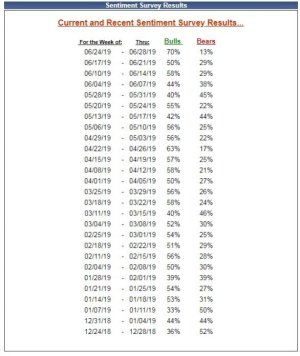

First question would be, how many people are participating in the survey compared to years past?

Second question is what do allocations on the tracker say? Per Ocean's List, nothing like the sentiment survey.

[TABLE="width: 80%"]

[TR]

[TD="width: 22%, bgcolor: #eeeeee, align: center"]

All members combined averages[/TD]

[TD="width: 9%, bgcolor: #eeeeee, align: center"]

Returns %[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

G %[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

F %[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

C %[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

S %[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

I %[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

L2050[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

L2040[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

L2030[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

L2020[/TD]

[TD="width: 6%, bgcolor: #eeeeee, align: center"]

Income[/TD]

[/TR]

[TR]

[TD="width: 22%, bgcolor: #ecd672, align: center"] Total members: 1285[/TD]

[TD="width: 9%, bgcolor: #e3e4fa, align: center"] 10.34[/TD]

[TD="width: 6%, bgcolor: C1CCFF, align: center"] 38.63[/TD]

[TD="width: 6%, bgcolor: C1CCFF, align: center"] 6.68[/TD]

[TD="width: 6%, bgcolor: C1CCFF, align: center"] 16.29[/TD]

[TD="width: 6%, bgcolor: C1CCFF, align: center"] 27.76[/TD]

[TD="width: 6%, bgcolor: C1CCFF, align: center"] 5.74[/TD]

[TD="width: 6, bgcolor: #e3e4fa, align: center"] 2.01[/TD]

[TD="width: 6%, bgcolor: #e3e4fa, align: center"] 0.45[/TD]

[TD="width: 6%, bgcolor: #e3e4fa, align: center"] 0.84[/TD]

[TD="width: 6%, bgcolor: #e3e4fa, align: center"] 0.78[/TD]

[TD="width: 6%, bgcolor: #e3e4fa, align: center"] 0.83[/TD]

[/TR]

[/TABLE]