clester

Market Veteran

- Reaction score

- 37

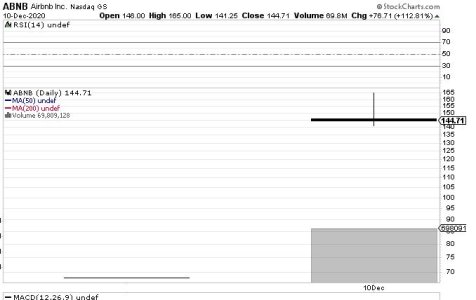

I've been looking for any reason to stay in s fund. Here are a few. S fund is in a cup and handle formation which is bullish if it breaks above the handle. The RSI has worked off the high reading now in the fifties. As long as it stays above 50 it's still bullish. Double top but other indices have already broken out. Uptrend from December still intact but getting close to bottom line. Everyone looking for pullback still, so contrarian view would be to buy. Economic data is getting better. Transports have held the 50 day.

But, flat tops usually bring market drops. Gasoline is high. We are up big for just 2 months into the year. S fund has been lagging C fund. Europe?

So, all in all, things still look positive but getting iffy.

But, flat tops usually bring market drops. Gasoline is high. We are up big for just 2 months into the year. S fund has been lagging C fund. Europe?

So, all in all, things still look positive but getting iffy.