weatherweenie

TSP Legend

- Reaction score

- 179

Great call!

Latest move sent me from the 700's in the Tracker up to near the top in the past week. Patience (waiting for the late January dip) paid off.

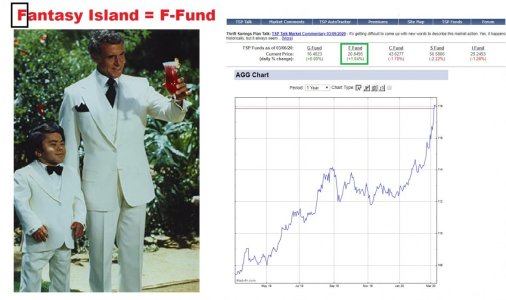

Now with 2 strong up days, trying not to get too greedy. Seems unlikely to see new highs right away given CoronaVirus uncertainties...and possible bear flag on major indices...so will lock in +3% for Feb and use 1st Feb IFT to sell 100% S and go back into 100% G COB today.