-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

JTH

TSP Legend

- Reaction score

- 1,158

Thanks for the chart JT.

Sorry, been "unplugged" the past few days.

So were' gonna see a pretty hard tumble (-3%) tomorrow??

Lol no my friend, I think this pattern is busted!

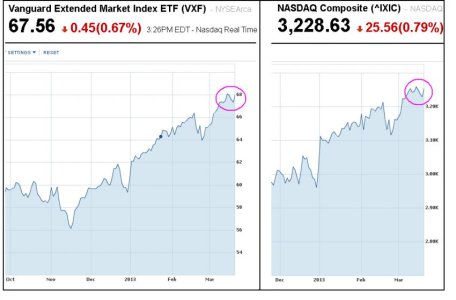

View attachment 22747

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Everything seems to be staying on course per previous thoughts a week ago:

Mainly last weeks correction to the 50 day EMA was the pressure release on the steam cooker...and we would be cooking up to higher highs.

From Feb 22nd post (link below with charts)

"As I said the other day, I am (err, mean was) not worried about the quick drop. Long sustained rallies can have a quick 2-3% drop to the 20 day EMA...which only serves as a quick steam release on the pressure cooker before a quick rise to higher heights."

http://www.tsptalk.com/mb/members-account-talk/15177-fireweathermet-account-talk.html#post396035

2 things continue to support my belief that we're at least headed up to the Fibonacci upper band in the 1550's.

1) Sequester fears aside...what has actually happened with modest tax hikes Jan1st...and moderate spending cuts with the sequester...is that the US Congress and president have done what many say could not be done...a bipartisan approach of tax hikes and spending cuts to tame the deficit.

Last time this happened was 1994...which led to a 6 year trend of significantly reducing the deficit and resulted in a mega bull run in the markets.

2) Possible GDP reduction due to sequestered Gov't spending is actually good news for the markets. This makes it more likely that Bernanke and his Fed underlings keep the petal to the metal with QE. Remember, the biggest reason we dropped off a few weeks ago were the Fed minutes that some Fed Chiefs felt it was time to phase QE out. Sequesterd Fed spending makes this much less likely now.

So with the Fed now probably locked in for at least the rest of the year, , remember Jim Cramers motto "Don't Fight the Fed".

And with bi-partisan deficit reduction plan grudgingly in place...Don't fight ingredients that led to bull market of 1990's.

Mainly last weeks correction to the 50 day EMA was the pressure release on the steam cooker...and we would be cooking up to higher highs.

From Feb 22nd post (link below with charts)

"As I said the other day, I am (err, mean was) not worried about the quick drop. Long sustained rallies can have a quick 2-3% drop to the 20 day EMA...which only serves as a quick steam release on the pressure cooker before a quick rise to higher heights."

http://www.tsptalk.com/mb/members-account-talk/15177-fireweathermet-account-talk.html#post396035

2 things continue to support my belief that we're at least headed up to the Fibonacci upper band in the 1550's.

1) Sequester fears aside...what has actually happened with modest tax hikes Jan1st...and moderate spending cuts with the sequester...is that the US Congress and president have done what many say could not be done...a bipartisan approach of tax hikes and spending cuts to tame the deficit.

Last time this happened was 1994...which led to a 6 year trend of significantly reducing the deficit and resulted in a mega bull run in the markets.

2) Possible GDP reduction due to sequestered Gov't spending is actually good news for the markets. This makes it more likely that Bernanke and his Fed underlings keep the petal to the metal with QE. Remember, the biggest reason we dropped off a few weeks ago were the Fed minutes that some Fed Chiefs felt it was time to phase QE out. Sequesterd Fed spending makes this much less likely now.

So with the Fed now probably locked in for at least the rest of the year, , remember Jim Cramers motto "Don't Fight the Fed".

And with bi-partisan deficit reduction plan grudgingly in place...Don't fight ingredients that led to bull market of 1990's.

JimmyJoe

TSP Analyst

- Reaction score

- 8

The support is 1540. It will soon be 1550. Spring is here. Right on time to get the market on a solid plateau. Financials are still undervalued. From the solid base I mentioned the markets have no recourse but to rise. It is anticipated that money will flow into Europe during late spring with tourism, so the I fund will pop up like cherry tree buds. The I fund, the forgotten step child of our funds, will roll later in the year. After we hit 1600 in early summer the market will find its new beginning. Onward then to 1700 by the end of the year. Presently, the market cannot go flat nor will it go down at this time, during these conditions. Tomorrow expect another day similar to today. The SPX must seek its new all time high, and it will.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Locking in profits...Bounced out today...100% G as of COB Wed.

Think we still have higher to go, but rarely do we go much higher when we're up 7 out of 8 days...and sitting at all-time or near all-time highs (S&P).

Looking for a slightly better buy back in (minus the -I- Fund) within a few days.

Think we still have higher to go, but rarely do we go much higher when we're up 7 out of 8 days...and sitting at all-time or near all-time highs (S&P).

Looking for a slightly better buy back in (minus the -I- Fund) within a few days.

JTH

TSP Legend

- Reaction score

- 1,158

Locking in profits...Bounced out today...100% G as of COB Wed.

Think we still have higher to go, but rarely do we go much higher when we're up 7 out of 8 days...and sitting at all-time or near all-time highs (S&P).

Looking for a slightly better buy back in (minus the -I- Fund) within a few days.

I'm not looking for much of a pullback, I suspect we'll both be jumping back in before too long.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I'm not looking for much of a pullback, I suspect we'll both be jumping back in before too long.

Agree JT,

I think the pattern of down recent Mondays is a result of weeklong surges that allow even the slightest weekend negative news to prompt a quick Monday profit taking.

If this happens again and the markets take a quick dive Monday, I suspect I'll jump back in...depending on what the news is.

I think the main fear with the most recent jobs report is that the economy may begin to do "too well" and Bernanke's most "anti-QE" under-chiefs may start making some noise again.

But nothing will happen for many months still...plan on using something like that as a buy-back-in opportunity.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Well, locking in gains a few days ago and temporarily fleeing to the G fund shows why its nearly impossible to outperform stocks in a strong bull run.:cheesy:

However, based on the parabolic rise so far, including the DOW being up near 10 days in a row...I will continue to resist "chasing", and will try to remember that when the market is at new highs, any small scale negative news typically gets amplified negative market response.

At this point, with a drop to the 50 day EMA only being 3 weeks ago, don't expect any drop to bee too big (unless unforeseen black swan news event develops).

So plan is to look for a drop to the 8-day EMA (Cramer favorite ) as a buy in if a normal "profit-tacking" shallow dip pops in.

That would be basically an S&P drop of only around 1% to near 1544.

However, based on the parabolic rise so far, including the DOW being up near 10 days in a row...I will continue to resist "chasing", and will try to remember that when the market is at new highs, any small scale negative news typically gets amplified negative market response.

At this point, with a drop to the 50 day EMA only being 3 weeks ago, don't expect any drop to bee too big (unless unforeseen black swan news event develops).

So plan is to look for a drop to the 8-day EMA (Cramer favorite ) as a buy in if a normal "profit-tacking" shallow dip pops in.

That would be basically an S&P drop of only around 1% to near 1544.

JTH

TSP Legend

- Reaction score

- 1,158

Well, locking in gains a few days ago and temporarily fleeing to the G fund shows why its nearly impossible to outperform stocks in a strong bull run.:cheesy:

However, based on the parabolic rise so far, including the DOW being up near 10 days in a row...I will continue to resist "chasing", and will try to remember that when the market is at new highs, any small scale negative news typically gets amplified negative market response.

At this point, with a drop to the 50 day EMA only being 3 weeks ago, don't expect any drop to bee too big (unless unforeseen black swan news event develops).

So plan is to look for a drop to the 8-day EMA (Cramer favorite ) as a buy in if a normal "profit-tacking" shallow dip pops in.

That would be basically an S&P drop of only around 1% to near 1544.

I feel for ya, it's tough to chase a market, especially after today and it only get's tougher...

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Well, waking up this morning and turning on CNBC, seeing most stocks in the red, and headlines of possible runs on the banks in Cyprus (economy the size of Vermont) made me feel better about bailing on this rally a few days ago...and avoiding the temptation of jumping in late last week to chase this rally with my last remaining IFT.

