FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Feeling good now about locking in profits yesterday.

As always, the trick is "WHEN to get back in".

In my system (which I don't stick too often...sadly for me) it would get me back in today, locking in a better than 0.50% gain on the major indices for the month.

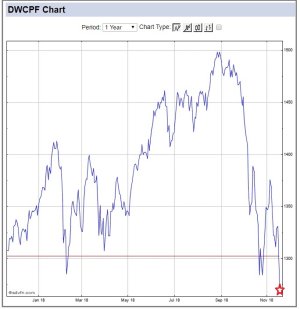

But it seems recently these downturns off the first bottom have a bit more amplitude, often testing the old bottom.

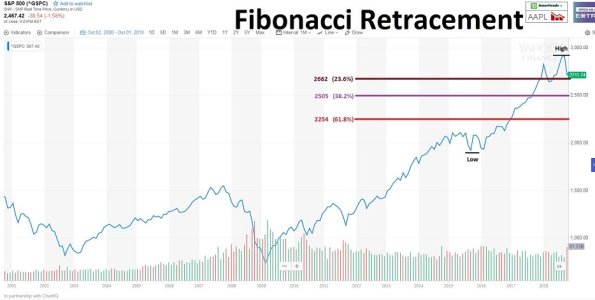

Tom, in his evening analysis, identified some open gaps that will probably get filled that might serve as a better "buy in point". (below).

As always, the trick is "WHEN to get back in".

In my system (which I don't stick too often...sadly for me) it would get me back in today, locking in a better than 0.50% gain on the major indices for the month.

But it seems recently these downturns off the first bottom have a bit more amplitude, often testing the old bottom.

Tom, in his evening analysis, identified some open gaps that will probably get filled that might serve as a better "buy in point". (below).