FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

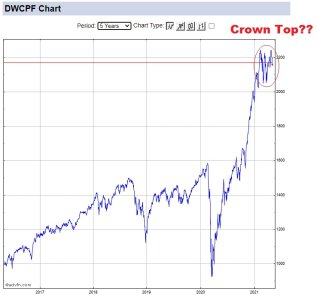

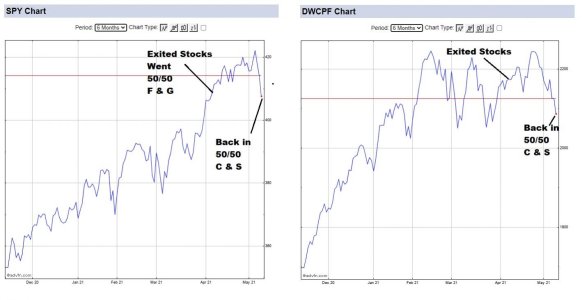

After a very strong, seemingly slightly overextended push in the S&P, there is temptation to briefly lock in profits and wait for a lower price top buy back in.

VIX dropping to near 1 year lows this morning (close to April 1st 1 year low) confirming this.

F looks possibly like a bear flag (per Tom's discussion) but possibly breaking out in short term so in going to safety I will split my assets into 50% G and 50% F COB today, and hope most of the S&P correction doesn't occur the next few hours-lol.

VIX dropping to near 1 year lows this morning (close to April 1st 1 year low) confirming this.

F looks possibly like a bear flag (per Tom's discussion) but possibly breaking out in short term so in going to safety I will split my assets into 50% G and 50% F COB today, and hope most of the S&P correction doesn't occur the next few hours-lol.