FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

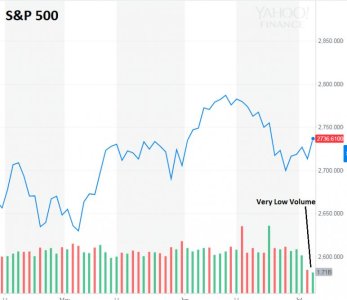

Was fortunate enough to miss most of this downturn and am currently parked in the G fund after locking in monthly gains over a week ago (up 3.3% for the month).

About to go back in on this bloodbath day, 100% S COB today.

About to go back in on this bloodbath day, 100% S COB today.