-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Took some off the table today...was previously allocated fully in stocks...50%S and 50% I.

IFT to take effect COB Today will be 50% I and 50% G.

Reasons are:

At new highs, very parabolic, straight up....overshooting upper peak trend-line.

See S fund Chart below (used Willshire 4500).

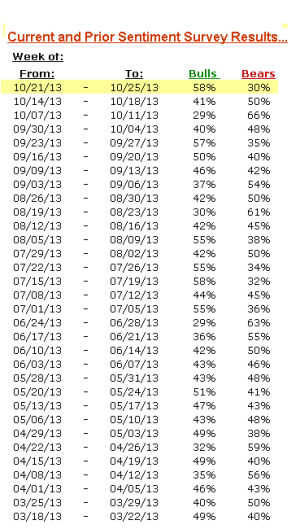

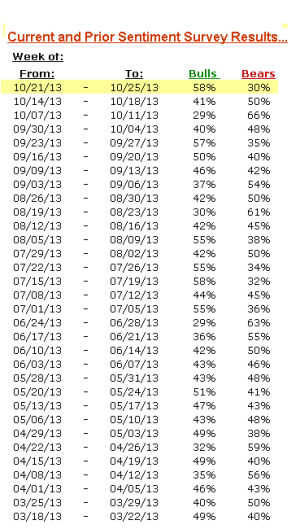

Sentiment Survey just missed a sell signal by an inch yesterday...58 Bulls 30 Bears.

That's the closest its come to a sell in several months.

Also, some people who I consider the "smart money" over the past few years began exiting yesterday.

However, sometimes the wall of worry leads to a climb higher...so will leave half my money in...the -I- Fund portion...just in case the wall of worry gives us a better climb, or if international markets don't get spooked right away from a bad US housing or jobs number, due out next Tue. That could be a "sell the news", no matter what the news, type day.

On the flip side, I think we were headed for 1740-1750 on the S&P in late Sept...but got stopped just short by politics. If we had hit 1740 back then the new trend-line peak would be near 1770.

Just another reason for keeping 50% in stocks for now.

IFT to take effect COB Today will be 50% I and 50% G.

Reasons are:

At new highs, very parabolic, straight up....overshooting upper peak trend-line.

See S fund Chart below (used Willshire 4500).

Sentiment Survey just missed a sell signal by an inch yesterday...58 Bulls 30 Bears.

That's the closest its come to a sell in several months.

Also, some people who I consider the "smart money" over the past few years began exiting yesterday.

However, sometimes the wall of worry leads to a climb higher...so will leave half my money in...the -I- Fund portion...just in case the wall of worry gives us a better climb, or if international markets don't get spooked right away from a bad US housing or jobs number, due out next Tue. That could be a "sell the news", no matter what the news, type day.

On the flip side, I think we were headed for 1740-1750 on the S&P in late Sept...but got stopped just short by politics. If we had hit 1740 back then the new trend-line peak would be near 1770.

Just another reason for keeping 50% in stocks for now.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Bailed today from 50% I / 50% G.

Will be 100% G COB Today.

1740-1750 was a possible short term market top barometer via the S&P for me...feeling is that bad jobs news = good QE news will be a short lived sugar high now that we are well at new market highs, and QE has already been pretty much priced in.

Wall St Big Boys may start locking in profits very soon, so that they can buy in lower in a few weeks.

If I fund holds today, should be looking at near 3.4-3.5% gain for October. I'm good with that.

Plan on getting back in early Nov if we go into our typical 5-8 day downturn of 2-3%.

Will be 100% G COB Today.

1740-1750 was a possible short term market top barometer via the S&P for me...feeling is that bad jobs news = good QE news will be a short lived sugar high now that we are well at new market highs, and QE has already been pretty much priced in.

Wall St Big Boys may start locking in profits very soon, so that they can buy in lower in a few weeks.

If I fund holds today, should be looking at near 3.4-3.5% gain for October. I'm good with that.

Plan on getting back in early Nov if we go into our typical 5-8 day downturn of 2-3%.

