Well, we were down to the last 3 trading days of the month, and had an extra IFT in hand.

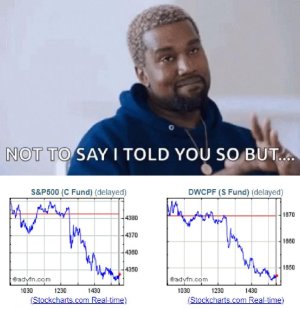

The recent drop on all the major indices has been fierce, got caught in half of it, but was able to bail enough to avoid the final 3% drop.

While I'm still bearish in the medium term (next 2-3 weeks) it seems a short term window of opportunity might be briefly opening.

Using the S&P chart as a barometer, we can see the 9% drop from the most recent highs 2 months ago, has some signs indicating, if not a bottom at the very least, a decent "Dead Cat Bounce" potential, especially where we had 2 roughly equal 7% legs downward, with a brief bounce in between (see chart)

First, any downturn near 10% that lasts for over a month, with complexities (brief sharp bounces in opposite directions) can often be viewed as hitting a bottom if we're in a Bull Market.

If we no longer are in a Bull market...then of course there are other factors...but one key level of going from Bull to Bear market is the 200 day moving avg holding as resistance. We are basically there right now, and often that serves as a deflection point, even if eventually we do move lower.

Also there is a big open gap a few percent up from current levels, and those gaps are usually filled, before heading lower.

So, despite my medium term trepidations, I decided to roll the dice for a quick 1-3 day move back into equities (C Fund)...with a finger on the sell trigger if things go bad.

Left 100% G position and used 2nd Sep IFT to go

100% C COB Today.