-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Todays action just clouds the future.

S&P up...not quite erasing its losses yesterday, adding another spike onto the crown (below).

So the charts (and the markets) are chopping & churning...unsure of the future.

Seems much hinges on whether Cyprus and the EU will come to agreement over the weekend, talking some global risk off the table.

Hard to say, but gut feeling is that the Europeans will figure out a patch fix.

Past history has always shown that whenever a Euro crisis looms big into the weekend, the Europeans find a solution before the weekend is over. This usually leads to big Monday up-days, which have been scarce lately.

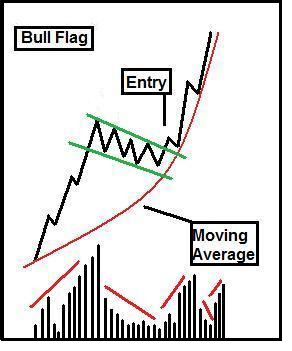

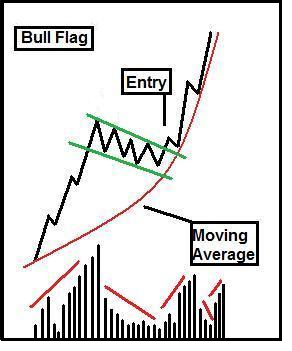

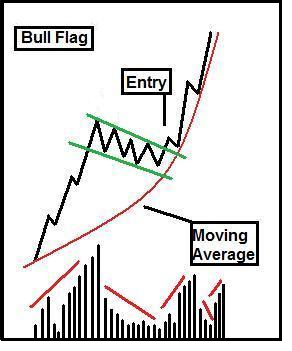

If this happens, then the above chart will likely go from a crown top to more of a bull flag (below)

So my plan is simple.

Keep the powder dry over the weekend.

If Cyprus is settled and market has a good up day (near 1%), I will quickly jump in and look for a higher high, along the long term trendline established by Tom, which could be 1575-1595.

If Cyprus is unsettled, or if markets "sell the news", or other bigger negative news pops up, and markets tank down, I'll either stand pat, or if its a big downward move (lower than yesterdays low) then I might use my last IFT to go into the -F- fund.

Speaking of more significant news that actually could rattle the markets, what would happen if Bernanke left?

Reason I ask, is that Mr Bowl found this article off of Bloomberg (legit news source) that says Bernanke does not plan on sticking around too much longer. (below).

Bernanke Saying He

If this gets more play on the news over the weekend or early next week....then that has "market spook" potential.

But this market has been very resilient this year and rising rockets don't stop on a dime.

Keeping an open mind...with options open...as we head into next week.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Janet Yelin will be his replacement when he decides to hit the road. There are many fight/flight mentality bond holders that continue to disbelieve in the new bull cycle in stocks, thus the market will continue to power higher. This is exactly the psychology present in an early stage bull market. Now is the time to be right and sit tight.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

With todays slight downward action, charts resembling more of a "bull flag" than a crown top.

Given that Cyprus issue has been settled for now (much to the chagrin of Russian criminal elements), there appears very little catalyst to any sharp fall.

So, did what I should have done on Jan 1st...go 100% S.

If I'm wrong, and another black swan event unfolds, I can quickly exit out without feeling like I wasted an IFT, since only 3 more trading days remain in the month.

Interestingly, Cramer put out a "game plan for the week" that suggested buying weakness today if it was a down day.

Cramer's Game Plan For the Week Ahead - Yahoo! Finance

Given that Cyprus issue has been settled for now (much to the chagrin of Russian criminal elements), there appears very little catalyst to any sharp fall.

So, did what I should have done on Jan 1st...go 100% S.

If I'm wrong, and another black swan event unfolds, I can quickly exit out without feeling like I wasted an IFT, since only 3 more trading days remain in the month.

Interestingly, Cramer put out a "game plan for the week" that suggested buying weakness today if it was a down day.

Cramer's Game Plan For the Week Ahead - Yahoo! Finance

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

So far, this last IFT into the S on COB Monday (attached post) is working like clockwork.

Breakout pretty much confirms last weeks false top was likely a "bull flag".

Bull Flag pattern below:

Check that to the past few weeks action on the C or S funds...or Nasdaq...look similar??