Khotso

Market Veteran

- Reaction score

- 27

Great call hanging in I fund through today!Bailed today from 50% I / 50% G.

Will be 100% G COB Today.

1740-1750 was a possible short term market top barometer via the S&P for me...feeling is that bad jobs news = good QE news will be a short lived sugar high now that we are well at new market highs, and QE has already been pretty much priced in.

Wall St Big Boys may start locking in profits very soon, so that they can buy in lower in a few weeks.

If I fund holds today, should be looking at near 3.4-3.5% gain for October. I'm good with that.

Plan on getting back in early Nov if we go into our typical 5-8 day downturn of 2-3%.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Great call hanging in I fund through today!

Thanks Khotso. Seems I'm like a broken clock...exactly right twice a day...way off most of the rest of the time (lol)

Khotso

Market Veteran

- Reaction score

- 27

Thanks Khotso. Seems I'm like a broken clock...exactly right twice a day...way off most of the rest of the time (lol)

I don't know about that -- you're looking pretty good on the tracker compared to me. BTW, your I fund timing looks like even better today!

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

From Late October

Zzzzzzzzz........Yeeeaaawwn (lol)

Was anybody surprised today?

Wondering why the market fell off the cliff, with no major bad news?

Despite that QE is still intact and safer than ever?

Its because Wall St Big Money decided today was the day to drop the hammer. That's all.

Even CNBC was struggling to find the news that fit the market drop. I'm sure FOX will say its because of Obamacare.

But there is no news. None. This is simply a manipulated game...where mutual fund managers want your buy and hold $$ on a regular basis, while they pump and dump.

Then they buy in again at a lower price. Which is when you want to be getting in.

For anybody foolish enough to follow me , I will post some analysis and strategies later tonight of how and when I plan to buy back in.

, I will post some analysis and strategies later tonight of how and when I plan to buy back in.

FWM

Bailed today from 50% I / 50% G.

Will be 100% G COB Today.

1740-1750 was a possible short term market top barometer via the S&P for me...feeling is that bad jobs news = good QE news will be a short lived sugar high now that we are well at new market highs, and QE has already been pretty much priced in.

Wall St Big Boys may start locking in profits very soon, so that they can buy in lower in a few weeks.

If I fund holds today, should be looking at near 3.4-3.5% gain for October. I'm good with that.

Plan on getting back in early Nov if we go into our typical 5-8 day downturn of 2-3%.

Zzzzzzzzz........Yeeeaaawwn (lol)

Was anybody surprised today?

Wondering why the market fell off the cliff, with no major bad news?

Despite that QE is still intact and safer than ever?

Its because Wall St Big Money decided today was the day to drop the hammer. That's all.

Even CNBC was struggling to find the news that fit the market drop. I'm sure FOX will say its because of Obamacare.

But there is no news. None. This is simply a manipulated game...where mutual fund managers want your buy and hold $$ on a regular basis, while they pump and dump.

Then they buy in again at a lower price. Which is when you want to be getting in.

For anybody foolish enough to follow me

FWM

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

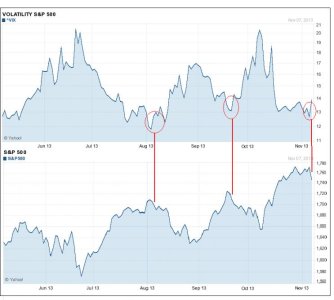

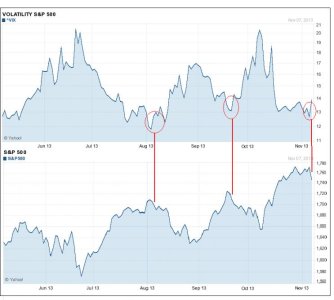

Before today's close, saw some eerie signals when comparing the VIX (top) vs S&P (bottom) chart.

Notice how the VIX "1st sharp rise off low point" confirms the S&P has begun a downturn.

Everything is lining up for this, including our 7-week cycles where we are currently about 7 weeks from the start of our last "initial fall from a top".

