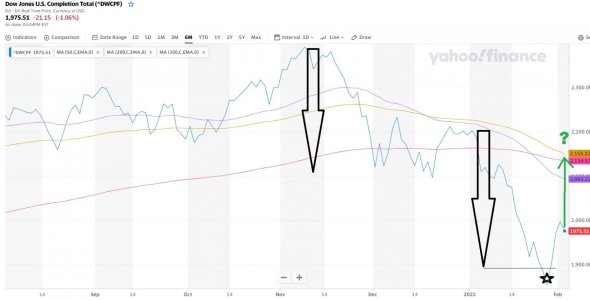

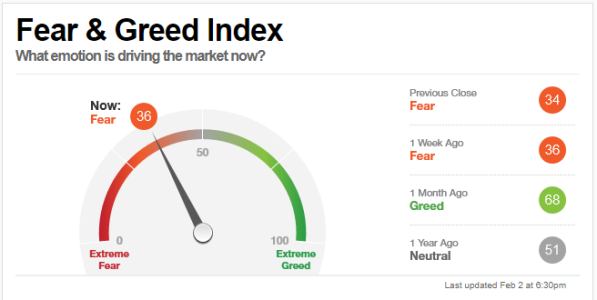

Tried sticking to a new system this year...one that during a Bull Market stays mostly "IN" equities, and just exits once every month or 2 at or near short term market peaks, for 2-5 days...but sometimes longer if the "peak" keeps rising. Used a combo of VIX and Sentiment Survey, along with chart patterns to determine those short term peaks.

The verdict...well...mixed.

If you had told me back last January 2021 that at the end of the year the S-Fund would be up 12%, and that I would be beating the S by nearly 8%, I would have imagined this system working beyond my wildest dreams, and that maybe I'd even be getting one of those cool coffee mugs for finishing at the top of the Tracker (lol)!

But...my mistake, and my weakness, was not knowing what the right fund would be to target, and stay in most of the time. Given that the S-fund has been our top fund during most bull market years, I just assumed that was where I would park my $$ this year. But it became apparent as the year went on that the C-fund was outperforming the S. To make matters worse, there were micro-cycles of 1-2 weeks where the S outperformed the C, and it seemed that when I made some decisions to go into stocks, and changed from the S to the C, I did it at precisely the wrong times, when the S had its occasional big runs, limiting the gains I would make, despite timing some market peaks nearly perfectly. By the latter part of the year, I stopped trying to guess, and kept my stock allocations mostly 50/50 C and S.

So sitting at 20.36%...am beating the S (12.55%)...I (11.32%)...F (-1.44%) and G (1.37%) handily. But the true target this year was the C (29.21%) and I totally missed that. ;damnit

So now, with still 2 Dec IFT's at hand, and 2 business days left, I'll likely make an IFT either today or tomorrow, to change from my 50/50 S/C allocation that I've kept since Nov, and go mostly, or all into the C, heading into the Ne Year. Happy New Years to all and wishing you all happy returns for 2022!