Didn't have time to post before trading deadline, but used my 2nd June IFT to throw my remaining 50% out of -G- and into the -C-.

This move could bite me badly in the short term if the markets react negatively to the Fed announcement, but too many factors pushing me to go all in:

1) My system has me going into stocks whenever I make gains on the major indices.

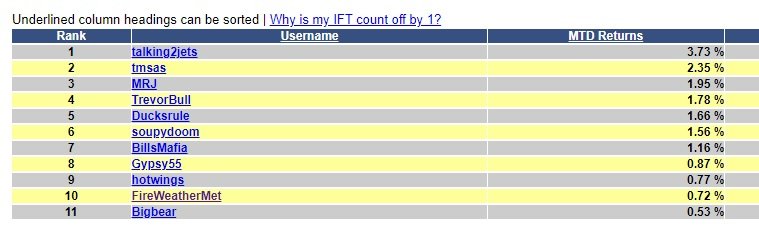

At my last IFT in late May I was 1% ahead of the C and 6% ahead of the S. Sitting out during the last market drop has me now 7% ahead of the C and nearly 15% ahead of the S.

In previous years whenever I successfully dodged a major market downturn, I would sit there and pat myself on the back, only to see a ferocious Bear Market Rally wipe away any 5-10% gain I had from sitting on the -G- Lilly-pad.

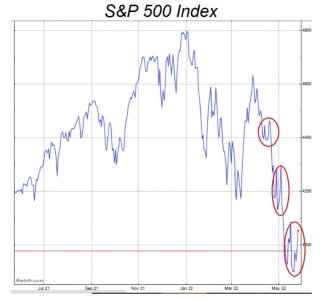

2) S&P has been down for 5 straight days, thats rare. Even more rare, the ferocity of the downturn, S&P dropped over 7% in just 3 days.

That massive free-fall seemed to be related to the fact the markets had baked in a 0.5% rate hike, suddenly the chances of a 0.75% hike went from near 20% to better than 50/50.

But this AM most financial analysts on Bloomberg and CNBC said the market is now expecting an 0.75% hike, which would signal the Fed is serious about inflation, and might be perceived as favorable, and that 0.50% might signal the Fed would remain behind the inflation curve.

One guy did say if the Fed went with a whole 1%, that could send some short term shock waves...but that it would be temporary.

3) Due to the huge drops of 2-5% per day on some of the past few days, some big open gaps appeared on the indices. Those would be short term targets, before considering exiting stocks again.

Tom did a nice chart of them so I'll just post his here below:

So all in all, a bit of a gamble throwing the rest of my cash into the market, but it seems the rewards a few days from now should outweigh the risks, (hopefully). Leaving old position of 50% C 50% G and going

100% C COB today.