FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Meant to update earlier, but struggled with decisions, and finally at 1159 ET I hit the IFT button for 50% G and 50% F.

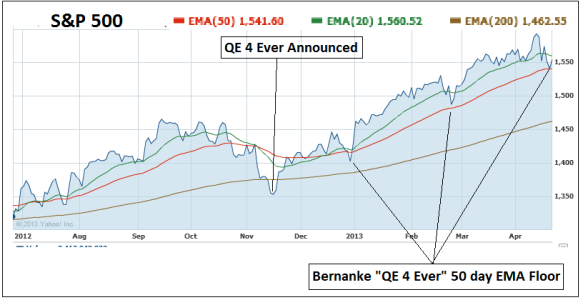

As stated yesterday, the landscape has changed...Dow Transports breaking downward into 50 day EMA territory, and as JTH mentioned yesterday, money (likely led by fund managers) has shifted from small caps to safer large caps, and the next rotation is into cash (Jasons words, not mine). So looking to at least get out of the S.

Only missing ingredient is our Sentiment Survey...still on a buy or hold, and I suspect it will get even more "bearish" later today, indicating a strong buy (lol).

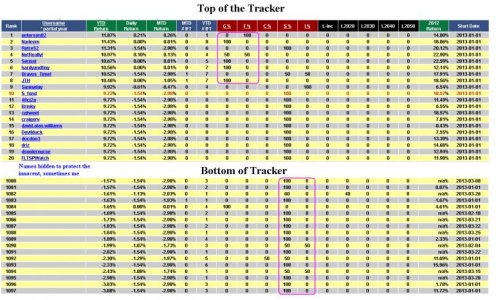

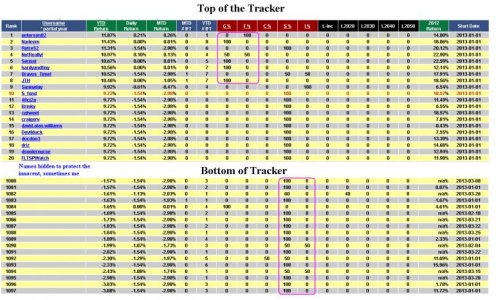

One thing that caught my interest...a look at the smartest of our smart money...compared to the lowest part of the tracker which just a week or two ago was mainly F or G, is now primarily in stocks.

Hey..who dat at #8??

As stated yesterday, the landscape has changed...Dow Transports breaking downward into 50 day EMA territory, and as JTH mentioned yesterday, money (likely led by fund managers) has shifted from small caps to safer large caps, and the next rotation is into cash (Jasons words, not mine). So looking to at least get out of the S.

Only missing ingredient is our Sentiment Survey...still on a buy or hold, and I suspect it will get even more "bearish" later today, indicating a strong buy (lol).

One thing that caught my interest...a look at the smartest of our smart money...compared to the lowest part of the tracker which just a week or two ago was mainly F or G, is now primarily in stocks.

Hey..who dat at #8??