FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Decided to stay 100% invested today (50% S - 50% I).

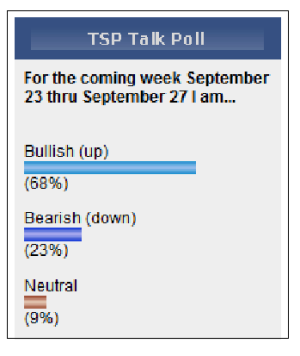

There seems to be nervous anticipation today, both on the major indices and on CNBC "Morning Squawk", where most analysts are expecting a modest taper, and saying that certainty is something that most investors will be looking at as a buying opportunity. One analyst said it best...that tapering news in the realm of market expectations of about 10 Billion, would give this market the excuse its looking for to surge forward....but anything more than that, or anything else unexpected, would trigger a sharp selloff. The Fed, under Bernanke, has always been cognizant of making careful announcements, not triggering unnecessary panic, and this week should be no different.

I'm feeling nervous, and almost shed 50% back into G this morning, but often , that "nervousness" is simply that "Wall of Worry" that JTH, Birch, Tom and others here have often cited as a needed ingredient for more rallying. In the past, I would often bail too early on this nervousness and miss the latter part of a rally. A few days ago, on this thread I looked at the S&P Chart since Jan 1st (below) and saw that the most recent 2 cycles had abut a 4-5 week temporal period between trough (bottom) and following peak. Then as for the trendline of the peak, I did a "projection" of "where this market WANTS to go"...and you'll see a top of about 1740-1750 on a projected time frame of late September to early October. That means this rally has 2-3% more upside over the next 10-15 days. Of course, the key word is thats what the charts say the market WANTS to do. Geopolitical and other Financial news can alter that timeline. A bad Fed announcement this week, or a followed budget battle between the President and the House starting next week would be a great excuse to take profits and trigger the sell-off a bit sooner. So will take it day by day and see what tomorrow brings.

There seems to be nervous anticipation today, both on the major indices and on CNBC "Morning Squawk", where most analysts are expecting a modest taper, and saying that certainty is something that most investors will be looking at as a buying opportunity. One analyst said it best...that tapering news in the realm of market expectations of about 10 Billion, would give this market the excuse its looking for to surge forward....but anything more than that, or anything else unexpected, would trigger a sharp selloff. The Fed, under Bernanke, has always been cognizant of making careful announcements, not triggering unnecessary panic, and this week should be no different.

I'm feeling nervous, and almost shed 50% back into G this morning, but often , that "nervousness" is simply that "Wall of Worry" that JTH, Birch, Tom and others here have often cited as a needed ingredient for more rallying. In the past, I would often bail too early on this nervousness and miss the latter part of a rally. A few days ago, on this thread I looked at the S&P Chart since Jan 1st (below) and saw that the most recent 2 cycles had abut a 4-5 week temporal period between trough (bottom) and following peak. Then as for the trendline of the peak, I did a "projection" of "where this market WANTS to go"...and you'll see a top of about 1740-1750 on a projected time frame of late September to early October. That means this rally has 2-3% more upside over the next 10-15 days. Of course, the key word is thats what the charts say the market WANTS to do. Geopolitical and other Financial news can alter that timeline. A bad Fed announcement this week, or a followed budget battle between the President and the House starting next week would be a great excuse to take profits and trigger the sell-off a bit sooner. So will take it day by day and see what tomorrow brings.