- Reaction score

- 2,462

Interesting, and a little scary. Shows that the administration has no economic experts. https://www.cnbc.com/amp/2018/12/28/...k-markets.html

How about Larry Kudlow? Ironically, he was the economic expert on CNBC for a while.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Interesting, and a little scary. Shows that the administration has no economic experts. https://www.cnbc.com/amp/2018/12/28/...k-markets.html

Was involved in two shutdowns or more and always got paid for the time off the next payday after the shutdown, Free Vacation and paid for it, nobody is NOT getting paid.

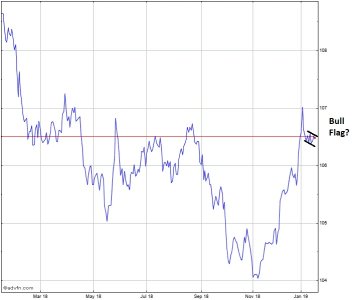

Fading this 2-3 day monster rally. Doesn't feel like the bottom yet especially given all the Washington uncertainty still in the air, and after watching CNBC's Fast Money's Carter Worth, he laid out some pretty good points on why there is likely more to go.

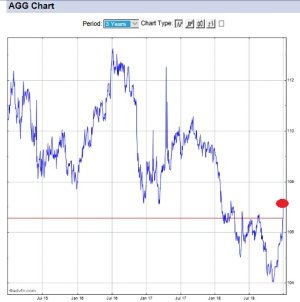

Using 1st Dec IFT to exit S and C funds, shifting all into F, COB today (Dec 28).

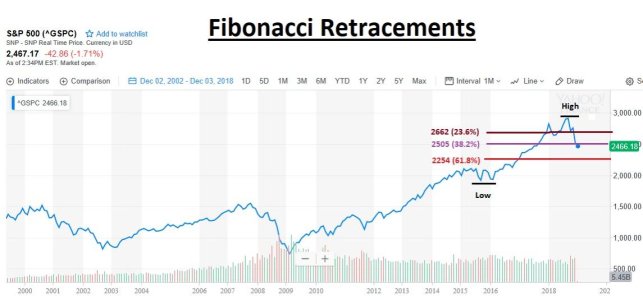

BTW, this is a Fibonacci Retracement I did a week ago on the S&P, based on medium term bottom and tops. Notice where we are now near 2487 around noon EST, piercing the 1st 2 levels with 2254 being the next.

View attachment 43956

Was involved in two shutdowns or more and always got paid for the time off the next payday after the shutdown, Free Vacation and paid for it, nobody is NOT getting paid.

I miss the random posts with the jamaican dude smoking a J lol

Boghie is talking abouit the Sequestration of 2013 where we all took a 20% pay cut for several months. That hurt our organization because we are prefunded and we ended the fiscal year with too much left so take it away next year. We had people hurt because the financial hardship affected the clearaces of some folks living too close to the edge and we lost them for a year or more until they could get back in. The actual furloughs happened after the new fiscal year and didn't affect us.

Yer right I retired in 2010.That was it.

I worked (and still work for) the DOD. I think you had already retired NNuut so you didn't get to live that dream. That experience in 2013 was a bad one. Not a killer, but not a vacation either. The previous 'shutdowns' were made whole financially soon after the gubmint reopened. I was expecting what happened so I was ready. But, like Cactus says, there were quite a few who were really hurt during that one.

The DoD has been authorized for FY2019, so no issues for me.

With most other indices struggling but S still having a huge day (so far) will start to shift towards defense and protect 6-7% monthly gains (depending how things finish today).

Using 2nd IFT to leave 100% S position and go 50F and still remain 50 S.

Next move would be waiting to see if things boil over, then move remaining S into G. Or not, if things continue to climb.