Here are some of the top financial boogey-man headlines today:

Why the Cyprus Bail In Is a Bigger Deal Than You Think

Why the Cyprus Bail In Is a Bigger Deal Than You Think | Daily Ticker - Yahoo! Finance

3 Reasons the Cyprus Deposit Tax Matters to U.S. Investors

3 Reasons the Cyprus Deposit Tax Matters to U.S. Investors | Breakout - Yahoo! Finance

Cyprus is basically Europes version of Bahamanian Banks, where many Russian industry leader oligarchs (along with mafia bosses) stashed their money. Now they have no access to their money. Wouldn't be surprised to see a Cyprus or ECB chief behind this decision to end up being found floating in the Mediterranean later this week.

But bottom line is that typically when bad Euro news affects the worlds markets, the first day of the news is not the last day. German and Italian big banks are down 2-4%. The worry is that people might feel that if the ECB can levy a 6-10% tax on depositors accounts in Cyprus, could this happen to Italian, Greek and Spanish banks?

JTH ran some very interesting stats on down days from a Fri into the following week:

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk.html#post399419

Basically Jason found that when down Fri & Mon...then Tue would likely be the last down day, and a good buy in opportunity.

So anyway...my plan is to NOT buy in today. At the earliest wold be tomorrow...but I plan on watching some key S&P resistance levels:

8-day EMA - 1551 (almost there)

10-day EMA - 1548

20-day EMA - 1535

50-day EMA - 1507

My 1st guess at a short term bottom this week is somewhere between the 10-20 day EMA's (or near 1543, which ironically a few days ago I mentioned 1544 as a good buy in target as it was then the 8-day EMA). Will keep my powder dry and be patient....but not overly fearful either.

Here are some of the top financial boogey-man headlines today:

Why the Cyprus Bail In Is a Bigger Deal Than You Think

Why the Cyprus Bail In Is a Bigger Deal Than You Think | Daily Ticker - Yahoo! Finance

3 Reasons the Cyprus Deposit Tax Matters to U.S. Investors

3 Reasons the Cyprus Deposit Tax Matters to U.S. Investors | Breakout - Yahoo! Finance

Cyprus is basically Europes version of Bahamanian Banks, where many Russian industry leader oligarchs (along with mafia bosses) stashed their money. Now they have no access to their money. Wouldn't be surprised to see a Cyprus or ECB chief behind this decision to end up being found floating in the Mediterranean later this week.

But bottom line is that typically when bad Euro news affects the worlds markets, the first day of the news is not the last day. German and Italian big banks are down 2-4%. The worry is that people might feel that if the ECB can levy a 6-10% tax on depositors accounts in Cyprus, could this happen to Italian, Greek and Spanish banks?

JTH ran some very interesting stats on down days from a Fri into the following week:

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk.html#post399419

Basically Jason found that when down Fri & Mon...then Tue would likely be the last down day, and a good buy in opportunity.

So anyway...my plan is to NOT buy in today. At the earliest wold be tomorrow...but I plan on watching some key S&P resistance levels:

8-day EMA - 1551 (almost there)

10-day EMA - 1548

20-day EMA - 1535

50-day EMA - 1507

My 1st guess at a short term bottom this week is somewhere between the 10-20 day EMA's (or near 1543, which ironically a few days ago I mentioned 1544 as a good buy in target as it was then the 8-day EMA). Will keep my powder dry and be patient....but not overly fearful either.

Viva_La_Migra

Market Veteran

- Reaction score

- 56

That's the inherent problem with Socialism. Eventually you run out of other people's money.Well, waking up this morning and turning on CNBC, seeing most stocks in the red, and headlines of possible runs on the banks in Cyprus (economy the size of Vermont) made me feel better about bailing on this rally a few days ago...and avoiding the temptation of jumping in late last week to chase this rally with my last remaining IFT.

Here are some of the top financial boogey-man headlines today:

Why the Cyprus Bail In Is a Bigger Deal Than You Think

Why the Cyprus Bail In Is a Bigger Deal Than You Think | Daily Ticker - Yahoo! Finance

3 Reasons the Cyprus Deposit Tax Matters to U.S. Investors

3 Reasons the Cyprus Deposit Tax Matters to U.S. Investors | Breakout - Yahoo! Finance

Cyprus is basically Europes version of Bahamanian Banks, where many Russian industry leader oligarchs (along with mafia bosses) stashed their money. Now they have no access to their money. Wouldn't be surprised to see a Cyprus or ECB chief behind this decision to end up being found floating in the Mediterranean later this week.

