-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

When I do go back into stocks (possibly on the next dip early this week if we get one), it might be time to do like Birch and go mostly into the -I- Fund.

Jim Cramer thinks Europe has put in its "bottom".

Cramer this past Thursday:

"This move today (Draghi- ECB rate cut) could be the single most important game changer that could occur in 2013. ..."

"Here's the bottom line...you might not believe me. I don't actually know a soul who does believe me. I don't care. The combination of companies that I speak to who do business in Europe... the terrific earnings from once-totally-on-the-ropes European banks... and the European Central Bank's bold move and great move today to cut rates... has put in a bottom in Europe, and a recovery has already begun. Yes, the turn has come. It explains so much of this move that people have been puzzled over. And you know what? It will keep explaining it for many quarters to come."

Mad Money Recap | Nightly Recap for:* Thursday, May 2, 2013

Jim Cramer thinks Europe has put in its "bottom".

Cramer this past Thursday:

"This move today (Draghi- ECB rate cut) could be the single most important game changer that could occur in 2013. ..."

"Here's the bottom line...you might not believe me. I don't actually know a soul who does believe me. I don't care. The combination of companies that I speak to who do business in Europe... the terrific earnings from once-totally-on-the-ropes European banks... and the European Central Bank's bold move and great move today to cut rates... has put in a bottom in Europe, and a recovery has already begun. Yes, the turn has come. It explains so much of this move that people have been puzzled over. And you know what? It will keep explaining it for many quarters to come."

Mad Money Recap | Nightly Recap for:* Thursday, May 2, 2013

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

POSTED MAY 4TH

Exit into G COB today likely to only be temporary. A look at the charts says why (below)

View attachment 23644

A look at the solid trend-line since QE 4-Eva shows that we still did not hit it even with today's action.

However, given how parabolic upward we've been, and that Monday tends to sell off, figured better to bail a little early and catch a quick 1-2 day dip early this week.

Don't think we're near a top yet.

There has been a consistent 6-7 week periodicity between consecutive peaks (or troughs) the past 4 months.

With our last peak on April 11th, the charts say "next stop...May 25-30th...which following the trendline would put us at 1655-1665. However, the "sell in May" crowd could push this back a bit, so playing it safer, when I jump back in, I would anticipate getting out mid May...where the trendline says 1645.

No plan is perfect, and "Black Swan" news events wreak havoc when we're at new highs...but this is the plan nonetheless.

Have a great weekend...FWM

Well, like I said...no plan is perfect...in an ideal world I would actually listen to what I spout and stay in the market at least till 1645 (see above from May 4th) instead of exiting earlier.

Extending that same trendline above a week further puts it in the 1660's...or very close to our top the other day.

So with everything following cue...I would expect our next move to be a short term pullback of near 3%...near 1635 within the next 3 trading days. Then, barring unusual news...a push higher to new highs once again.

The only thing that might send this market a bit lower...is the fear of "sell in May and go away".

We'll know this is or isn't a factor pretty early this coming morning, but I think we'll see at least one more day of 1-2% down...and if it goes to the zone of our recent 6-7 week interval pullbacks to the 50 day EMA, well thats 1590's territory.

I am looking for a middle of the two...between 1635 and 1595...namely 1615 for a low,. If we drop below 1630 I'll be all in.. This could happen as early as Friday if panic selling to avoid "Sell in May" crowd takes hold.

Afterwards, the reality of "Benny and the Fed" should take hold...and a low volume, moderate upswing may begin as early as the day after Memorial Day...plan to be in on it.

So starting to plan my entrance, but will see how this dip (if its a dip at all) develops in the next 2 days.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Thanks...FWM

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Jumped back in from 100% G to new COB allocation of 50% C and 50% S.

In my May 4th post below, I indicated that the pattern showed our next dip to be mid (or late) May. Well...here we are.

I was looking for more of a sharper selloff, via our 6-7 week cycle of briefly dropping towards the 50 day EMA.

The action of the past 3 days only takes us to the 10 day EMA. (below)

Interesting article outakes (below)

Fed's Bullard Wants Faster Inflation Before Tapering QE

"comments from Federal Reserve Chairman Ben Bernanke at the Joint Economic Committee of Congress on Wednesday rocked markets, as he hinted that policymakers might review the Fed's $85 billion-a month asset-purchase program in the next few meetings, should market conditions improve."

This explains our brief intra-day plunge into the 1630's. BUT...then some insight on today's comments by one of the regional Fed chiefs (from St Louis).

"Before I am in favor of tapering I would like to see some assurance that inflation is going to move back towards target," from St Louis Fed Chief Buillard

This explains our late day rise back to near even....so until inflation ramps up, Fed can afford to stay in.

So basically, the Fed remains in place...nothing drastic via QE in the coming weeks (and probably coming months).

Even the "Sell in May" did not take effect today...which basically tells me that if investors are not going to sell off big on the day before the 3 day Memorial Day weekend, then they plan on sticking around for awhile.

Also...Tom's "seasonality" charts show that we have statistically, some good up days in the last few days of May.

Latest Sentiment Survey also suggests going in (staying in) stocks.

So with all that in mind...I jumped into stocks today.

This drop to the 10 day EMA might be the pressure valve needed to recharge our run-up to 1700.

Only worrisome thing that suggests more downside...is that there is a slight "top" on the charts from a few days ago...and we are due for a 50 day EMA pullback.

However, given today's lack of selling. am betting that we still have another 1-2 weeks before that more serious drop to the 50 day EMA (currently 1596).:worried:

Have a great Memorial Day Weekend Everyone!!!

FWM

In my May 4th post below, I indicated that the pattern showed our next dip to be mid (or late) May. Well...here we are.

I was looking for more of a sharper selloff, via our 6-7 week cycle of briefly dropping towards the 50 day EMA.

The action of the past 3 days only takes us to the 10 day EMA. (below)

Interesting article outakes (below)

Fed's Bullard Wants Faster Inflation Before Tapering QE

"comments from Federal Reserve Chairman Ben Bernanke at the Joint Economic Committee of Congress on Wednesday rocked markets, as he hinted that policymakers might review the Fed's $85 billion-a month asset-purchase program in the next few meetings, should market conditions improve."

This explains our brief intra-day plunge into the 1630's. BUT...then some insight on today's comments by one of the regional Fed chiefs (from St Louis).

"Before I am in favor of tapering I would like to see some assurance that inflation is going to move back towards target," from St Louis Fed Chief Buillard

This explains our late day rise back to near even....so until inflation ramps up, Fed can afford to stay in.

So basically, the Fed remains in place...nothing drastic via QE in the coming weeks (and probably coming months).

Even the "Sell in May" did not take effect today...which basically tells me that if investors are not going to sell off big on the day before the 3 day Memorial Day weekend, then they plan on sticking around for awhile.

Also...Tom's "seasonality" charts show that we have statistically, some good up days in the last few days of May.

Latest Sentiment Survey also suggests going in (staying in) stocks.

So with all that in mind...I jumped into stocks today.

This drop to the 10 day EMA might be the pressure valve needed to recharge our run-up to 1700.

Only worrisome thing that suggests more downside...is that there is a slight "top" on the charts from a few days ago...and we are due for a 50 day EMA pullback.

However, given today's lack of selling. am betting that we still have another 1-2 weeks before that more serious drop to the 50 day EMA (currently 1596).:worried:

Have a great Memorial Day Weekend Everyone!!!

FWM

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I had already moved back in on 5/9 and have made about 2% since then, but looks like I'll be giving it back now and I'm out of IFTs. I guess I'll ride it out and hope to make it back by the end of the month.

Might be the best play....if the brief dip pattern of the past 5 months continues...new highs are likely by the end of May,

At some point, in the game of "musical chairs", the music does stop....and not everyone will be able to "grap a chair"...just feel that the Bernanke Orchestra will play a little while longer.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

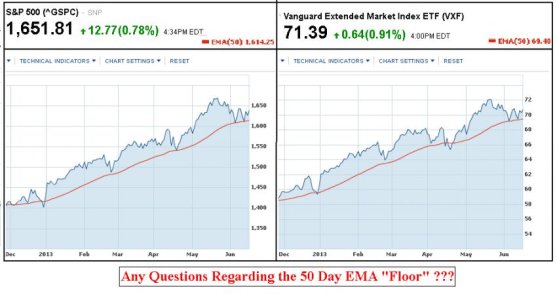

Well, here we are, 6 months into "QE 4-eva" and not much has changed.