Todays rally was very strong, especially in the end. That clouds things a bit.

Seems we're at a crossroads. Either yesterday was a "glitch" or both yesterdays and today's volatility is something more ominous.

or both yesterdays and today's volatility is something more ominous.

I feel its the latter. Lets look at the chart pattern. (below)

Either we just had a market consolidation or semi bull flag (which would be positive) or we are completing a more significant high amplitude crown top (this would be negative).

You be the judge.

In the face of higher volatility and near annual lows on the VIX, I am playing it safe and staying in cash for now.

So far, any downturn has been no match for the 50 Day EMA (red line). Extending that 50 EMA a bit into the future, I see a target bottom of near 1720 (circled in black).

Our longer term trend-line suggests a little lower low...closer to 1700 (black line). About 2 weeks ago, Guy Adami from CNBC's Fast Money Talk suggested the market would soon fall and he targeted a new low near 1710. That fits right in beautifully on this chart...so will patiently wait for a new price in this ballpark.

As for what could take the markets lower, besides being near all time highs in a topping pattern, is FED hearings for Yellen nomination starting next week. Any surprises or strong opposition would lead to big QE uncertainty...adding to the QE uncertainty sure to sink in following today's euphoria of better than expected jobs number.

Notice how the VIX "1st sharp rise off low point" confirms the S&P has begun a downturn.

Everything is lining up for this, including our 7-week cycles where we are currently about 7 weeks from the start of our last "initial fall from a top".

Todays rally was very strong, especially in the end. That clouds things a bit.

Seems we're at a crossroads. Either yesterday was a "glitch"

I feel its the latter. Lets look at the chart pattern. (below)

Either we just had a market consolidation or semi bull flag (which would be positive) or we are completing a more significant high amplitude crown top (this would be negative).

You be the judge.

In the face of higher volatility and near annual lows on the VIX, I am playing it safe and staying in cash for now.

So far, any downturn has been no match for the 50 Day EMA (red line). Extending that 50 EMA a bit into the future, I see a target bottom of near 1720 (circled in black).

Our longer term trend-line suggests a little lower low...closer to 1700 (black line). About 2 weeks ago, Guy Adami from CNBC's Fast Money Talk suggested the market would soon fall and he targeted a new low near 1710. That fits right in beautifully on this chart...so will patiently wait for a new price in this ballpark.

As for what could take the markets lower, besides being near all time highs in a topping pattern, is FED hearings for Yellen nomination starting next week. Any surprises or strong opposition would lead to big QE uncertainty...adding to the QE uncertainty sure to sink in following today's euphoria of better than expected jobs number.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Interesting article regarding QE, from one of its original architects in 2008:

Andrew Huszar: Confessions of a Quantitative Easer

We went on a bond-buying spree that was supposed to help Main Street.

Instead, it was a feast for Wall Street.

Andrew Huszar: Confessions of a Quantitative Easer - WSJ.com

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Now that's just darn right terrible - without wall street there would be no economic growth. And then Birchtree wouldn't be getting wealthy either. Thanx QE.

How about without economic growth there would be no Wall St????

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I dunno. You tell me. Take a look at where G fund is YTD and you tell me if you would have been better off staying in it.

But you made a bold move that worked out for you. Congrats on that. You staying long?

Me, I'm waiting for my price. Happy to be in cash right now.

But you made a bold move that worked out for you. Congrats on that. You staying long?

Me, I'm waiting for my price. Happy to be in cash right now.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

I sit way too long in the "G" now I need to figure when to get out of the market, Might be about January 16th?I dunno. You tell me. Take a look at where G fund is YTD and you tell me if you would have been better off staying in it.

But you made a bold move that worked out for you. Congrats on that. You staying long?

Me, I'm waiting for my price. Happy to be in cash right now.

How's that Liberal thing working out for you lately?

Birchtree

TSP Talk Royalty

- Reaction score

- 143

"Too many stock market dummies are getting rich - huge top forming."

http://www.marketoracle.co.uk/Article43105.html

http://www.marketoracle.co.uk/Article43105.html

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Been on the sidelines for over 6 weeks, waiting for a better price, but I think that this past weeks 4-5 day downturn of around 1-2 percent might be about it.

Tried going in yesterday but got frozen up by TSP.gov website. Made me miss today's gains but went in anyway (50% S and 50% I).

Reasons for going in include:

- Seasonality

- Just coming off a 4-5 day downturn to the 20 day EMA. We were likely due to drop to the 50 day EMA (like I Fund) but most money managers know what happens this time of year and likely did not want to sell too much more....and miss out on X-Mas Rally.

- Jobs News good, but not great. Means economy is definitely on sold footing, but not so good that immediate tapering is likely.

- No news in either partisan politics or tapering...as Congress and Fed will be on vacation till early January. Markets tend to like that.

So will go all in.

Only main concern is that our Sentiment Survey has shown the most "bullishness" in well over a year. Check out these readings (below). Can't remember when we had so many readings at or near the magic 2 to 1 ratio. I do worry that too much money rushing it could cause a big reversal soon. Surprised it hasn't already happened, but will watch our AutoTracker allocations very closely for the shift, especially in the top 50, for any selling.

Until then, may the "melt up" continue.

[TABLE="width: 191"]

[TR]

[TD="align: center"]From:[/TD]

[TD="align: center"][/TD]

[TD="align: center"] To:[/TD]

[TD="align: center"] Bulls[/TD]

[TD="align: center"] Bears[/TD]

[/TR]

[TR]

[TD="align: center"] 12/09/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 12/13/13[/TD]

[TD="align: center"] 53%

[/TD]

[TD="align: center"] 37%[/TD]

[/TR]

[TR]

[TD="align: center"] 12/02/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 12/06/13[/TD]

[TD="align: center"] 62%

[/TD]

[TD="align: center"] 29%

[/TD]

[/TR]

[TR]

[TD="align: center"] 11/25/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/29/13[/TD]

[TD="align: center"] 59%[/TD]

[TD="align: center"] 30%[/TD]

[/TR]

[TR]

[TD="align: center"] 11/18/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/22/13[/TD]

[TD="align: center"] 64%

[/TD]

[TD="align: center"] 26%[/TD]

[/TR]

[TR]

[TD="align: center"] 11/11/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/15/13[/TD]

[TD="align: center"] 55%[/TD]

[TD="align: center"] 36%[/TD]

[/TR]

[TR]

[TD="align: center"] 11/04/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/08/13[/TD]

[TD="align: center"] 53%[/TD]

[TD="align: center"] 35%

[/TD]

[/TR]

[TR]

[TD="align: center"] 10/28/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/01/13[/TD]

[TD="align: center"] 58%[/TD]

[TD="align: center"] 34%[/TD]

[/TR]

[TR]

[TD="align: center"] 10/21/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 10/25/13[/TD]

[TD="align: center"] 58%[/TD]

[TD="align: center"] 30%[/TD]

[/TR]

[/TABLE]

Tried going in yesterday but got frozen up by TSP.gov website. Made me miss today's gains but went in anyway (50% S and 50% I).

Reasons for going in include:

- Seasonality

- Just coming off a 4-5 day downturn to the 20 day EMA. We were likely due to drop to the 50 day EMA (like I Fund) but most money managers know what happens this time of year and likely did not want to sell too much more....and miss out on X-Mas Rally.

- Jobs News good, but not great. Means economy is definitely on sold footing, but not so good that immediate tapering is likely.

- No news in either partisan politics or tapering...as Congress and Fed will be on vacation till early January. Markets tend to like that.

So will go all in.

Only main concern is that our Sentiment Survey has shown the most "bullishness" in well over a year. Check out these readings (below). Can't remember when we had so many readings at or near the magic 2 to 1 ratio. I do worry that too much money rushing it could cause a big reversal soon. Surprised it hasn't already happened, but will watch our AutoTracker allocations very closely for the shift, especially in the top 50, for any selling.

Until then, may the "melt up" continue.

