up a little earlier today to grab some more analysis.

But my new system was to sell only at new, well established highs...so if the market corrects in the short term, then I guess I'll correct with it.

If we surge to new highs in the coming days, I'll make myself a promise to not get too greedy and be a little quicker with the trigger finger.