-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

IMHO

Risky move. Get out. DC bounces tend to be 2 days...so on the first positive morning u can try in. But on the 2nd day....whether its up or down, get out. Don't want to ride the next leg down.

A safer winning move would be to go into the F fund and stay there for the rest of the month and maybe into September.

I liked your advise. It appears that you have a good understanding o DCBs. I still have A position in SPY in a brokerage account and woul like to get out if there should be a DCB on Monday or Tuesday. For my understanding, can you please explain how to know when a DCB is in progress. That is, what signs to look for. Tia.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I liked your advise. It appears that you have a good understanding o DCBs. I still have A position in SPY in a brokerage account and woul like to get out if there should be a DCB on Monday or Tuesday. For my understanding, can you please explain how to know when a DCB is in progress. That is, what signs to look for. Tia.

Hi Airlift,

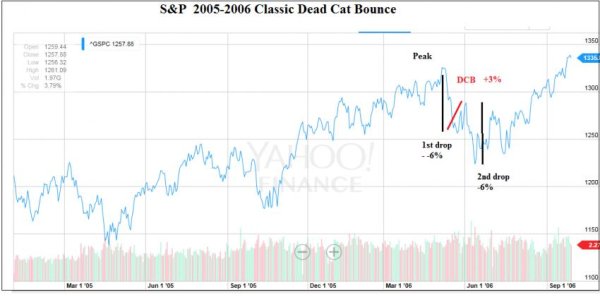

I found a "classic" DCB 9 years ago.

Its typically an abrupt 4-8% downturn...followed by a 50% retracement in 2-4 days...followed by an equal pole length downward to the first leg down.

Then its time to be "all in" as bull market continues.

But current situation is a little different. Unlike above when we were moving upwards leading to the short term DCB pattern, our current situation has been flat/range bound for 7-8 months.

A long, flat top that long seems to me, would indicate a long term downturn...more than 7-8 months. Short upward 3-5% spikes likely...but so are 6-9% down spikes.

Hope that helps

Boghie

Market Veteran

- Reaction score

- 363

I don't think I see a dead cat swinging around.

The market is a bit overvalued and will correct till it is undervalued. My guess is another 10% or so. Looking at Friday I would guess a slow decline next week, followed by a selling dump, followed by a slow decline and then another dump.

Then it is feeding time... I will probably be around -2% when I get back in with more risk...

The market is a bit overvalued and will correct till it is undervalued. My guess is another 10% or so. Looking at Friday I would guess a slow decline next week, followed by a selling dump, followed by a slow decline and then another dump.

Then it is feeding time... I will probably be around -2% when I get back in with more risk...

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I don't think I see a dead cat swinging around.

The market is a bit overvalued and will correct till it is undervalued. My guess is another 10% or so. Looking at Friday I would guess a slow decline next week, followed by a selling dump, followed by a slow decline and then another dump.

Then it is feeding time... I will probably be around -2% when I get back in with more risk...

I agree to a point. But our worst corrections (including from Jan 2008 to March 2009) was chock full of DCB's, while dropping nearly 60% over 14 months.

The reason is "the human condition"....selfish and stupid (pigs get slaughtered)....greedy to make up recent losses....denial of how bad it might be...automatic machine pre-set stock buy-backs...or fund managers so honed in on individual stock prices that they see something at a 3 month low and they see it as a buying opportunity...without thinking that the stock might not be acting independently anymore, but caught up in the current vortex itself. All of these is why a precipitous fall has little, short up-surges.

Cramer made that next to last point the other day (people seeing current stocks at recent lows)...and he actually apologized to his shows audience, telling them he should have told them to sell, and that this won't end until the "Fed Lady Sings" (which isn't until mid-late Sep) AND Chinese stocks fall back to levels they were before their precipitous rise about a year ago (which is another 25-30% down) AND Oil reaches a bottom, which the Saudi's claim they can take into the $25/barrel range and still profit while knocking out all its competitors.

Another CNBC international guest said that falling oil and related DEFLATION is posing a huge risk to the global economy, because slight inflation is good...its growth. But deflation keeps growth less than 2% and doesn't allow economies to build up enough velocity to grow out of deficits/debts, etc... He said this could be big....and I believe him.

Cramer says we're tied to this China/Worldwide Deflationary/Recessionary vortex right now. As to how bad this could be....

In the 90s S&P rose 250% from 1994-2000 (6-yrs).