[TABLE="width: 191"]

[TR]

[TD="align: center"]From:[/TD]

[TD="align: center"][/TD]

[TD="align: center"] To:[/TD]

[TD="align: center"] Bulls[/TD]

[TD="align: center"] Bears[/TD]

[/TR]

[TR]

[TD="align: center"] 12/09/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 12/13/13[/TD]

[TD="align: center"] 53%

[/TD]

[TD="align: center"] 37%[/TD]

[/TR]

[TR]

[TD="align: center"] 12/02/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 12/06/13[/TD]

[TD="align: center"] 62%

[/TD]

[TD="align: center"] 29%

[/TD]

[/TR]

[TR]

[TD="align: center"] 11/25/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/29/13[/TD]

[TD="align: center"] 59%[/TD]

[TD="align: center"] 30%[/TD]

[/TR]

[TR]

[TD="align: center"] 11/18/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/22/13[/TD]

[TD="align: center"] 64%

[/TD]

[TD="align: center"] 26%[/TD]

[/TR]

[TR]

[TD="align: center"] 11/11/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/15/13[/TD]

[TD="align: center"] 55%[/TD]

[TD="align: center"] 36%[/TD]

[/TR]

[TR]

[TD="align: center"] 11/04/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/08/13[/TD]

[TD="align: center"] 53%[/TD]

[TD="align: center"] 35%

[/TD]

[/TR]

[TR]

[TD="align: center"] 10/28/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 11/01/13[/TD]

[TD="align: center"] 58%[/TD]

[TD="align: center"] 34%[/TD]

[/TR]

[TR]

[TD="align: center"] 10/21/13[/TD]

[TD="align: center"] -[/TD]

[TD="align: center"] 10/25/13[/TD]

[TD="align: center"] 58%[/TD]

[TD="align: center"] 30%[/TD]

[/TR]

[/TABLE]

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 851

FOMC meets December 17-18, but believe that no news conference scheduled. Not sure they would announce anything on QE but think its possible.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Happy New Year Everyone!

One of my New Years resolutions was to not get too spooked out of the markets...so even if today happens to be the beginning of a 2-3% pullback I will likely stay in. Reason is these type of corrections have been shallow and short term over the past year, mostly bottoming in 2 weeks or less, followed by a rise to new highs. Given we're only into the 1st trading day of the year, it makes sense that this would put us at a higher level by the end of the month.

If however, this was just a one day profit-taking....and we quickly jump back to new highs, I will try to stay in for a few more days, but would then consider briefly getting out (IFT#1) by the end of next week if we start getting into the 1860's since we would then be primed for that slight 2-3% correction. I would plan on buying back in at a lower price (IFT#2) before months end.

Anyway, that's the plan...but will keep in mind that no plan is perfect.

One cautionary note...since we've been on our euphoric holiday melt-up, Sentiment Survey has sold off on over bullishness that has been unmatched for all of 2013.

That chicken could be coming home to roost right now. If so it would really suck to have to take a 2-3% loss to start off the year...but for every 2-3% dip there has always been a 4-6% upswing

One of my New Years resolutions was to not get too spooked out of the markets...so even if today happens to be the beginning of a 2-3% pullback I will likely stay in. Reason is these type of corrections have been shallow and short term over the past year, mostly bottoming in 2 weeks or less, followed by a rise to new highs. Given we're only into the 1st trading day of the year, it makes sense that this would put us at a higher level by the end of the month.

If however, this was just a one day profit-taking....and we quickly jump back to new highs, I will try to stay in for a few more days, but would then consider briefly getting out (IFT#1) by the end of next week if we start getting into the 1860's since we would then be primed for that slight 2-3% correction. I would plan on buying back in at a lower price (IFT#2) before months end.

Anyway, that's the plan...but will keep in mind that no plan is perfect.

One cautionary note...since we've been on our euphoric holiday melt-up, Sentiment Survey has sold off on over bullishness that has been unmatched for all of 2013.

That chicken could be coming home to roost right now. If so it would really suck to have to take a 2-3% loss to start off the year...but for every 2-3% dip there has always been a 4-6% upswing

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 116