-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

jpcavin

TSP Legend

- Reaction score

- 97

I was going to join the bus tour today but time got away from me.You can't always believe what you read.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

FWM,

We have significant differences politically, but I have to congratulate you on your investing successes. Keep it up!!

-RMI

We have significant differences politically, but I have to congratulate you on your investing successes. Keep it up!!

-RMI

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

With 2 unused IFT's for August and a slight bounce I decided to jump back into the G fund COB today.

Breaking the rules yet again...bad to sell near a recent market bottom, unless you're pretty sure there's more bottoming to go. This drop is largely geopolitical and may play more of a role than just the charts, but the charts always matter. A look at the S&P (below) shows that if our last "bounce" was a "dead-cat"..then we can sometimes use the amplitude of the the 1st drop, and add it to the recent bounce. Doing so, shows a potential fall to near 1600 (horizontal blue line). This comes very close to the trend line of recent lows...so extrapolating both...possibly a 1600-1610 target.

If we have bottomed and shoot up tomorrow, then I'll jump right back into stocks and today's IFT from S to G might simply amount to "monetary masturbation":ban: but there is a thought process behind it. If missiles fly Thu-Fri and stocks shoot upward (Like Dutch's Alpha article pointed out happened in Iraq), then I can jump right back in. But this is different from Iraq, in that Syria is a much stronger Russian ally and props up the Russian arms industry with its purchases. Putin might make some big but vague threats (not much he can really do), and markets could fall even further. Combine that with the threat of a GOP led Gov't shutdown over Obamacare, and maybe we have some validation for a "mini" Hindenburg Omen (lol). If market falls below the 1600-1610 mark, the next target might be the 200 Day EMA, currently near 1575. That would be a worst case scenario though, and this market has proven to be very resilient, never coming near any "worst case scenario's" over the past 9 months....so we'll see.

Breaking the rules yet again...bad to sell near a recent market bottom, unless you're pretty sure there's more bottoming to go. This drop is largely geopolitical and may play more of a role than just the charts, but the charts always matter. A look at the S&P (below) shows that if our last "bounce" was a "dead-cat"..then we can sometimes use the amplitude of the the 1st drop, and add it to the recent bounce. Doing so, shows a potential fall to near 1600 (horizontal blue line). This comes very close to the trend line of recent lows...so extrapolating both...possibly a 1600-1610 target.

If we have bottomed and shoot up tomorrow, then I'll jump right back into stocks and today's IFT from S to G might simply amount to "monetary masturbation":ban: but there is a thought process behind it. If missiles fly Thu-Fri and stocks shoot upward (Like Dutch's Alpha article pointed out happened in Iraq), then I can jump right back in. But this is different from Iraq, in that Syria is a much stronger Russian ally and props up the Russian arms industry with its purchases. Putin might make some big but vague threats (not much he can really do), and markets could fall even further. Combine that with the threat of a GOP led Gov't shutdown over Obamacare, and maybe we have some validation for a "mini" Hindenburg Omen (lol). If market falls below the 1600-1610 mark, the next target might be the 200 Day EMA, currently near 1575. That would be a worst case scenario though, and this market has proven to be very resilient, never coming near any "worst case scenario's" over the past 9 months....so we'll see.

- Reaction score

- 2,476

Beware the post holiday reversal. These pre-holiday days can have us leaning the wrong way. Just saying, a light volume up day tomorrow wouldn't mean all that much.If we have bottomed and shoot up tomorrow, then I'll jump right back into stocks and today's IFT from S to G might simply amount to "monetary masturbation"

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Beware the post holiday reversal. These pre-holiday days can have us leaning the wrong way. Just saying, a light volume up day tomorrow wouldn't mean all that much.

Yeah...good point...gotta keep Labor Day seasonality in mind. Thanks

- Reaction score

- 2,476

Yes. I don't think I worded it right. The "reversal" from the larger trend happens before the holiday, then the post-holiday action resumes that larger trend, which is down. Yesterday and today's upside may be that reversal, and tomorrow, the Friday before Labor Day weekend, has a pretty positive bias. It's an Oscarism.

- Reaction score

- 2,476

By the way, Oscar thinks the holiday reversal was the drop this past Tuesday. I think that's a stretch.It's an Oscarism.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Well, holding last IFT in hand and watching a downtrend counter the typical day b4 Labor Day up day, decided to go ahead and jump in.

