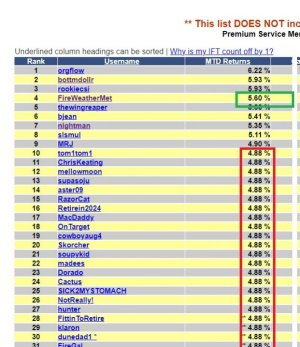

Really happy with my move back into stocks on the last day of May, paying dividends to the tune of 5.24% so far in June.

When stocks go up so quickly, so fast, I always get worried about the market being overextended in the short-term.

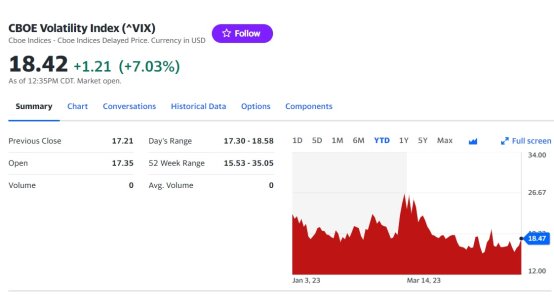

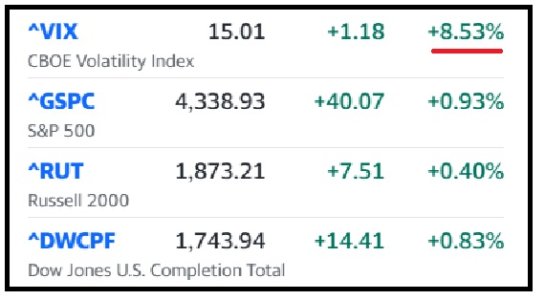

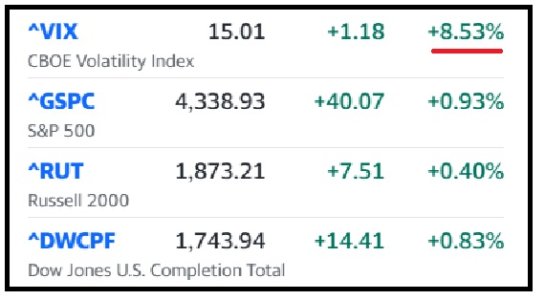

What bothered me even more this past morning, and ALMOST made me lock in profits & bail, was that while main stock indices were up nicely, the VIX skyrocketed UPWARDS, instead of sliding downwards.

Also noticed the C-Fund outperforming Small Caps suddenly the past few days...sometimes a sign that a rally is getting long in the tooth.

But decided I will stay the course at least thru CPI announcement TUE and maybe even Fed announcement later this week.

With price of oil sharply lower than a year ago, CPI should be down sharply. BUT on top of huge rise in stocks, good news on CPI/Rates could push us well into "Overextended & Profit Taking" territory. With 2 June moves still available, can afford a step out, then step back in at a lower price.

We'll see what Tuesday brings...good luck to all.