Voodoo

You've made 1 or 2 accurate albeit irrelevant points, regarding whats currently affecting the US Economy and most importantly our investment decisions.

BUT...you've added a lot of bull$hit points, that I've seen stem from highly partisan news outlets...as I watch news from all spectrums.

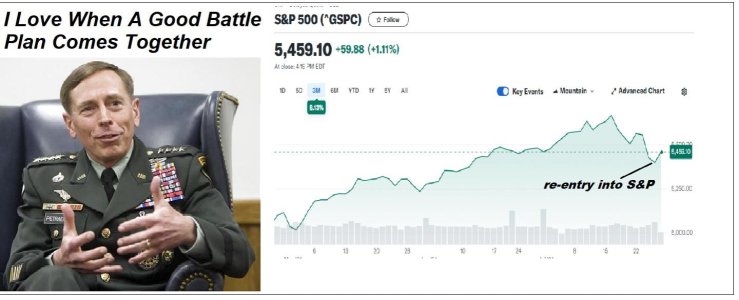

Was analyzing data this morning to maybe make an IFT but decided to hold off, so now I can easily answer and debunk many of these points, which I feel would lead anyone into making bad investment decisions today.

Prefer all the facts, not just a FBI press release that doesn't disclose lack of data from large cities, you know, the safe ones like LA and NYC...

FBI says crime has plummeted to start 2024 - but is missing a big part of the data | The Independent

This one I see a lot from partisan news outlets, trying to amplify crime, leading up to election day.

But I prefer an actual non-partisan Gov data figure, over a "spun" article from a tabloid.

Yes NYC and LA did not report numbers, but from the article

this has long since been the case, where only 2/3rds of police precincts report to the FBI.

So if NYC,LA regularly didn't report to the FBI in the past, then its irrelevant, and including them now, but excluding them in previous years, would give you an invalid data trend ( I took Statistics in Grad School).

And even your tabloid article acknowledges that overall crime in NYC is down, like it is in most parts of the country, but its specifically "Subway Crime" thats up sharply.

However, for OUR purposes, national/global economy and investing, crime in 1 metro area, and only subway crime in another metro area is NOT something that impacts the economy from Florida to Texas to Tennessee to Utah (where I live now) and most areas in-between.

Semantics, maybe, but inflation is not down. The rate of inflation is decreasing, but not down by any stretch. It's a cumulative effect, additive or subtractive in some instances, but it surely isn't down.

Access to this page has been denied (Link still works for me, SeekingAlpha)

This is one of the most laughable things I've heard, because this cumulative effect is nearly ALWAYS the case for the past 100+ years.

Even when inflation is down at the Fed target rate of 2%, its ALSO ALWAYS CUMULATUVELY INCREASING.

Its only when the economy is in a severe Recession or outright Depression, is where you actually see "Negative" Inflation, (aka Deflation) over the course of the year. This is extremely rare.

And when the economy is performing better than average, that typically leads to a

slight increase in inflation.

And salaries also increased sharply, and have been outpacing inflation over the past 16 months.

Just a moment...

Otherwise your Alpha article was from 2022 and was calling for a Recession starting in January 2023 which did not happen....but it did accurately predict that CPI had peaked and would decrease, and that US stock indices would be positive by 10-15% in 2023 (S&P was actually up 24% in 2023), which seemed to be the main point of the article.

Jobs....have to agree we could use some outside labor sources. A free for all across the border from nearly every nation on earth isn't the remedy, and it's quite evident to see.

I agree that there needs to be some better controls on the border, but this is a political issue.

The economic one, from both the GOP during Bush Years, and Today under Biden, is the "Inconvenient Truth" is that our economy is largely driven by cheap labor. And border crossings increase when the economy is good and decrease when US economy is bad (like 2009-2011 under Obama).

Its sad to see Texas border towns being overrun, before illegal migrants looking mostly for work, fan out across the country, but this in no way would make me flee stocks, actually it would lead me to do the opposite, since it would indicate our Economy is attracting extra workers.