Ironic how, what some refer to as "the most disrespected rally in recent times" has also been one of the most predictable rallies of recent times.:cheesy:

Can anyone at this time even minutely doubt the 100% correlation between the current QE environment and the 50 day EMA Floor? (See both C and S Funds below)

Today's action blows the indices well above the recently formed resistance on the S&P (1643).

Now the wildcard is the Fed announcement (always is in this market environment).

Now if the Fed announces a surprise trim in QE, look out below for a 2% (or more) down day.

But so far, anyone betting against "Benny & the Feds" has gotten their a$$ets handed to them...every time.

Think I'll bet on Ben.

Ironic how, what some refer to as "the most disrespected rally in recent times" has also been one of the most predictable rallies of recent times.:cheesy:

Can anyone at this time even minutely doubt the 100% correlation between the current QE environment and the 50 day EMA Floor? (See both C and S Funds below)

Today's action blows the indices well above the recently formed resistance on the S&P (1643).

Now the wildcard is the Fed announcement (always is in this market environment).

Now if the Fed announces a surprise trim in QE, look out below for a 2% (or more) down day.

But so far, anyone betting against "Benny & the Feds" has gotten their a$$ets handed to them...every time.

Think I'll bet on Ben.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Well, a big down day with NO QE tapering. LOL! imagine that!:cheesy:

However, remaining in stocks. Nothing broken.

Not only did we stay above the 50 day EMA, but today's dip is still a "higher low" in a recent uptrend (below).

Fed staying in, so can't imagine a sustained downturn from here...better chances that today was the fakeout, and the next few days we will see a decent rise.

That's the plan...but again, no plan is perfect, so will keep my eye's & ears open.:suspicious:

However, remaining in stocks. Nothing broken.

Not only did we stay above the 50 day EMA, but today's dip is still a "higher low" in a recent uptrend (below).

Fed staying in, so can't imagine a sustained downturn from here...better chances that today was the fakeout, and the next few days we will see a decent rise.

That's the plan...but again, no plan is perfect, so will keep my eye's & ears open.:suspicious:

Last edited:

rcknfrewld

TSP Pro

- Reaction score

- 8

you can polish a turd as much as you want...but it's still a turd

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Well, a big down day with NO QE tapering. LOL! imagine that!:cheesy:

However, remaining in stocks. Nothing broken.

Not only did we stay above the 50 day EMA, but today's dip is still a "higher low" in a recent uptrend (below).

Fed staying in, so can't imagine a sustained downturn from here...better chances that today was the fakeout, and the next few days we will see a decent rise.

That's the plan...but again, no plan is perfect, so will keep my eye's & ears open.:suspicious:

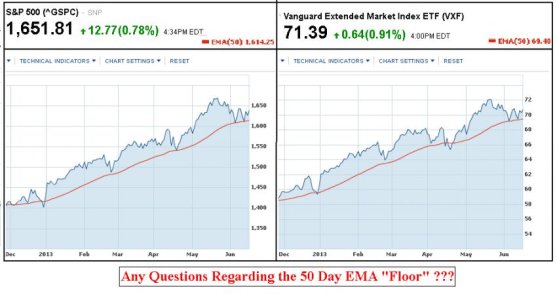

View attachment 24197

Well, since then...the trend has been broken.

Been pondering my next move and decided that instead of panicking, it was time to wait...to digest some more news.

Well, Ben DID let us down, kinda-sorta, slightly.

He didn't say he was tapering this month, or next...but did firm up his intension of tapering timetable to "sooner rather than later".

Since the stock market is a forward looking indicator, you can say that the next 1-2 months of full QE was already baked in. Markets now disecting what will be by the end of summer/early fall.

Then troubling comments from China's Central bank.

All along with some recent rise in interest rates threatening to level out what has been a rebirth in the housing market.

Finally Cramer, who said "never fear" a few weeks ago, now says "this aint over yet" pertaining to our downside potential.

So with 2 IFT's still left, decided to bail to safety as a precaution.

