Those who were following my thread saw how bullish I was the past 2 months, with inflation going down and rate cuts appearing on the horizon for 2024.

I made a decent profit off it late last year, but now having different feelings in the short term.

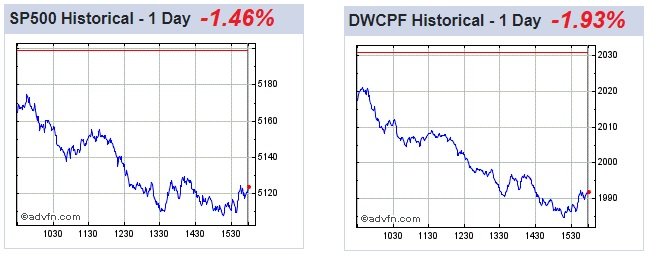

Latest CPI went UP 0.3% from 3.1% to 3.4%. This could have huge implications on the long expected March rate cutting that Wall St has already priced in.

I actually wanted to exit Friday, but had problems logging in and missed the deadline...nothing changing my opinion today, Tom, Oscar Carboni made some good points on this issue.

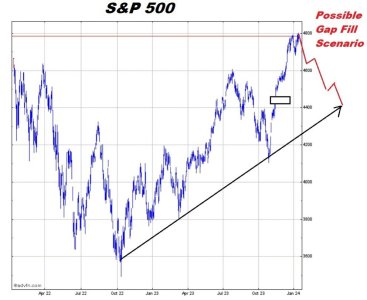

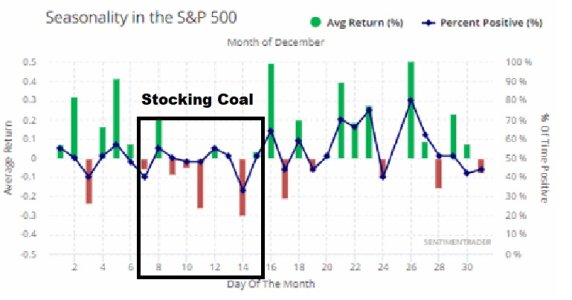

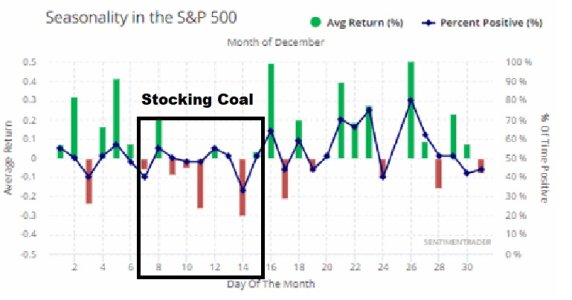

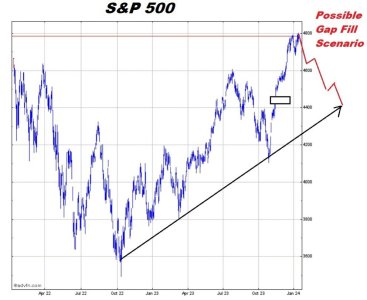

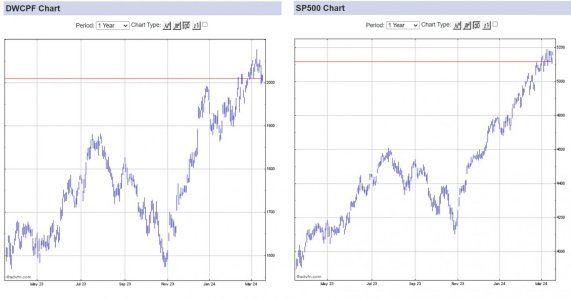

My system is to stay in stocks most of the time but exit at key charting points briefly. Well, the large scale S&P shows something different recently, instead of short bull flag downturns in a rising pattern, its starting to show more of a "Top". It also has a large open gap about 8% below current levels. Unless we see a reverse to the original "Inflation is Lowering" storyline, I think what we are seeing now is a top forming, from the chopping of smart money that bet on rate cuts Nov-Dec but is now starting to see that March rate cut thesis falling apart in the short term and selling stocks to lock in profits, vs the "Dumb Money" who missed out on the recent rally and now finally are bold enough to jump back in. This chopping will end soon and the market should go big one way or the other. My fear is its going to go down, and I charted out (

in red) how we might fill that open gap 8% lower, which lines up with the longer range trendline of recent lows. We'll see how it turns out, but having 2 IFT's in hand, if unexpected good news on inflation somehow comes out, I still have another January move to jump back in. So using 1st Jan IFT to exit 100% S position and going

100% G COB today which is what I tried to do last Friday unsuccessfully.