But bottom line is that typically when bad Euro news affects the worlds markets, the first day of the news is not the last day. German and Italian big banks are down 2-4%. The worry is that people might feel that if the ECB can levy a 6-10% tax on depositors accounts in Cyprus, could this happen to Italian, Greek and Spanish banks?

JTH ran some very interesting stats on down days from a Fri into the following week:

http://www.tsptalk.com/mb/members-account-talk/6089-jths-account-talk.html#post399419

Basically Jason found that when down Fri & Mon...then Tue would likely be the last down day, and a good buy in opportunity.

So anyway...my plan is to NOT buy in today. At the earliest wold be tomorrow...but I plan on watching some key S&P resistance levels:

8-day EMA - 1551 (almost there)

10-day EMA - 1548

20-day EMA - 1535

50-day EMA - 1507

My 1st guess at a short term bottom this week is somewhere between the 10-20 day EMA's (or near 1543, which ironically a few days ago I mentioned 1544 as a good buy in target as it was then the 8-day EMA). Will keep my powder dry and be patient....but not overly fearful either.

Viva_La_Migra

Market Veteran

- Reaction score

- 56

That's the inherent problem with Socialism. Eventually you run out of other people's money.

Sorry FWM. I thought I was in a political thread.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Sorry FWM. I thought I was in a political thread.

Its OK VLM. I'm alright with a certain amount of "political" since often it goes hand in hand with economic news.

I assume you're talking about the seizing of Cyprus bank accounts?

Interesting that in Cyprus they penalized the regular account holder rather than the banks bond or share holder. This might be due to the fact that much of the money in Cyprus banks is from people other than Cyprus, often of criminal character (Russian Mafia or Russian Energy Oligarchs-really no difference than Mafia). Thus less politically harmful.

"Pure Socialism" just like "Pure Unregulated Capitalism" leads to the same dismal low standards of living for most of a countries population. See East Germany 1970's or USA in the sweatshop days from the 1880's thru 1930's.

The countries with the highest standard of living are those that are based upon a highly regulated capitalist systems, to ensure a level playing field which is a core ingredient to a free market...along with socialized tenants for modern day necessities like health coverage for all, affordable education. See Sweden, Germany, Canada, Australia.

There is a HUGE misconception (hear it from Kudlow or Fox Business News all the time) that "free markets" mean less regulated markets, and its actually quite the opposite. The less regulation, the more chance of market manipulation of supply&demand, and monopolies are sometimes as bad as communism....which is why those evil communist dictators Richard Nixon & Ronald Reagan broke up the telcom industry monopoly in the 1970's into the early 1980's.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

From link below...interesting video on pending pullback, and an analyst setting a target to buy in.

Excerpts from article/video in blue below:

Saut defines a buying stampede as a streak of up days with only one to two-and-a-half day pauses or pullbacks before extending higher.

Today marks day 53 of the current run.

The longest such streak Saut has seen in his 50 years of chronicling the market is exactly 53 days. :worried:

"If we close down again today it would be three sessions in a row on the downside and that typically would break the back of the buying stampede and you would get a correction," he (Saut) states.

The typical pullback is 5 to 7%.

From the recent highs on the S&P500, that gives a downside target of 1,453 to 1,484 in the relatively near term.

As Saut sees it, a negative close today (indicated by sharp mid-morning selloff) would be strong evidence that the correction phase has begun.

The question for investors is whether they choose to try to trade it or just ride it out.

http://finance.yahoo.com/blogs/breakout/buying-stampede-ending-saut-154455087.html

Excerpts from article/video in blue below:

Saut defines a buying stampede as a streak of up days with only one to two-and-a-half day pauses or pullbacks before extending higher.

Today marks day 53 of the current run.

The longest such streak Saut has seen in his 50 years of chronicling the market is exactly 53 days. :worried:

"If we close down again today it would be three sessions in a row on the downside and that typically would break the back of the buying stampede and you would get a correction," he (Saut) states.

The typical pullback is 5 to 7%.

From the recent highs on the S&P500, that gives a downside target of 1,453 to 1,484 in the relatively near term.