Wanted to spread the potential wealth/risk a bit so went from 100% G to 50% S...40% I...10% C by COB today.

Accelerated selling later in the day, and brief dip buying at the end made me feel better about my decision.

Think that Syria threat (everyone's big worry) was blown too much out of proportion. Even Obama probably realizes he played his hand to quickly, too strongly.

Too many negatives of going hard into Syria (pissing off Russia, most of international community & both Dems and GOP).

If nothing big happens over the weekend, and a more mild, diplomatic solution evolves, a big buyback rally could ensue.

Also pays to be invested at the end of the month,. this way you can ride an early month uptrend, step aside and lock in gains, and have a 2nd IFT for a lower low, or when the danger clears.

But more risks ahead in September, namely another Gov't shutdown showdown...so any September rally could be short lived. Gonna have to stay nimble.:blink:

Have a great weekend fellow Laborers!

Wanted to spread the potential wealth/risk a bit so went from 100% G to 50% S...40% I...10% C by COB today.

Accelerated selling later in the day, and brief dip buying at the end made me feel better about my decision.

Think that Syria threat (everyone's big worry) was blown too much out of proportion. Even Obama probably realizes he played his hand to quickly, too strongly.

Too many negatives of going hard into Syria (pissing off Russia, most of international community & both Dems and GOP).

If nothing big happens over the weekend, and a more mild, diplomatic solution evolves, a big buyback rally could ensue.

Also pays to be invested at the end of the month,. this way you can ride an early month uptrend, step aside and lock in gains, and have a 2nd IFT for a lower low, or when the danger clears.

But more risks ahead in September, namely another Gov't shutdown showdown...so any September rally could be short lived. Gonna have to stay nimble.:blink:

Have a great weekend fellow Laborers!

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

International markets in Europe and Asia had a HUGE day today...up 1.5% to 2.5%.

Should propel our markets Tuesday...and makes me glad I put 40% into the -I- fund Friday.

But watching the news tonight, it seems that the Neocons have infiltrated both parties...so the likelihood of some sort of US military response in Syria has gone up.

This could increase volatility...but with Obama hinting at limited, "no boots on the ground" type action, that seems to have taken a lot of fear out of the markets, which may have oversold based on that fear, hence the global stock bounce-back Monday.

Should propel our markets Tuesday...and makes me glad I put 40% into the -I- fund Friday.

But watching the news tonight, it seems that the Neocons have infiltrated both parties...so the likelihood of some sort of US military response in Syria has gone up.

This could increase volatility...but with Obama hinting at limited, "no boots on the ground" type action, that seems to have taken a lot of fear out of the markets, which may have oversold based on that fear, hence the global stock bounce-back Monday.

Last edited:

jkenjohnson

Market Veteran

- Reaction score

- 24

International markets in Europe and Asia had a HUGE day today...up 1.5% to 2.5%.

Should propel our markets Tuesday...and makes me glad I put 40% into the -I- fund Friday.

But watching the news tonight, it seems that the Neocons have infiltrated both parties...so the likelihood of some sort of US military response in Syria has gone up.

This could increase volatility...but with Obama hinting at limited, "no boots on the ground" type action, that seems to have taken a lot of fear out of the markets, which may have oversold based on that fear, hence the global stock bounce-back Monday.

Let's do it and get it over with.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Exited today into 100% G (COB Today).

Reasons for it...I mentioned last week about volatility. We still have Congressional vote on going to war tomorrow, and with the runup today, I am a bit worried about any "sell the news" tomorrow. Not to mention upcoming jobs numbers Friday, then Fed meeting looms, and also possible Gov't shutdown threat by end of month.

Since I had 40% of my allocation in the I Fund (rest in S and C) I had a nice day yesterday and if todays prices hold...should put me near 1.50% for the month.

Not bad for 2 days work in September nonetheless where the long term average has been negative for past few decades.

I read Tom's bear flag concern (although today's action might break that pattern). But this geopolitical stuff is tricky, Birch had a good article that pointed out that stocks fall with rumors of war, but rise when the bullets fly, so that is also a possibility, when in fact, bullets (or in this case missises) fly...IF congress approves military action.

But markets going strongly in one direction are often sent swiftly the other way when something unexpected happens (like maybe vote tomorrow, or Russia's, or Iran's verbal response to it), not to mention jobs report on Friday. September is the king of volatility and I gotta keep that in mind.

