-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

Itchn2retire

Investor

- Reaction score

- 6

Where did you pull those graphics and explanation of the ascending triangle pattern?

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Where did you pull those graphics and explanation of the ascending triangle pattern?

Here you go.

Understanding Chart Patterns - Technical Stock Analysis

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

April Monthly Wrap Up

Overall for April, my account finished up at +0.46%

The other funds for April: C fund +0.96%.....S fund -1.50%.....I fund +4.11%.....F fund -0.28%

So I beat 2 of 4 funds for the month. ...but only 1 stock fund...the -S- fund.

On the Monthly tracker I finished only # 399 (out of 1400) for March.

The more important score...for the year...I am up +5.30%. That is #102 on the Tracker.

Was #221 for the year last month so am steadily "moving on up"...

The other funds for the year: C fund +1.94%.....S fund +3.81%.....I fund +10.05%.....F fund +1.40%

So am now beating both the C fund (benchmark) quite handily still, and have now put over 1% distance between myself and the S fund (and its stampeding herd of 120 members).

I fund remains elusive and I need to stop being afraid of it and start thinking about going into it 70-100% soon, if large scale economic backdrop continues.

Am fully invested a third in each fund currently going into May.

Good luck to everyone.:smile:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

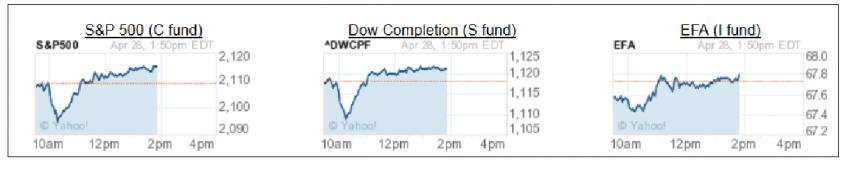

After a pretty good May being 100% invested in stocks, 1/3rd each (C, S, I), I am tentatively contemplating using 1st May IFT to briefly (1-3 days) step aside.

My system calls for strategically doing this several days into those new highs, catching the 1-2 days profit-taking that typically goes on, then quickly buying back in at lower pricess.

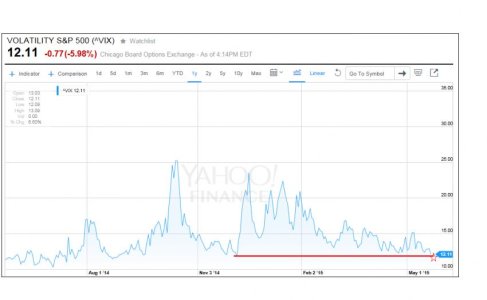

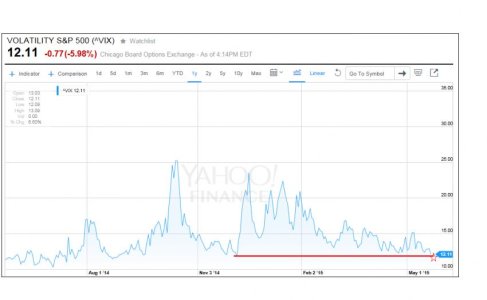

Typically look for new, recent low levels of VIX also.

Will see how markets start Friday.

A down day assures I don't move.

An up day of more than 0.50% makes it pretty likely I might step aside.

Anything in between...well, when in doubt, stay in.

Just because we get 2 IFT's monthly doesn't mean we have to always use them, but if I stay in, I'll probably re-adjust before May ends, shifting more over to the I Fund.

That's the tentative plan....but staying open-minded and fluid and keeping eyes/ears open.

My system calls for strategically doing this several days into those new highs, catching the 1-2 days profit-taking that typically goes on, then quickly buying back in at lower pricess.

Typically look for new, recent low levels of VIX also.

Will see how markets start Friday.

A down day assures I don't move.

An up day of more than 0.50% makes it pretty likely I might step aside.

Anything in between...well, when in doubt, stay in.

Just because we get 2 IFT's monthly doesn't mean we have to always use them, but if I stay in, I'll probably re-adjust before May ends, shifting more over to the I Fund.

That's the tentative plan....but staying open-minded and fluid and keeping eyes/ears open.

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 816

Great chart and strategy! Best wishes!!!:smile:After a pretty good May being 100% invested in stocks, 1/3rd each (C, S, I), I am tentatively contemplating using 1st May IFT to briefly (1-3 days) step aside.

My system calls for strategically doing this several days into those new highs, catching the 1-2 days profit-taking that typically goes on, then quickly buying back in at lower pricess.

Typically look for new, recent low levels of VIX also.

View attachment 33833

Will see how markets start Friday.

A down day assures I don't move.

An up day of more than 0.50% makes it pretty likely I might step aside.

Anything in between...well, when in doubt, stay in.

Just because we get 2 IFT's monthly doesn't mean we have to always use them, but if I stay in, I'll probably re-adjust before May ends, shifting more over to the I Fund.

That's the tentative plan....but staying open-minded and fluid and keeping eyes/ears open.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

After a pretty good May being 100% invested in stocks, 1/3rd each (C, S, I), I am tentatively contemplating using 1st May IFT to briefly (1-3 days) step aside.

My system calls for strategically doing this several days into those new highs, catching the 1-2 days profit-taking that typically goes on, then quickly buying back in at lower pricess.

Typically look for new, recent low levels of VIX also.

View attachment 33833

Will see how markets start Friday.

A down day assures I don't move.

An up day of more than 0.50% makes it pretty likely I might step aside.

Anything in between...well, when in doubt, stay in.

Just because we get 2 IFT's monthly doesn't mean we have to always use them, but if I stay in, I'll probably re-adjust before May ends, shifting more over to the I Fund.

That's the tentative plan....but staying open-minded and fluid and keeping eyes/ears open.

Memo to thyself...when the market is at new highs, and you get these feelings...don't just hypothesize about them...ACT ON THEM!!!;swear

Ok, done chewing myself out.

A golden opportunity was missed to step aside late last week (above) and make a 1% plus gain on all the indices.

No negative repercussions though...still around top 100 on Tracker and still moving along with the market and keeping good lead on both S and C funds...but could have moved up into the top 50 by doing what my system calls for...briefly stepping aside 1-3 days at obvious short term overbought points.

Oh well, will have to wait till the next opportunity, as markets bouncing back strongly just like was suggested (per Tom's "Cup and Handle" call a few days ago).

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

May Monthly Wrap Up

Overall for May, my account finished up at +0.88%

The other funds for May: C fund +1.29%.....S fund +1.84%.....I fund -0.42%.....F fund -0.26%

So I beat 2 of 4 funds for the month. ...but only 1 stock fund...the -I- fund.

On the Monthly tracker I finished only # 729 (out of 1433) for May...about middle of the pack.

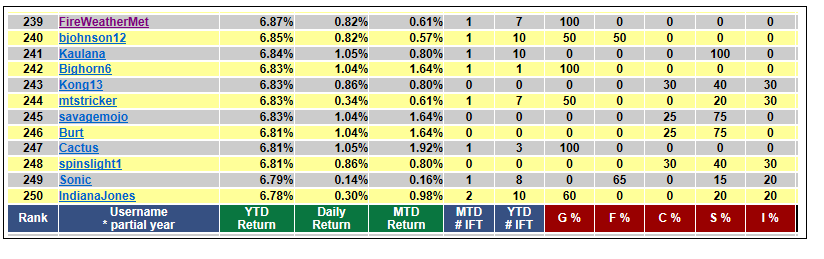

The more important score...for the year...I am up +6.22%. That is #111 on the Tracker.

Was #102 for the year last month so am basically "treading water" which is what I expected by not making any IFT's for the month of May.