As Saut sees it, a negative close today (indicated by sharp mid-morning selloff) would be strong evidence that the correction phase has begun.

The question for investors is whether they choose to try to trade it or just ride it out.

http://finance.yahoo.com/blogs/breakout/buying-stampede-ending-saut-154455087.html

Last edited:

One hour left for Ferdinand to prove Mr. Saut wrong as the rally builds steam.

Just read that Cyprus voted down the bank tax on depositors. Rebound time!!

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Today's headlines.

FedEx Earnings: Monster Miss Is an Early Warning Sign for Multinationals

FedEx Earnings: Monster Miss Is an Early Warning Sign for Multinationals | Breakout - Yahoo! Finance

First FedEx, Now Oracle! Trouble Ahead for Earnings Season

First FedEx, Now Oracle! Trouble Ahead for Earnings Season | Breakout - Yahoo! Finance

FedEx, Caterpillar And Oracle Disappoint: What Sign Are These Bellwethers Sending?

FedEx, Caterpillar And Oracle Disappoint: What Sign Are These Bellwethers Sending? - Seeking Alpha

Cyprus rejects bailout deal leaving eurozone facing fresh crisis

Cyprus rejects bailout deal leaving eurozone facing fresh crisis | World news | The Guardian

FedEx Earnings: Monster Miss Is an Early Warning Sign for Multinationals

FedEx Earnings: Monster Miss Is an Early Warning Sign for Multinationals | Breakout - Yahoo! Finance

First FedEx, Now Oracle! Trouble Ahead for Earnings Season

First FedEx, Now Oracle! Trouble Ahead for Earnings Season | Breakout - Yahoo! Finance

FedEx, Caterpillar And Oracle Disappoint: What Sign Are These Bellwethers Sending?

FedEx, Caterpillar And Oracle Disappoint: What Sign Are These Bellwethers Sending? - Seeking Alpha

Cyprus rejects bailout deal leaving eurozone facing fresh crisis

Cyprus rejects bailout deal leaving eurozone facing fresh crisis | World news | The Guardian

This is why we don't chase rally's.

Always notice that negative news headlines are always magnified near market tops.

However, the FedEx and CAT negative outlooks are worrysome...since they indicate the state of the global economy, and good domestic news only takes our markets upward so far, before global realities kick in with limits on future growth. We may have gone up too high...too quickly past 3 months.

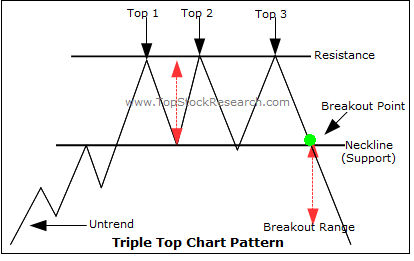

With that, I've noticed (and so has Tom) that most of the major indices have been forming a crown top again.

So will this be another "False Crown" like we had in late Feb, or something more significant?

Crown top downturns are typically NOT brief 2-3 day downturns before heading back to new highs. They usually follow a pattern of a few down days in a row, followed by a 1-2 day "deadcat bounce" followed by a few more down days to a lower low. This is a more prolonged downturn that, IF it materializes, could lead to a 2 week or more downturn before considering buying in again. Last semi crown top and downturn we had was 5 months ago...law of averages says we are due.

Bottom line, I will stay in the G...but watch the news very carefully. Would be nice if Cyprus situation gets settled soon.

But nothing can settle the fact that CAT and Fed EX are showing a global slowdown since January, and if this (along with weakening in China) are true, I don't see a significant move higher in US equities in the short term, despite helicopter Ben doing all he can...although that might make me jump back in sooner than the charts would suggest.

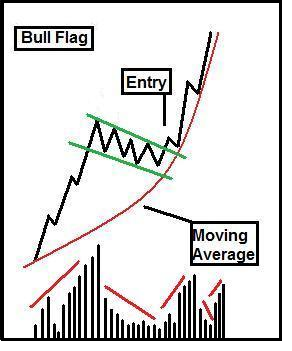

And if this is a false crown top...we should see a decent rebound tomorrow (Fri) that would make the charts look more like a Bull Flag (below) which would then make me think about getting in.

As we close out today....we are NOT seeing dip buyers coming in at the end of the day.

Uhh-Ohh.:worried:

Last edited:

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 115