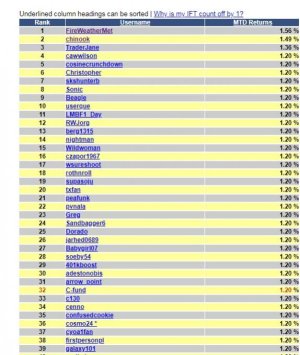

FireWeatherMet

Market Veteran

- Reaction score

- 244

- AutoTracker

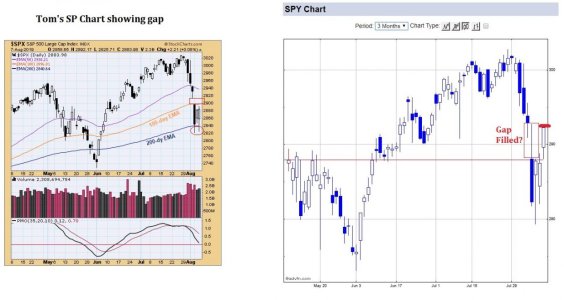

Per video below, some short term pain in next few days possible, before runup to +3000 levels on SP.

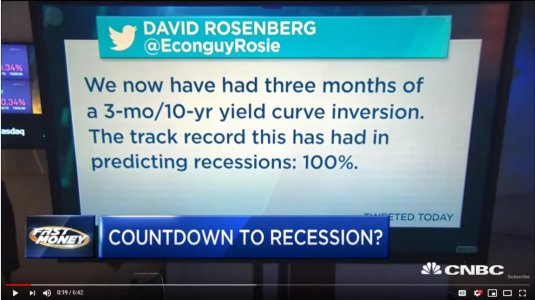

Jobs report due Friday, and it has the potential to be a "Sell the News" event, especially if it comes in close to expected numbers, as better jobs numbers, and stocks in record teritory with record low unemployment would make it tougher for Fed justifying a rate cut in July.

Locking in 1% July profits, going 100%G, but plan on jumping back in at a lower price (hopefully).

Jobs report due Friday, and it has the potential to be a "Sell the News" event, especially if it comes in close to expected numbers, as better jobs numbers, and stocks in record teritory with record low unemployment would make it tougher for Fed justifying a rate cut in July.

Locking in 1% July profits, going 100%G, but plan on jumping back in at a lower price (hopefully).

Last edited: