FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

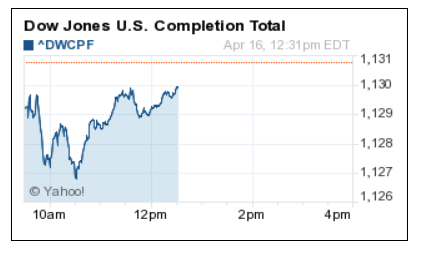

Liking the reverse action this morning...this market just does not want to stay down for too long. (below)

View attachment 33355

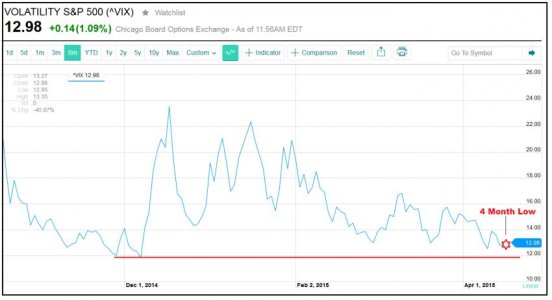

However, looking at the VIX...we have been in a very steady downward glide and are at 4-month lows. (below)

This is a concern...feel stocks can "melt up" a bit more from here, but probably won't see anymore "Big" up-days before we peak.

View attachment 33356

Also, our sentiment is starting to get quite bullish. All this is making me start paying attention and planning a possible sell soon.

Good Luck! Too bad we can't buy Greece and turn it into a vacation spot.

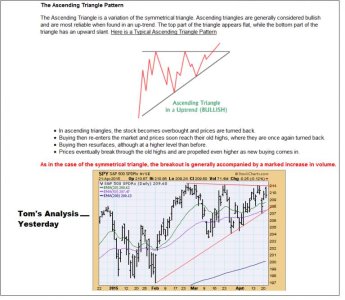

This is the one that scares me...

The SPY looks more like a cup and handle than a rising wedge so I'm not as negative on it.

Going back in...a 3rd in each of C...S...I.

Want to keep a toe in each. I Fund may be the most overbought at the moment so will lower exposure just a bit there. C might have the most upside and has been outperforming S as of late.

Looks like breakout has begun as charts (Ascending Triangle or Cup and Handle) predicted.

Going back in...a 3rd in each of C...S...I.

Want to keep a toe in each. I Fund may be the most overbought at the moment so will lower exposure just a bit there. C might have the most upside and has been outperforming S as of late.

Looks like breakout has begun as charts (Ascending Triangle or Cup and Handle) predicted.