From 2009-15 about 230%. in 6 yrs.

Normal long term stock avg is about 8% annually...compounded over 6 yrs that's about 60%. When you're quadrupling that average...the pressure cooker has to relieve that excess steam at some point. All stock, stochastic, bullshit aside...it is as simple as that.

My best guess, based on that table I posted just a few days ago with recent long term tranquility reversals...I'll start with the avg (or median)...down 42% next 13 months.

That gives us a buy and hold at S&P near 1360 by September 2016. Until then...if history holds...we will see 7% down weeks, followed by 3% up weeks...mixed with some flatness in between.

There was a poster recently who took issue to my musical selection of the current free-fall. Truth be told, I jokingly dedicated it only to those few on the tracker above me still in stocks. Otherwise to the rest of you...I feel your pain. Proof? Go look at where I finished 2014 (hint...start at the bottom). It's taken me 8 years and a horrible 2014 to stare into the abyss and come up with a system that works...that uses my strengths (pattern recognition) and avoids my weaknesses (overall knowledge of the market).

If you scroll back in my account talk to January this year, you'll see what I mean about my new system. This year was its trial run...and so far...its working pretty good.

I also made a vow in 2009 that I never wanted to get caught up in that kind of vortex again. I am trying to fulfill that promise now.

But I also don't want any of you to fall into that either. That's why I've been ringing the alarm bells all week, for all those who would listen.

Some on this thread have asked how to get out of it, and I tried to give the best advice I could.

BUT...there is a beauty to this kind of downturn.

It sets you up for a fantastic medium-long range profit. If you get out early (early is less than 10% loss) you get to sit in the sling-shot as it gets pulled back. Then 10-15 months from now...when we approach some of the target goals I've mentioned (that history has given us...NOT any brilliance from me), you get to sit in that slot as the stretched back, oversold slingshot releases and "whoosh!!!" those first few weeks can yield HUGE gains (5-10% month).

In the meantime, my strategy is to hunker down, and as my system dictates, spend 90-95% in the best fund, which in this environment is typically the F-fund, although in short spurts it can spiral with the rest of the market, in which case you quickly switch to G.

BUT I will look to go on an occasional 1-3 day "hunt"...if we've had a week like the past one (we will), just for stupid fun, I might buy in early next week (if I had an IFT) just to catch part of that 2-3% DCB, but quickly get out by day 1 to 3, whether it works or not.

So I wish everyone the best during these times. Its a gut-wrencher for sure, but when you're safely on the sidelines...avoiding weeks like this, it feels the same way as a 7% upweek. because in reality it is...you just reap it when you jump back in fully 12-15 months from now.:smile:

But to those who don't respect history...who are selfish (think PIGS)...and poo poo all this. I wish you well too.

But, without apology, I will dedicate this song to you as you fall further and further down the tracker. I hope you get the message before its too late, for your benefit.

FYI, I swear whoever wrote the lyrics must have been a stock broker/thrash fan in late 2008 stock free-fall.

Reading the words in the first 60 seconds...it talks about taking a beating, confusion, denial (something's got to give) and eventually the "Whoosh" downward as "the bodies hit the floor". ala 1929 stock market crash when brokers did just that.

The instrumental piece "sounds" like the market "felt" this past Friday.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

userque

TSP Legend

- Reaction score

- 36

Note that this assumes: 'buy-and-hold.'

Just to add some perspective on this selloff:

In the last 5 trading days we've lost 15 months of profits that were made since the end of May 2014 (C-Fund).

View attachment 34961

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

With about 90% of us (and Wall St fund managers) underperforming "Buy and Hold" its valid for most of us here.

Whipsaw

Market Veteran

- Reaction score

- 239

So compared with October's bottom, do you think we're done at 10% or is there more to come?

That's the $64K question at the moment... The major indicies (DOW, NAS, SPX) are heading south again after peaking an hour or so ago intraday.

Last edited:

Cactus

TSP Pro

- Reaction score

- 38

I agree with you, FWM, but with this site being geared to trading, talk like that may end up getting you banned. :laugh: :ban:With about 90% of us (and Wall St fund managers) underperforming "Buy and Hold" its valid for most of us here.

That's the $64K question at the moment... The major indicies (DOW, NAS, SPX) are heading south again after peaking an hour or so ago intraday.

