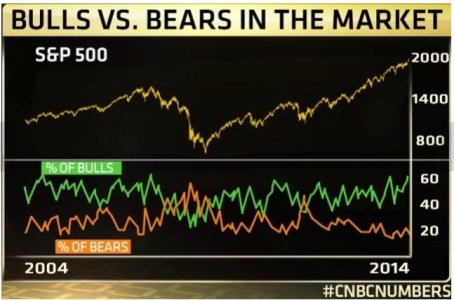

Some of the craziness we've seen lately has been a little hard to chart, with the vastly differing patterns on the Large Caps, Small Caps, and Tech indices.

But it seems pretty obvious that the tech sector, especially the Biotech sector, has been the main leader in the recent downturn. So, to see where exactly we are on the cycle and make a judgement where the overall market is headed next, I decided to take a closer look at an index that I don't follow too closely. The NASDAQ Biotech Index.

A look at its

longer term peak trend-line tells a big part of the story...Biotech was in a nice steady upward trend before mixing Mega Steroids with its New years Eve champagne and rocketing straight up about 22% in less than 8 weeks! That put it so far above its trend-line that money managers, analysts had no choice but sell at those drastically over-bought levels not seen since 1999-2000. When the sell off came, it came hard, over a similar time frame (7 weeks), down...guess what...

almost 22%.

The downward pattern had some nice complexity, with 2-3 dead-cat bounces before settling below both the

long term bottom channel trend-line and the

200 EMA...for a low on April 14th. Since then, a short rise and choppy sideways churning for about 3 weeks.

To me, this pattern lends me to believe that Biotech indeed DID bottom about 3 weeks ago.

6-8 weeks and

+20% is a good temporal/percentage combo for a total correction, as is a settling below the

200 day EMA and

longer term bottom channel trend-line.

View attachment 28586

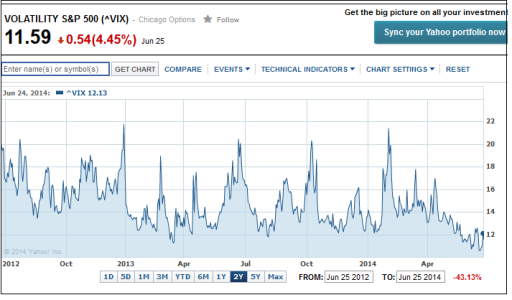

So what does this all mean to me?

Call me crazy, but I think Biotech is done falling and is primed to take back at least some of its lost price.

For the major indices that should lead to a nice springboard to jump with up along the "wall of worry" that is still out there, largely from geo-political issues that may have little economic bearing at this point, as well as the

"Sell in May" fear.

So I am putting (or keeping) my money where my mouth is :laugh:, staying all in (50% S and 50% C).

If anyone has any different take on all this, I am always willing to hear it (and be convinced by it if the argument is strong enough).