May's jobs number are not a bright spot by any means and mostly ignored.

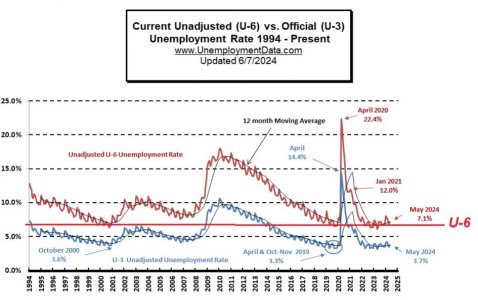

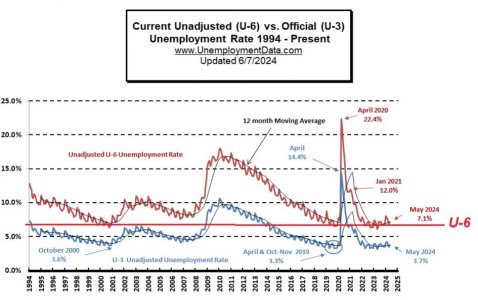

625,000 full time jobs lost, replaced by 286,000 part time employees. The 4% unemployment numbers are farcical, and typically inaccurate, but the one consistently touted by everyone. However, a more accurate representation would be the U-6 unemployment number, currently standing at 7.4%.

Access Denied (As does this one, BLS)

OK this is total crap here...and here's why.

For those who don't know U-3 is the total industry standard Unemployment Rate...U-6 is ALWAYS HIGHER because it counts part time workers who claim to be seeking full-time employment.

The historical U-3 vs U-6 chart tells the whole story, that the current 7.1% U-6 rate is near 30 year historic lows, similar to 2019 and much lower than, say 2018, when the U-6 rate was 8-9%.

So any news outlet that tries to poo-poo the regular U-3 Unemployment rate by pointing at the U-6 rate is likely a bull$hit fake or partisan news site.

"Standard Chartered estimates that nearly half the growth in non-farm payrolls reported by the Labor Department since October can be attributed to immigrant groups that include refugees, those seeking asylum and parolees, the bank’s Head of Global G10 FX Research and North America Macro Strategy Steve Englander and economist Dan Pan wrote in a research note. All told, those workers added 109,000 jobs per month. The average net monthly increase during that period was about 231,000."

https://www.politico.com/newsletters/morning-money/2024/06/04/what-bidens-immigration-order-means-for-the-job-market-00161379

Yeah that estimate is probably correct IMHO, but has ZERO to do with investment decisions of not being in equities. Since we are deep below the statistical "Full Employment" level where the U-3 Unemployment rate is 5%, and in a severe labor shortage, there's less people who are seeking full time employment, its often people already working a part-time job, taking another part-time job, or retirees looking for a part-time job only.

Reason its so hard to get below 5% unemployment is there's always a group of workers who leave the workforce, to go to college and get a better job, drop out for maternity/paternity leave, take time off to travel the world (I have a few friends who are doing this now), as well as bad workers who get fired for cause, not to mention the over 1 million adults being incarcerated and no longer part of the workforce.

Look Voodoo, I'm sorry if I sounded a bit harsh, and I wouldn't do this on anyone else's page, but this page is mine, so....

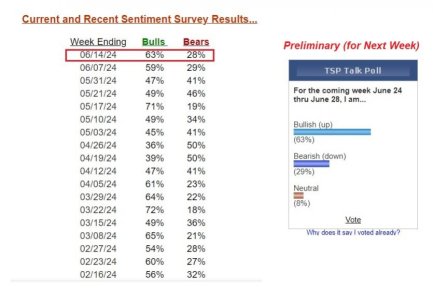

Bottom line...as opposed to "Irrational Exuberance"...I fear that you are using "Irrational Fear" based on false, partisan spun news sources, to keep an overly negative view of the economy and more importantly, the market, perhaps keeping yourself out of stocks much of the time. How's that working out this year so far?