Fed meeting coming up in less than 2 weeks, usually a perfect time for markets to sell-off a few days ahead of the meeting, only to shoot skyward when the meeting concludes the same way it always has...that no immediate tapering is expected till things improve. Those things seem to be perfect re-entry points.

Of course, maybe we've bottomed late last week and we are no in our permanent upward rise for the next few weeks...to higher highs. The charts support that theory. All things are possible.

But Bulls and Bears survive and thrive, while pigs always get slaughtered. With 1.5% in the back pocket in the worst month of the year, and another IFT to go back in at any opportune time, I'll briefly step aside and sleep easily tonight (lol)

Reasons for it...I mentioned last week about volatility. We still have Congressional vote on going to war tomorrow, and with the runup today, I am a bit worried about any "sell the news" tomorrow. Not to mention upcoming jobs numbers Friday, then Fed meeting looms, and also possible Gov't shutdown threat by end of month.

Since I had 40% of my allocation in the I Fund (rest in S and C) I had a nice day yesterday and if todays prices hold...should put me near 1.50% for the month.

Not bad for 2 days work in September nonetheless where the long term average has been negative for past few decades.

I read Tom's bear flag concern (although today's action might break that pattern). But this geopolitical stuff is tricky, Birch had a good article that pointed out that stocks fall with rumors of war, but rise when the bullets fly, so that is also a possibility, when in fact, bullets (or in this case missises) fly...IF congress approves military action.

But markets going strongly in one direction are often sent swiftly the other way when something unexpected happens (like maybe vote tomorrow, or Russia's, or Iran's verbal response to it), not to mention jobs report on Friday. September is the king of volatility and I gotta keep that in mind.

Fed meeting coming up in less than 2 weeks, usually a perfect time for markets to sell-off a few days ahead of the meeting, only to shoot skyward when the meeting concludes the same way it always has...that no immediate tapering is expected till things improve. Those things seem to be perfect re-entry points.

Of course, maybe we've bottomed late last week and we are no in our permanent upward rise for the next few weeks...to higher highs. The charts support that theory. All things are possible.

But Bulls and Bears survive and thrive, while pigs always get slaughtered. With 1.5% in the back pocket in the worst month of the year, and another IFT to go back in at any opportune time, I'll briefly step aside and sleep easily tonight (lol)

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I try to never be entrenched in a decision, when the reasons for that decision are no longer valid.

Today's sustained push above resistance levels tells me that:

A) Syria is no longer a market concern (since an all out US ground war is off the table).

B) Enough evidence is in that says the Fed will not be tapering quicker than expected (although will likely begin tapering at some point).

c) That the low of 1630 on Aug 27th was likely the low in this current market cycle, and that the climb up any "wall of worry" should take us to new highs in the next 2-3 weeks, repeating the past 4-6 week cycles of the past 9 months.

Gone all in this morning...50% S and 50% I as of COB Today. I stands for "I am a sucker for punishment", but everything I've read shows that that Europe and Asia should be bouncing back stronger than expected...and I Fund has the most "upside" on the charts....so we'll see.

Today's sustained push above resistance levels tells me that:

A) Syria is no longer a market concern (since an all out US ground war is off the table).

B) Enough evidence is in that says the Fed will not be tapering quicker than expected (although will likely begin tapering at some point).

c) That the low of 1630 on Aug 27th was likely the low in this current market cycle, and that the climb up any "wall of worry" should take us to new highs in the next 2-3 weeks, repeating the past 4-6 week cycles of the past 9 months.

Gone all in this morning...50% S and 50% I as of COB Today. I stands for "I am a sucker for punishment", but everything I've read shows that that Europe and Asia should be bouncing back stronger than expected...and I Fund has the most "upside" on the charts....so we'll see.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

So far am really happy with my move back into stocks 2 days ago...making approx 1.25% in the past 2 days (yest and tdy). And pleasantly, surprisingly, my I Fund portion has been my big horse so far past 2 days.

Trying to apply a "lessons learned" from previous flawed judgements...namely to have a plan B ready in case previous assumptions (another "lower low" coming) were false, and to act on them immediately (when S&P first pushed past resistance). In this market environment, when we bust thru that resistance level, its hard to find "a good buy in opportunity"...which has hurt me n the past. So I vowed I would just by in and not waste even one god up a (which yesterday was, esp in the I).