The other funds for the year: C fund +3.26%.....S fund +5.71%.....I fund +9.59%.....F fund +1.13%

So I continue to lead the C and S funds...and gained on the I a little bit. I missed a golden opportunity to make a quick 1-2 day "out and back in" move late in the month (see previous post). But no damage done as system stays intact. Will stay fully invested going into June with a 1/3rd in each C-S-I and wait again for a few days at new highs, then see if I can do a quick 1-3 day "out and in" to gain a little more ground on the markets.

The one gratifying thing of this system...if this was a year like most others where the S is the fund leader, and being 0.51% above the S for the year, I'd be ranked # 11 for the year (instead of # 111).

So the system works...and I will just continue...biding my time.

I could just go 100% S and not touch it for the rest of the year and be guaranteed to finish a 0.50% ahead of the S fund for the year. A major victory for anyone on the tracker.

But will continue to cautiously wait...and see if any other opportunities present themselves.

Will continue to maintain an I fund presence as well, although it did not pan out this month. Its all in the $ vs Euro.

Good luck to all. :smile:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

My favorite part of Mad Money is when Cramer brings in the Fibonacci Queen Carolyn Borodin to do an "Off the Charts" analysis.

This one should be of interest to everyone here.

It looks at the long term pattern of the S&P, and answers the question are we at a long term top and if so, what levels to watch out for. Click "play" on video.

S&P must not fail at 2137...or else...

Off the Charts: Key levels in S&P 500 & Dow Transports | Watch the video - Yahoo News

This one should be of interest to everyone here.

It looks at the long term pattern of the S&P, and answers the question are we at a long term top and if so, what levels to watch out for. Click "play" on video.

S&P must not fail at 2137...or else...

Off the Charts: Key levels in S&P 500 & Dow Transports | Watch the video - Yahoo News

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Was thinking of bailing into G today as US markets were slightly up, but with current fall past few minutes, I don't want to exit on a down day, closer to recent lows than recent highs.

Macro atmosphere sucks, Fed News, even if good, likely to be a "sell the news".

Greece is digging in its heels, along with EU.

Greece, creditors dig in their heels on eve of meeting - Yahoo News

Still sifting thru data and news. Probably staying put for now...a Greece agreement would likely have markets shooting upwards quick. I exited like this once and it cost me.

However, Euro experts for weeks have said this could be the start of the "end game"

Maybe I'll just not look at stock prices for a week, for mental sanity.:notrust:

Macro atmosphere sucks, Fed News, even if good, likely to be a "sell the news".

Greece is digging in its heels, along with EU.

Greece, creditors dig in their heels on eve of meeting - Yahoo News

Still sifting thru data and news. Probably staying put for now...a Greece agreement would likely have markets shooting upwards quick. I exited like this once and it cost me.

However, Euro experts for weeks have said this could be the start of the "end game"

Maybe I'll just not look at stock prices for a week, for mental sanity.:notrust:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

We're getting closer to SPX 2067...

Yes, but reversals like this keep the waters murky.

If tomorrow is up slightly I will probably use 1st IFT to step aside to safety and watch the conclusion of this Greek Drama.

Chances are the Greek debt discussions will go down to the wire and with another 8 trading days we can pierce that 2067 mark pretty quickly.

But my gut tells me that maybe today was the last opportunity to exit. We'll see.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Using 1st IFT of the month to shift from 1/3rd in C-S-I into 100% G COB today.

Not looking a gift horse in the mouth....these windows of opportunity to lock in profits and miss the next brief downturn don't seem to last long in this "Whipsaw" pattern.

News driven over-buying this morning, based on yesterdays Fed conference plus Merkel saying she's "optimistic". CNBC analysts think Greece thing will magnify next week, and I have long agreed. If a surprise Greece announcement comes up today or over the weekend then that would set me back behind the market, but in uncertain times, ya gotta play the averages.:notrust:

Not looking a gift horse in the mouth....these windows of opportunity to lock in profits and miss the next brief downturn don't seem to last long in this "Whipsaw" pattern.

