ravensfan

Market Veteran

- Reaction score

- 293

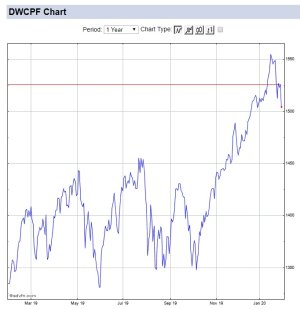

False alarm on September exodus from markets.

Using first September IFT to leave G Lillypad, and go 100% C COB today.

Still wary of high October volatility but don't feel like market crash is gong to happen tomorrow (famous last words-gulp)!

Full steam ahead...famous last words of the Captain of the Titanic...:worried: