FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

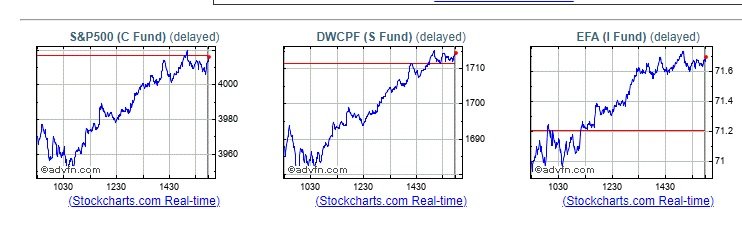

Have been hibernating in the -G- since mid October, locking in a few percent in OCT but missing much of the continued rally.

I've learned "Not to Chase" the market, and was patiently waiting for a good entry point.

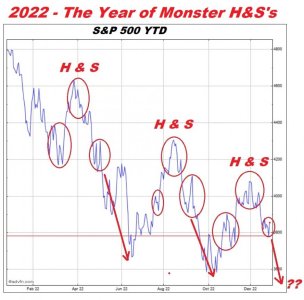

In Tom's discussions he occasioanlly mentioned the big Open Gap in mid November..and have been eying it ever since.

Well, our descent the last few days, along with this mornings big drop, have us just about there, almost filling that gap.

With the seasonality favoring low volume "Holiday Rallies" and reaching that big technical gap barrier...and it being a Friday, with momentum swings typical on Mondays, I've decided to catch the "falling knife". Hopefully my hands won't get too bloody.

Leaving 100% G position COB today (Fri) and going 100% C...with my 1st Dec IFT.

View attachment 56596

Hmmmm???

Maybe the Market lost patience late in the trading day as well, and said "Filling 90% of the gap is close enough"??