Just an update to all, in my "Bullish" outlook I did state a caveat: -

"But as always, one has to keep an eye out for any "Black Swan" events that can quickly make oil prices rise again...and be ready to quickly change investment course based on that." I posted this on Whipsaw's thread last week.

So a few things...I noticed the price of gas at my favorite Gas station stopped going down, and actually went up 1 cent late last week...although it dropped back this morning.

Made me gloss the news and quickly came across a very disturbing article on how the Saudi's said that if we make nice with Iran and allow its oil on the market, they'll cut production to even that out! Uh-oh!

Oil analyst: OPEC+ reminded markets it’s the ‘central banker to crude’

Then...I checked the price of Crude...and saw that there was a 7% rise off the recent low, and that had just pierced the 2 month long downtrend.

So like I said, I am ready to be nimble with my strategy, and change course in the short term.

At the same time, my system calls for me to win "little battles" during the course of the year, until I get a few percent ahead of the major indices, then once I get to about 5% ahead of the funds, make no changes unless its a crystal clear buy/sell signal.

As of today, I'm about

-5% for the year, BUT that has me Beating the

F fund by 4%, Beating the

C fund by 7%, Beating the

I Fund by 12%, Beating the

S fund by 14%.

Who whudda thought the

G-fund would be the

'Fund du Jour" this year? lol.

So really I'm not supposed to budge much at this point, and just ride the "down and ups" until the end of the year.

But I haven't used an IFT yet in August and can afford to be nimble, get out at a key point, then get back in at a better price before months end, or if my hypothesis goes wrong again, due to unforeseen events.

So lets look at the S&P chart (below)

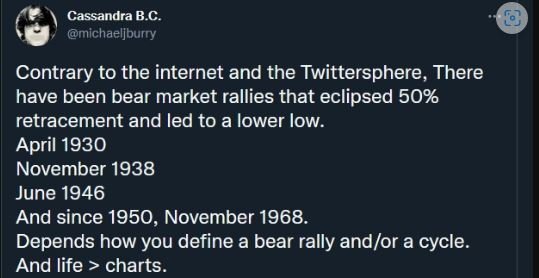

Seems that 50% retracement line was a barrier at least in the short term...or maybe more.

The recent fall has dropped all the way to fill the previous "Open Gap" from one of our big up days 2 weeks ago....and it seems to be holding around there, as its near another resistance line, as well as near the 50 & 100 Day EMA's, which are all converging near the same area.

So I would like to think this area could hold, maybe?? If so and we bounce, the 1st obstacle is the filling of the more recent "

Open Gap" from just the other day, on our way down. Thats my short term exit target.

At that point, depending on what happens with Oil, with Powell speech expected later this week from Jackson, I might quickly jump back in, or stay out and wait for another downturn.

We could also be setting up for a "range-bound" sideways chopping pattern also, till oil/inflation expectations clarify.

So that's my story...and I'm stickin to it (or not) lol.