Several reasons...one are the charts. Now that we broke past the longstanding 50 day EMA, it stands to reason that the recent spike down (points A-B below) was our initial fall and the current 2 day rally is our "deadcat bounce". If this proves to be correct, and you take the point from from points A to B, and add that flagpole to today's close (point C), it takes us down to near 1525....which ironically is close to our 200 day EMA....somewhere we typically visit once a year, especially after a big strong upward ride (like we've had Jan-May).

If I'm wrong, and Bernanke tomorrow signs a contract on live TV declaring he won't change QE for another 12 months, then I'll jump back in. Also, another fresh set of moves arrives this Monday.

But I'd hate to be sitting at 1525 a week from today, thinking how nice it would have been to have sold at 1603. If we go up, I don't think we have that same upward momentum (75-80 pts) potential to get us back to new highs, than we have of the same pointspread of downward potential to near a low of 1525.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

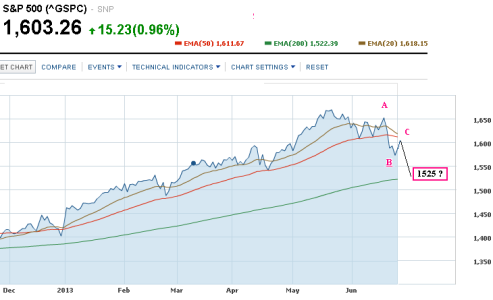

Well, despite having to navigate thru the financial "iceberg field", the main indices managed to break above the 50 and 20 day EMA's (below). Since this is the 4th day or more above these levels, it constitutes a breakout, and seems to point to our most recent market low as a short term bottom. This is a very basic "buy" signal.

The thing for me though, is when to buy.

Now I know the answer from BT would be "right away" or "yesterday" and I really wouldn't be able to argue the sarcastic logic there.

But, in many of our recent breakouts/rapid initial run-ups, we tend to get a brief break back down to our 1st resistance level, which in this case would be in vicinity of both 20 and 50 day EMA's, (currently at 1615 and 1622 and slowly rising). This often happens in the form of a short 1-2% drop, sometimes only in a 1-3 day period.

So I will try to be patient and wait for a buying opportunity rather than following the herd....and will try to keep in mind that when you get that really bad day on a bad rumor (or 2 days) don't let it spook you, unless its truly a catastrophic event. Catastrophic rumors are short lived, especially in this market...gotta embrace them as buying opportunities.

The thing for me though, is when to buy.

Now I know the answer from BT would be "right away" or "yesterday" and I really wouldn't be able to argue the sarcastic logic there.

But, in many of our recent breakouts/rapid initial run-ups, we tend to get a brief break back down to our 1st resistance level, which in this case would be in vicinity of both 20 and 50 day EMA's, (currently at 1615 and 1622 and slowly rising). This often happens in the form of a short 1-2% drop, sometimes only in a 1-3 day period.

So I will try to be patient and wait for a buying opportunity rather than following the herd....and will try to keep in mind that when you get that really bad day on a bad rumor (or 2 days) don't let it spook you, unless its truly a catastrophic event. Catastrophic rumors are short lived, especially in this market...gotta embrace them as buying opportunities.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Everything is coming together - overwhelming and dazed - absolutely amazing. Keep looking for breakdowns, and there aren't any - very 3rd wavish in all respects. Rising stocks kindle worries of a meltup. I'm going to maintain a bullish stance in perpetuity. Snort.

Khotso

Market Veteran

- Reaction score

- 27

Well, despite having to navigate thru the financial "iceberg field", the main indices managed to break above the 50 and 20 day EMA's (below). Since this is the 4th day or more above these levels, it constitutes a breakout, and seems to point to our most recent market low as a short term bottom. This is a very basic "buy" signal.

View attachment 24457

The thing for me though, is when to buy.

Now I know the answer from BT would be "right away" or "yesterday" and I really wouldn't be able to argue the sarcastic logic there.

But, in many of our recent breakouts/rapid initial run-ups, we tend to get a brief break back down to our 1st resistance level, which in this case would be in vicinity of both 20 and 50 day EMA's, (currently at 1615 and 1622 and slowly rising). This often happens in the form of a short 1-2% drop, sometimes only in a 1-3 day period.