News driven over-buying this morning, based on yesterdays Fed conference plus Merkel saying she's "optimistic". CNBC analysts think Greece thing will magnify next week, and I have long agreed. If a surprise Greece announcement comes up today or over the weekend then that would set me back behind the market, but in uncertain times, ya gotta play the averages.:notrust:

weatherweenie

TSP Legend

- Reaction score

- 177

A nice 'W' pattern forming on the SP500 daily chart is making my decision difficult.Using 1st IFT of the month to shift from 1/3rd in C-S-I into 100% G COB today.

Not looking a gift horse in the mouth....these windows of opportunity to lock in profits and miss the next brief downturn don't seem to last long in this "Whipsaw" pattern.

News driven over-buying this morning, based on yesterdays Fed conference plus Merkel saying she's "optimistic". CNBC analysts think Greece thing will magnify next week, and I have long agreed. If a surprise Greece announcement comes up today or over the weekend then that would set me back behind the market, but in uncertain times, ya gotta play the averages.:notrust:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

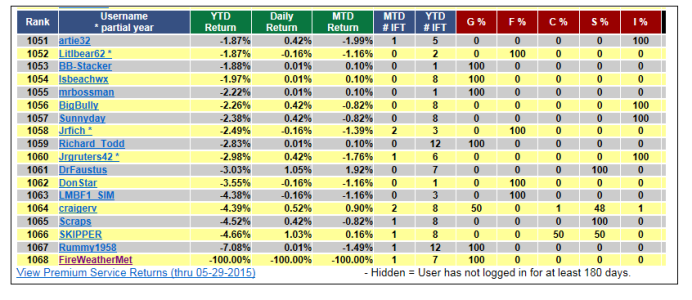

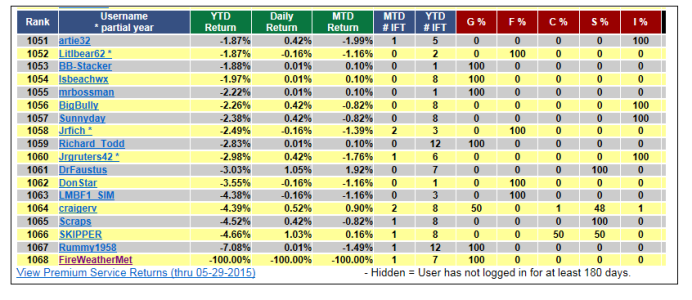

Funny, I started the morning being up exactly 6.00% for the year...and calculated that it went up to around 6.83% by COB today.

Instead, I found out that I somehow went down (-100%) today...all the way to last place!

Gotta wonder if Minnow or Norm took over Tracker calculations today

So I guess I'm not quite sure how to update my account talk this evening.

Instead, I found out that I somehow went down (-100%) today...all the way to last place!

Gotta wonder if Minnow or Norm took over Tracker calculations today

So I guess I'm not quite sure how to update my account talk this evening.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Funny, I started the morning being up exactly 6.00% for the year...and calculated that it went up to around 6.83% by COB today.

Instead, I found out that I somehow went down (-100%) today...all the way to last place!

Gotta wonder if Minnow or Norm took over Tracker calculations today

So I guess I'm not quite sure how to update my account talk this evening.

View attachment 34102

Thanks Tom. :smile:

wavecoder

TSP Pro

- Reaction score

- 24

Maybe I'll just not look at stock prices for a week, for mental sanity.:notrust:

I often do that (though my strategy mainly looks at the weekly / monthly charts being a long-term one). It does make investing easier on your stress levels, not looking daily

And a lot of times, it's worked in my favor. There were times when the 'old me' would bail on a position only to see it go right up after.

-100% on the autotracker, that's gotta be a record! who did you **** off? lol :nuts:

Similar threads

- Replies

- 0

- Views

- 115