FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

We are currently at a critical point.

The S&P and Nasdaq/Russel all bouncing near the old June low.

Tom mentioned that this market action is trying to decide where the next big move will be.

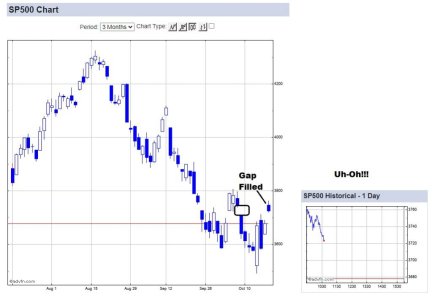

Pivot Boss on his video showed that the open gap up about 3% from here might be a good short-term upward target. (see chart below)...IF we can hold today & close above 3650???

Problem is...if this bouncing near the old June low is setting the stage for the next big move being DOWN...then the long term channel gives a hint at what the next downward target might be.3250-ish, basically 10-12% down from here.

One thing that is worrisome...even though SP/Nasdaq/Small Caps still holding near the June lows, the DOW has pierced those lows, and its upward bounces are finding upward resistance at that olld low. (chart below).

Thats troubling, as there's often one market leader which leads the trend for the rest, and if its the DOW, then the other indices could soon follow.

There are huge global geopolitical ongoing events that might lead to that big turn being downward, ie: UK/Europe Gas situation, Esp Russia sabotaging current pipeline to drive gas prices up, and making regular nuclear threats to scare the West, which could also scare markets.

My system is set up to stay ahead of the stock indices, and in that respect, is acting wonderfully as I'm 15-20% ahead of the C/S/I funds BUT I never factored in a long term Bear Market, and I am trying to decide if I should make the "Best Fund" my current target...i.e. staying in the G and just making short term entries into stocks at possible short term bottom bounces.

Things have changed since my mid summer bullish stance, namely downward oil prices stopped being correlated with CPI, and FED killed any hopes of curbing rate hikes. The adage "Don't FIght the Fed" works both ways, and I might have to change my system strategy to account for that, as well as political uncertainty.

Next months CPI showing better drops and Putin being poisoned could be something to change the geopolitical uncertainties to a more bullish stance.

The S&P and Nasdaq/Russel all bouncing near the old June low.

Tom mentioned that this market action is trying to decide where the next big move will be.

Pivot Boss on his video showed that the open gap up about 3% from here might be a good short-term upward target. (see chart below)...IF we can hold today & close above 3650???

Problem is...if this bouncing near the old June low is setting the stage for the next big move being DOWN...then the long term channel gives a hint at what the next downward target might be.3250-ish, basically 10-12% down from here.

One thing that is worrisome...even though SP/Nasdaq/Small Caps still holding near the June lows, the DOW has pierced those lows, and its upward bounces are finding upward resistance at that olld low. (chart below).

Thats troubling, as there's often one market leader which leads the trend for the rest, and if its the DOW, then the other indices could soon follow.

There are huge global geopolitical ongoing events that might lead to that big turn being downward, ie: UK/Europe Gas situation, Esp Russia sabotaging current pipeline to drive gas prices up, and making regular nuclear threats to scare the West, which could also scare markets.

My system is set up to stay ahead of the stock indices, and in that respect, is acting wonderfully as I'm 15-20% ahead of the C/S/I funds BUT I never factored in a long term Bear Market, and I am trying to decide if I should make the "Best Fund" my current target...i.e. staying in the G and just making short term entries into stocks at possible short term bottom bounces.

Things have changed since my mid summer bullish stance, namely downward oil prices stopped being correlated with CPI, and FED killed any hopes of curbing rate hikes. The adage "Don't FIght the Fed" works both ways, and I might have to change my system strategy to account for that, as well as political uncertainty.

Next months CPI showing better drops and Putin being poisoned could be something to change the geopolitical uncertainties to a more bullish stance.