FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

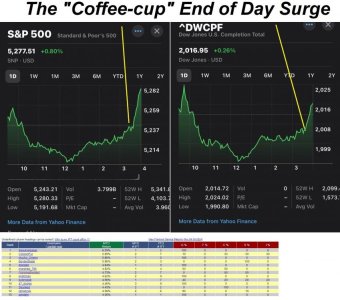

As explained yesterday, I'm rolling the other 50% of my dry powder into stocks COB today.

Going 50% C and 50% S COB today.

Going 50% C and 50% S COB today.

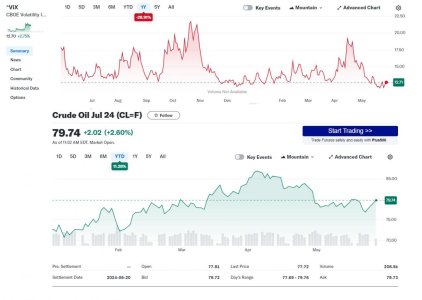

Now that we're approaching the 1st open Gap on the S&P as well as the "Oscar Carboni Special" indicator (100 Day EMA lol) I'm getting ready to throw my other 50% into stocks.

There is a scary open gap way, way down from there, I don't think our economic situation has deteriorated enough to take us down there (yet). We'll see what the future brings.

Could be some wild intraday swings if we plunge quickly another half percent to fill that gap, (or 1% to reach the 100 EMA) then see a sharp upward bounce from there.

Fasten your seatbelts...see chart below.

View attachment 60670