Anyway, my game-plan is full speed ahead as we go into April...but will be keeping eyes/ears open, including watching for too much dumb money rushing in...when I will likely step out.

Have a great Easter everyone!

Breakout pretty much confirms last weeks false top was likely a "bull flag".

Bull Flag pattern below:

Check that to the past few weeks action on the C or S funds...or Nasdaq...look similar??

Anyway, my game-plan is full speed ahead as we go into April...but will be keeping eyes/ears open, including watching for too much dumb money rushing in...when I will likely step out.

Have a great Easter everyone!

With todays slight downward action, charts resembling more of a "bull flag" than a crown top.

Given that Cyprus issue has been settled for now (much to the chagrin of Russian criminal elements), there appears very little catalyst to any sharp fall.

So, did what I should have done on Jan 1st...go 100% S.

If I'm wrong, and another black swan event unfolds, I can quickly exit out without feeling like I wasted an IFT, since only 3 more trading days remain in the month.

Interestingly, Cramer put out a "game plan for the week" that suggested buying weakness today if it was a down day.

Cramer's Game Plan For the Week Ahead - Yahoo! Finance

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

As we go into 1st day of April, some things to analyze.

Lets go abroad...to the I Fund (top chart) and China, via the Shanghai Index (bottom chart)

Notice the I fund is showing a similar "Bull Flag" to the one the US Indices showed (and broke upward of) last week.

Meanwhile, China has had some bad times, and its index has had about an 8% correction over a 7 week period, pushing just past the 200 day EMA, along with some "settling" near that level. I point this out, because to a chartist that wants to buy low and sell high, this is about when most of us would be strongly considering buying in...when there is blood in the streets (of Shanghai) and the 200 day EMA is acting like resistance.

What I'm trying to say, is that China, and the I Fund, might be poised to start a good run-up in the short term, which would likely add fuel to our domestic fire.

That, and the fact that our Sentiment Survey remains a buy/hold, is why I'm staying in stocks heading into April (currently 100% S fund).

Lets go abroad...to the I Fund (top chart) and China, via the Shanghai Index (bottom chart)

Notice the I fund is showing a similar "Bull Flag" to the one the US Indices showed (and broke upward of) last week.

Meanwhile, China has had some bad times, and its index has had about an 8% correction over a 7 week period, pushing just past the 200 day EMA, along with some "settling" near that level. I point this out, because to a chartist that wants to buy low and sell high, this is about when most of us would be strongly considering buying in...when there is blood in the streets (of Shanghai) and the 200 day EMA is acting like resistance.

What I'm trying to say, is that China, and the I Fund, might be poised to start a good run-up in the short term, which would likely add fuel to our domestic fire.

That, and the fact that our Sentiment Survey remains a buy/hold, is why I'm staying in stocks heading into April (currently 100% S fund).

Last edited:

rcknfrewld

TSP Pro

- Reaction score

- 8

Music to my ears...keep focused on the markets and informative charts you have been posting/analyzing recently...don't let da Birch man sidetrack ya

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Music to my ears...keep focused on the markets and informative charts you have been posting/analyzing recently...don't let da Birch man sidetrack ya

LOL Rcknfrewld!

Birch would really like this scenario...with the I Fund breaking out of its slump.

We'll see what happens this week. A lot of weird news floating around out there.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Well...this was unforeseen to me (and most on top in the Tracker)...a "Black Swan" news event special to the -S- fund only:

There's A Rotation Underway Out Of Small-Cap Stocks That Could Be Bad News For Everyone

By Matthew Boesler | Business Insider – Mon, Apr 1, 2013 1:51 PM EDT

By Matthew Boesler | Business Insider – Mon, Apr 1, 2013 1:51 PM EDT

Small-cap stocks have been lagging the market recently.

Miller Tabak's Jonathan Krinsky brings this to clients' attention today, writing, "Generally, when the small-caps show relative weakness vs. the large caps, it is a sign that investors are moving out of the riskier/high-beta names and into the 'relative safety' of the large/mega-caps."

There's A Rotation Underway Out Of Small-Cap Stocks That Could Be Bad News For Everyone - Yahoo! Finance

Hate to waste an IFT this early just to shift from one stock fund to the other, but may have to consider it if this trend continues.