So I will try to be patient and wait for a buying opportunity rather than following the herd....and will try to keep in mind that when you get that really bad day on a bad rumor (or 2 days) don't let it spook you, unless its truly a catastrophic event . Catastrophic rumors are short lived, especially in this market...gotta embrace them as buying opportunities.

Good reminder/advice ... now if I would only follow it! :laugh:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Have been frustrated on missing the latest rally but have tried to be patient in terms of not jumping in right at the high, but rather and picking an appropriate time (aka dip).

Been spending my time in the political forums, busting Norms "nnuuts" just for fun, but more so as not to keep looking at the up up and away charts and get sucked in just in time for a correction.

After the action of the past few days, as well as this mornings action, it seems that the major US indices are in the 2nd to 3rd day of minor to moderate negative action...approaching the 8-10 day EMA's, which is usually the biggest dip you get in a strong bull pattern. This strongly pushed me towards a "buy".

Another "buy" signal...was the Sentiment Survey so far...last check before the IFT deadline had 52% Bears 40% Bulls...so any correction should be minor.

Another "buy" signal...came from Coolhands observation that total stock allocation on the Tracker has dipped below 40%, which is a buy signal for him. I often glance at the Total Tracker for the year to see where the top 50-100 are...and then glance down to see where the bottom 50-100 are to get an impromptu "Smart $/Dumb $" indicator. I was surprised to see how many of the bottom 400-500 were mostly G or F...which made me feel that no major correction was likely as there are still too many out of stocks. Coolhands post on this can be found here:

http://www.tsptalk.com/mb/blogs/coolhand/2512-buy-signals-liquidity.html

But to have a bull market continue, it can't be all good news...you often need to have a mix of good AND bad news.

In the midst of the Happy B-day greetings on JTH's thread, Jason pointed out some danger of a double top AND potential of a 50% retracement that could take S&P to 1630...which had me worried too when I read it this morning.

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk.html#post415710

BTW...Happy b-day Jason.

Tom also mentioned the beginnings of some cracks forming, including a disturbing "mini-top" look to the Dow Transports. Transports down slightly again this morning, so that is a concern with the Transports often (albeit not always this year) being an early indicator of future stock trend. Tom's disc here:

TSP Talk Market Commentary

But, zooming back out to the big picture, more than halfway thru our current runup, Jim Cramer had his "Off the Charts" segment with the "Fibonacci Queen" Carolyn Borodin, who gave 2 possible price tops for the S&P...1721-1765 in the short term, and a longer term top of 1823. Link here:

Mad Money Recap | Nightly Recap for:* Friday, July 12, 2013

So...weighing in all this. decided to jump in this morning...50% S and 50% I.

Cramer had a segment about Europe finally putting in a bottom a few days ago, and the I fund has been the leader this month and is likely to become the go to pick of LMBM, so even though going into the I fund for me has always been the "kiss of death", I'll avoid learning the past lessons of my history and do it again (at least 50% anyway).

Been spending my time in the political forums, busting Norms "nnuuts" just for fun, but more so as not to keep looking at the up up and away charts and get sucked in just in time for a correction.

After the action of the past few days, as well as this mornings action, it seems that the major US indices are in the 2nd to 3rd day of minor to moderate negative action...approaching the 8-10 day EMA's, which is usually the biggest dip you get in a strong bull pattern. This strongly pushed me towards a "buy".

Another "buy" signal...was the Sentiment Survey so far...last check before the IFT deadline had 52% Bears 40% Bulls...so any correction should be minor.

Another "buy" signal...came from Coolhands observation that total stock allocation on the Tracker has dipped below 40%, which is a buy signal for him. I often glance at the Total Tracker for the year to see where the top 50-100 are...and then glance down to see where the bottom 50-100 are to get an impromptu "Smart $/Dumb $" indicator. I was surprised to see how many of the bottom 400-500 were mostly G or F...which made me feel that no major correction was likely as there are still too many out of stocks. Coolhands post on this can be found here:

http://www.tsptalk.com/mb/blogs/coolhand/2512-buy-signals-liquidity.html

But to have a bull market continue, it can't be all good news...you often need to have a mix of good AND bad news.