Coming up with an intermediate plan for bailing briefly, but that's not until we reach new highs on my barometer (S&P) which could happen as soon as early next week. This plan involves the assumption that we surge at least 1-2% past the most recent high. That would be 1725-1740. Trendline indicates possible 1750. That puts us near where we have seen our cyclical highs every 1.5 to 2 months on the temporal scale. Ironically, this comes out to late Sep, right around the new Fed announcement...hmmm, might be good timing for quick exit and buy back in within 2 weeks. Of course this excludes large scale news events...so have to stay fluid and always have a "Plan B"

Trying to apply a "lessons learned" from previous flawed judgements...namely to have a plan B ready in case previous assumptions (another "lower low" coming) were false, and to act on them immediately (when S&P first pushed past resistance). In this market environment, when we bust thru that resistance level, its hard to find "a good buy in opportunity"...which has hurt me n the past. So I vowed I would just by in and not waste even one god up a (which yesterday was, esp in the I).

Coming up with an intermediate plan for bailing briefly, but that's not until we reach new highs on my barometer (S&P) which could happen as soon as early next week. This plan involves the assumption that we surge at least 1-2% past the most recent high. That would be 1725-1740. Trendline indicates possible 1750. That puts us near where we have seen our cyclical highs every 1.5 to 2 months on the temporal scale. Ironically, this comes out to late Sep, right around the new Fed announcement...hmmm, might be good timing for quick exit and buy back in within 2 weeks. Of course this excludes large scale news events...so have to stay fluid and always have a "Plan B"

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

In doing analysis of what to do this week, I realized that I really missed Coolhands Tracker breakdown, so here's an abbreviated version:

Numbers are a day old, (COB last Fri), broken down into several different groups and kept simple with either stocks (C-S-I) or Safety (G-F)

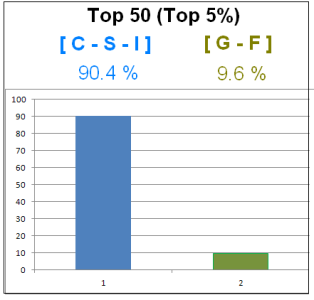

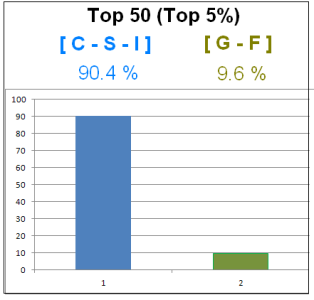

First is the Top 50...or top 5% as I used the 1st 1000 in the Tracker.

This is our current "Smart Money" this year.

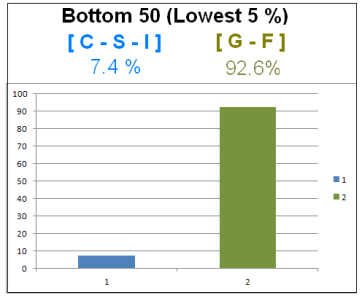

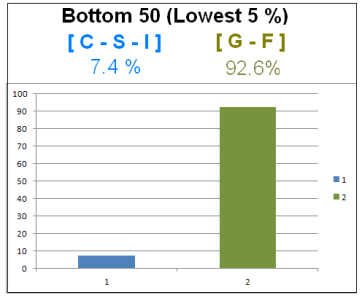

Next is our Lowest 50...or our bottom 5% since Jan 1st, our "Dumb Money" (for lack of a better term)

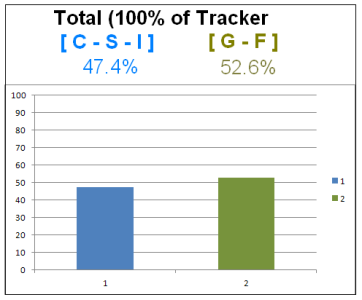

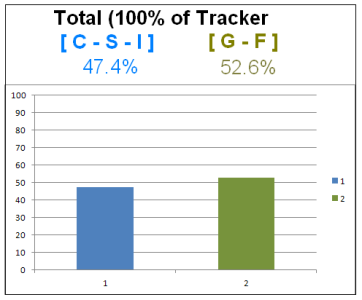

Here is our Total Tracker

So you can see that using our Smart money vs Dumb Money Indicator, it makes sense to currently be in Stocks.

And since a bit more than half (52.6%) of the current Tracker is in "Safety", it stands to reason that any dip might be short-lived.