Waiting here. Was going to add C & S. Unbelievable over reaction on the VIX and caught my lower support level on the DOW way to fast. I had pegged "15340 - 15500 dow next support level" around 8 this morning on twits. We could bounce considering summertime volatility but I don't need to be right on the bottom. Best of luck on everyone's decision.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

So compared with October's bottom, do you think we're done at 10% or is there more to come?

Yup...BUT...a few days of 2-3% upsurge is likely coming soon....then another 10%.

Go back in my posts a few days and you'll see a table that shows where HISTORY says we're going over the next 13 months.

Some big up months mixed in if you look at similar events...but better be nimble.

Like I said...now thru next spring or early summer, if you're gonna buy and hold one of our funds, then F stands for "friend".

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

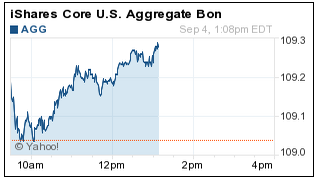

First day of the month...1st IFT of the month:

100% F fund COB today.

Will consider a dip buy after this 2nd leg nears the length of the 1st drop.

100% F fund COB today.

Will consider a dip buy after this 2nd leg nears the length of the 1st drop.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

August Monthly Wrap Up

Overall for August, my account was down -0.07%

As unimpressive as it was...it was possibly my best month outperforming the other funds for August, thanks for not getting greedy and bailing to safety as volatility started.

Other funds for the month: C fund -6.03%.....S fund -5.80%.....I fund -7.36%.....F fund -0.11%

So on the bright side I beat all the funds again for the month (except the G)...and more importantly missed most of the corrective slide...and preserved nearly all yearly gains.

On the Monthly tracker I finished #336 (out of 1462) for August...about the top 23% across the entire Tracker

The more important score...for the year...I was up +8.57%.

That was #26 on the Tracker (out of 1072 non-premium folks that I can "see"). That's in at about the top 3% of the Tracker.

Was #62 for the YTD last month so I'm still "moving on up".

The other funds for the year: C fund-2.84%.....S fund -1.24%.....I fund +0.73%.....F fund +0.68%

As for September, these are traditionally the worst times for stocks. And with a possible (or likely) Fed rate hike looming for Sep, and China uncertainties, continuing with my system of being in the best fund 90-95% of the time, I plan on spending a lot of time in the -F- fund. But will wait for new lows and with the increased volatility I might take a 1-2 day buy in and see if I could use the volatility to my advantage for a quick gain. But I don't see any possible surge in stocks to new highs unless a rate hike is off the table (or a few weeks AFTER it happens), Oil rises back up significantly, and China issues simmer down.

Good luck to all. :smile:

Tsunami

TSP Pro

- Reaction score

- 62

Awesome performance for sure last month and all year!

Your post reminded me of what I consider hands down my best year ever, 2008. The S&P finished down nearly 40% that horrible year, and yet I finished with a gain of +1.6%. Not just that, but I did it with my usual ridiculous number of trades (I just checked my spreadsheet, I made 40 IFTs that year), and even better I clawed back from double-digit losses not once, but twice in 2008; first from a -10.78% low in January to a +4.55% peak in October, then I plummeted once again to -10.66% in mid-November, and came back to finish the year in the green while most people endured an awful year (not to sound like I'm bragging, the next year 2009 was my worst and I finished trailing the market by 35%!). What a wild year that was and now I think we're in for a similar ride. I'm determined to get out of the red and jumped in today gambling that today would be the typical retest of the low. All my fingers and toes are crossed, futures are moving up strong now...I won't overstay my welcome though, maybe only 3 days and I'm out to G.

Your post reminded me of what I consider hands down my best year ever, 2008. The S&P finished down nearly 40% that horrible year, and yet I finished with a gain of +1.6%. Not just that, but I did it with my usual ridiculous number of trades (I just checked my spreadsheet, I made 40 IFTs that year), and even better I clawed back from double-digit losses not once, but twice in 2008; first from a -10.78% low in January to a +4.55% peak in October, then I plummeted once again to -10.66% in mid-November, and came back to finish the year in the green while most people endured an awful year (not to sound like I'm bragging, the next year 2009 was my worst and I finished trailing the market by 35%!). What a wild year that was and now I think we're in for a similar ride. I'm determined to get out of the red and jumped in today gambling that today would be the typical retest of the low. All my fingers and toes are crossed, futures are moving up strong now...I won't overstay my welcome though, maybe only 3 days and I'm out to G.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 115