In the midst of the Happy B-day greetings on JTH's thread, Jason pointed out some danger of a double top AND potential of a 50% retracement that could take S&P to 1630...which had me worried too when I read it this morning.

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk.html#post415710

BTW...Happy b-day Jason.

Tom also mentioned the beginnings of some cracks forming, including a disturbing "mini-top" look to the Dow Transports. Transports down slightly again this morning, so that is a concern with the Transports often (albeit not always this year) being an early indicator of future stock trend. Tom's disc here:

TSP Talk Market Commentary

But, zooming back out to the big picture, more than halfway thru our current runup, Jim Cramer had his "Off the Charts" segment with the "Fibonacci Queen" Carolyn Borodin, who gave 2 possible price tops for the S&P...1721-1765 in the short term, and a longer term top of 1823. Link here:

Mad Money Recap | Nightly Recap for:* Friday, July 12, 2013

So...weighing in all this. decided to jump in this morning...50% S and 50% I.

Cramer had a segment about Europe finally putting in a bottom a few days ago, and the I fund has been the leader this month and is likely to become the go to pick of LMBM, so even though going into the I fund for me has always been the "kiss of death", I'll avoid learning the past lessons of my history and do it again (at least 50% anyway).

Last edited:

rcknfrewld

TSP Pro

- Reaction score

- 8

i will not bait you anymore if you post more about the markets...you provide good insight

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

With one more IFT left in July I used it to adjust my 100% stock allocation...going from 50/50 S/I to just 100% S.

2 days of I fund experimentation has left me feeling like someone who has been in an an and out bad relationship, but keeps giving it one more try, hoping this time things will be different.

Will keep it simple and stay in the S fund...hoping that I can ride it to the next Fibonacci level of 1720 in the coming days...and maybe even the next level at 1760 a bit further down the road.

Hopefully the Fed won't throw a major zinger, but a possibility is for the Fed to keep full QE for another 2-3 months before trimming it slightly to 75 billion by Oct...then gradually trending to zero by late 2014...BUT that the "gradual tapering" has already been baked into the market...with no major corrections as long as the tapering is gradual, and remains "data-dependent"

This was described by a Wells Fargo analyst here:

Fed will stop bailing out the economy | Big Data Download - Yahoo! Finance

2 days of I fund experimentation has left me feeling like someone who has been in an an and out bad relationship, but keeps giving it one more try, hoping this time things will be different.

Will keep it simple and stay in the S fund...hoping that I can ride it to the next Fibonacci level of 1720 in the coming days...and maybe even the next level at 1760 a bit further down the road.

Hopefully the Fed won't throw a major zinger, but a possibility is for the Fed to keep full QE for another 2-3 months before trimming it slightly to 75 billion by Oct...then gradually trending to zero by late 2014...BUT that the "gradual tapering" has already been baked into the market...with no major corrections as long as the tapering is gradual, and remains "data-dependent"

This was described by a Wells Fargo analyst here:

Fed will stop bailing out the economy | Big Data Download - Yahoo! Finance

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Fed Downgrades U.S. Economic Growth to Modest, Stays the Course

Fed downgrades US economic growth to modest - Yahoo! Finance

Thank you Uncle Ben, for continuing to cook more rice.

Even my soon to be "former" at COB I fund is showing a nice spike.

As has been the case for months and months...anyone betting against the Fed...has come out on the losing end.

Fed downgrades US economic growth to modest - Yahoo! Finance

Thank you Uncle Ben, for continuing to cook more rice.

Even my soon to be "former" at COB I fund is showing a nice spike.

As has been the case for months and months...anyone betting against the Fed...has come out on the losing end.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

That was from about 2 weeks ago.Cramer had a segment about Europe finally putting in a bottom a few days ago, and the I fund has been the leader this month and is likely to become the go to pick of LMBM, so even though going into the I fund for me has always been the "kiss of death", I'll avoid learning the past lessons of my history and do it again (at least 50% anyway).

Here is a story that just popped up.

Europe May Now Be a Better Investment than America

Europe May Now Be a Better Investment than America | The Exchange - Yahoo! Finance

Maybe time to think about the I Fund???

However, every time I go into it though, I end up feeling sick right afterwards.

Last edited:

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 116