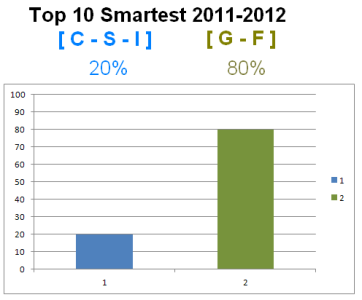

However, there is another group I began following....the "Smartest of the Smart Money". This is the Top 10 over the past 2 years (2011-2012)

I had to hunt them down a bit which was tricky because some had dropped out of the AutoTracker this year, but to the best of my abilities I came up with a "Top 10". One name you might see occasionally as a poster..."Contrarian Jeff"...as well as, believe it or not..."LMBM Method".

So despite that the current "smart money" is overwhelmingly bullish, our "smartest money" is overwhelmingly bearish. However, that top 10 is a small sample size, and some have not done that well in 2013's "QE-Forever" market environment, perhaps acting on once-reliable economic indicators that have been proven to be largely irrelevant this year, thanks to Big Ben's firm bottom baseline support. But that total 100% support might be chopped to 90% support later this week, which the market seems to have baked in, but does change the overall market environment. From here on in, the question might come up every month..."Is the Fed going to chop off another 10% this month?"

Not sure what my next move will be. I was planning on locking in this months profits (> 3% ) before the Fed meeting and call it a great September, since I have no more moves left to go back into stocks.

Another idea is to maybe "taper" down with the expected tapering...and take 50% off the table, and see if the other 50% of stocks can get to where some of the charts were suggesting we'd go, somewhere between 1725-1740....this way I'd at least be able to shed the rest of the stocks without too much loss if we start to crater from "Taper-Shock".

Will think about this some more over some wine tonight, while watching Cramer for his initial market take.

p.s.

Cramer late last week said there might be a brief 1-2 day sell-off on the taper news which he said would be a great time to "Buy-Buy-Buy".

Numbers are a day old, (COB last Fri), broken down into several different groups and kept simple with either stocks (C-S-I) or Safety (G-F)

First is the Top 50...or top 5% as I used the 1st 1000 in the Tracker.

This is our current "Smart Money" this year.

Next is our Lowest 50...or our bottom 5% since Jan 1st, our "Dumb Money" (for lack of a better term)

Here is our Total Tracker

And since a bit more than half (52.6%) of the current Tracker is in "Safety", it stands to reason that any dip might be short-lived.

However, there is another group I began following....the "Smartest of the Smart Money". This is the Top 10 over the past 2 years (2011-2012)

I had to hunt them down a bit which was tricky because some had dropped out of the AutoTracker this year, but to the best of my abilities I came up with a "Top 10". One name you might see occasionally as a poster..."Contrarian Jeff"...as well as, believe it or not..."LMBM Method".

So despite that the current "smart money" is overwhelmingly bullish, our "smartest money" is overwhelmingly bearish. However, that top 10 is a small sample size, and some have not done that well in 2013's "QE-Forever" market environment, perhaps acting on once-reliable economic indicators that have been proven to be largely irrelevant this year, thanks to Big Ben's firm bottom baseline support. But that total 100% support might be chopped to 90% support later this week, which the market seems to have baked in, but does change the overall market environment. From here on in, the question might come up every month..."Is the Fed going to chop off another 10% this month?"

Not sure what my next move will be. I was planning on locking in this months profits (> 3% ) before the Fed meeting and call it a great September, since I have no more moves left to go back into stocks.

Another idea is to maybe "taper" down with the expected tapering...and take 50% off the table, and see if the other 50% of stocks can get to where some of the charts were suggesting we'd go, somewhere between 1725-1740....this way I'd at least be able to shed the rest of the stocks without too much loss if we start to crater from "Taper-Shock".

Will think about this some more over some wine tonight, while watching Cramer for his initial market take.

p.s.

Cramer late last week said there might be a brief 1-2 day sell-off on the taper news which he said would be a great time to "Buy-Buy-Buy".

Last edited:

- Reaction score

- 2,476

Maybe I'm misunderstanding, but you do know he still posts that info, don't you? It's in the premium area and you have to login, but it's there and it's free.In doing analysis of what to do this week, I realized that I really missed Coolhands Tracker breakdown, so here's an abbreviated version:

(http://www.tsptalk.com/create-premium-account.php or video)

rcknfrewld

TSP Pro

- Reaction score

- 8

FWM has to be the most underrated market analysis poster on this site...for God's sake why do you have to be a liberal...i would kiss you but i'm not into black dudes

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 116