Will the S Fund turn into last months I Fund...down when everything else is up?

There's A Rotation Underway Out Of Small-Cap Stocks That Could Be Bad News For Everyone

By Matthew Boesler | Business Insider – Mon, Apr 1, 2013 1:51 PM EDT

By Matthew Boesler | Business Insider – Mon, Apr 1, 2013 1:51 PM EDTSmall-cap stocks have been lagging the market recently.

Miller Tabak's Jonathan Krinsky brings this to clients' attention today, writing, "Generally, when the small-caps show relative weakness vs. the large caps, it is a sign that investors are moving out of the riskier/high-beta names and into the 'relative safety' of the large/mega-caps."

There's A Rotation Underway Out Of Small-Cap Stocks That Could Be Bad News For Everyone - Yahoo! Finance

Hate to waste an IFT this early just to shift from one stock fund to the other, but may have to consider it if this trend continues.

Will the S Fund turn into last months I Fund...down when everything else is up?

JimmyJoe

TSP Analyst

- Reaction score

- 8

Maybe some bad news for the S fund. However, I heard good news at the end of the trading day as Maria Barteromo was talking with some former nay sayers, anti stock fund managers, didn't get their names, but they are now positive about stocks. They said, curiously enough, that the public's very "anticipation" for the stocks to correct and drop 5 or 10% actually creates a "contrarian" environment, thus keeping the stocks elevating.Well...this was unforeseen to me (and most on top in the Tracker)...a "Black Swan" news event special to the -S- fund only:

There's A Rotation Underway Out Of Small-Cap Stocks That Could Be Bad News For Everyone

By Matthew Boesler | Business Insider – Mon, Apr 1, 2013 1:51 PM EDT

Small-cap stocks have been lagging the market recently.

Miller Tabak's Jonathan Krinsky brings this to clients' attention today, writing, "Generally, when the small-caps show relative weakness vs. the large caps, it is a sign that investors are moving out of the riskier/high-beta names and into the 'relative safety' of the large/mega-caps."

There's A Rotation Underway Out Of Small-Cap Stocks That Could Be Bad News For Everyone - Yahoo! Finance

Hate to waste an IFT this early just to shift from one stock fund to the other, but may have to consider it if this trend continues.

Will the S Fund turn into last months I Fund...down when everything else is up?

JimmyJoe

TSP Analyst

- Reaction score

- 8

It is when there is exuberance about stocks that one must be concerned. I, for one, am happy about the market so I'll rely on those expecting the dip to provide the contrarian to the drop for me. I'm contrarian to the expected dip in the markets. I'm doing what is not expected by the markets. I'm in it to win it.Maybe some bad news for the S fund. However, I heard good news at the end of the trading day as Maria Barteromo was talking with some former nay sayers, anti stock fund managers, didn't get their names, but they are now positive about stocks. They said, curiously enough, that the public's very "anticipation" for the stocks to correct and drop 5 or 10% actually creates a "contrarian" environment, thus keeping the stocks elevating.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

This is horrible, FWM post a legit story, and Jimmy tries to backwash it with vile bullish manure. Where's the puke button when you need it.

It was rather Birchtree-ish of him... :notrust:

clester

Market Veteran

- Reaction score

- 37

IMO, it's trouble to be married to a position. When things change you have to change too. It's easy to argue based on your current position. It's best to be neutral so your emotions doesnt get the best of you. I'm still in but ready to exit when the time comes.

Khotso

Market Veteran

- Reaction score

- 27

Well...this was unforeseen to me (and most on top in the Tracker)...a "Black Swan" news event special to the -S- fund only:

There's A Rotation Underway Out Of Small-Cap Stocks That Could Be Bad News For Everyone

By Matthew Boesler | Business Insider – Mon, Apr 1, 2013 1:51 PM EDT

Small-cap stocks have been lagging the market recently.

Miller Tabak's Jonathan Krinsky brings this to clients' attention today, writing, "Generally, when the small-caps show relative weakness vs. the large caps, it is a sign that investors are moving out of the riskier/high-beta names and into the 'relative safety' of the large/mega-caps."

There's A Rotation Underway Out Of Small-Cap Stocks That Could Be Bad News For Everyone - Yahoo! Finance

Hate to waste an IFT this early just to shift from one stock fund to the other, but may have to consider it if this trend continues.

Will the S Fund turn into last months I Fund...down when everything else is up?

I'm pretty sure it will ... afterall all, I moved into it just in time to catch the last few down days, like I did last month with the I fund. Lol! I'm a pretty good contrarian indicator of late. Currently 100% F after a bad 4 day trade into the S!

JimmyJoe

TSP Analyst

- Reaction score

- 8

As one who can make IFTs twice a month, I speak for we of theTsp. We can't go chasing for gains like day traders. Perhap some of you with money elsewhere in the markets may. I hear what is good for me and those of us who are generally buy and holders. And I continue to hear from reliable sources, talking heads, Birchtree, you know, people that have made millions in the stock market, that this indeed is the climate to invest for a long, long haul to SPX 1700. I may go 50C 50I today.This is horrible, FWM post a legit story, and Jimmy tries to backwash it with vile bullish manure. Where's the puke button when you need it.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Very odd market this morning:

Stocks are down.

Gold is down

Oil is down

Vix up a little but not crazy like it tends to do as we slide off a top.

Disturbing is that Dow Tran$ have topped and now dropping towards 50 day EMA.

If you look at Dow Tran$, its very parabolic and shows good top and good drop (fuzzy blue line is my line to near where it is so far tdy)...hard to see how stocks could continue to rise against this (below):

Also, large caps have become the leader, but based only on a small number of sectors...pointed out on CNBC.

Large scale issue...recession in Europe, stagnation in Asia, esp China.

Also...hate being in stocks when JTH, J Ross (and I think Tom Crowly) are out.

Only thing that kept me from exiing to G was being undecided about whether we would see a brief deadcat bounce in S fund nexy day or 2.

Also, watching CNBC today, it seemed like "blood in the streets". So dip buyers might briefly jump back in.

Bottom line, will wait another day.

An up day might give a better exit price.

A down day in all indices confirms correction underway.

Both point to an exit...at least for now.

Stocks are down.

Gold is down

Oil is down

Vix up a little but not crazy like it tends to do as we slide off a top.

Disturbing is that Dow Tran$ have topped and now dropping towards 50 day EMA.

If you look at Dow Tran$, its very parabolic and shows good top and good drop (fuzzy blue line is my line to near where it is so far tdy)...hard to see how stocks could continue to rise against this (below):

Also, large caps have become the leader, but based only on a small number of sectors...pointed out on CNBC.

Large scale issue...recession in Europe, stagnation in Asia, esp China.

Also...hate being in stocks when JTH, J Ross (and I think Tom Crowly) are out.

Only thing that kept me from exiing to G was being undecided about whether we would see a brief deadcat bounce in S fund nexy day or 2.

Also, watching CNBC today, it seemed like "blood in the streets". So dip buyers might briefly jump back in.

Bottom line, will wait another day.

An up day might give a better exit price.

A down day in all indices confirms correction underway.

Both point to an exit...at least for now.

JTH

TSP Legend

- Reaction score

- 1,158

Very odd market this morning:

Stocks are down.

Gold is down

Oil is down

Vix up a little but not crazy like it tends to do as we slide off a top.

Disturbing is that Dow Tran$ have topped and now dropping towards 50 day EMA.

If you look at Dow Tran$, its very parabolic and shows good top and good drop (fuzzy blue line is my line to near where it is so far tdy)...hard to see how stocks could continue to rise against this (below):

View attachment 23177

Also, large caps have become the leader, but based only on a small number of sectors...pointed out on CNBC.

Large scale issue...recession in Europe, stagnation in Asia, esp China.

Also...hate being in stocks when JTH, J Ross (and I think Tom Crowly) are out.

Only thing that kept me from exiing to G was being undecided about whether we would see a brief deadcat bounce in S fund nexy day or 2.

Also, watching CNBC today, it seemed like "blood in the streets". So dip buyers might briefly jump back in.

Bottom line, will wait another day.

An up day might give a better exit price.

A down day in all indices confirms correction underway.

Both point to an exit...at least for now.

Very well said. Some folks have not noticed that the rotational saftey into defense stocks is already bloated, the next rotation is cash.

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 116