-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Go read 2 posts below...I made a stupid 1 day move into stocks and caught a 2.5% drop. Hindsight, should have stayed in.

Not chasing right now...just waiting for better buy.

Not chasing right now...just waiting for better buy.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Cramer: We're in a danger zone. Sideline your cash

Cramer: We're in a danger zone. Sideline your cash - Yahoo Finance

Cramer: We're in a danger zone. Sideline your cash - Yahoo Finance

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Looking at the charts (courtesy of Tom since I'm too lazy this morning) it looks like we've had our "Bottom" which has held for over a month now.

With debt ceiling settled...no more major China carnage...and interest rates looking like they will stay low longer...we should not only get to our recent highs, but probably make new highs.

In-between there is likely to be a brief sell-off, but will try to not get emotional about it.

Likely going into stocks today and start Nov invested...this way if we shoot up even farther, there is opportunity to briefly get out...and buy in again.

With debt ceiling settled...no more major China carnage...and interest rates looking like they will stay low longer...we should not only get to our recent highs, but probably make new highs.

In-between there is likely to be a brief sell-off, but will try to not get emotional about it.

Likely going into stocks today and start Nov invested...this way if we shoot up even farther, there is opportunity to briefly get out...and buy in again.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

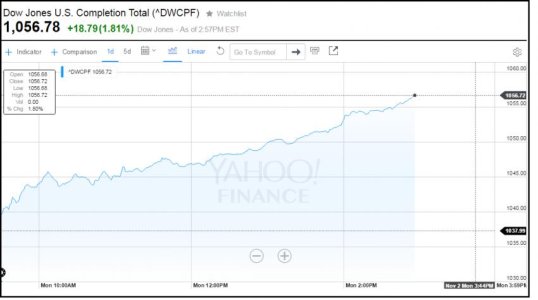

Looks like S-Fund has been the laggard and might have the most room to run. Going in 100% S COB today.

At the same time it does have a tiny bear flag formation forming, so could be a brief dip first. Or not. My system calls for me to be in stocks over 90% of the time unless we're in a full on bear market. Seems we're recovering nicely...need to get back on track...which probably means Monday morning we'll close down big.

At the same time it does have a tiny bear flag formation forming, so could be a brief dip first. Or not. My system calls for me to be in stocks over 90% of the time unless we're in a full on bear market. Seems we're recovering nicely...need to get back on track...which probably means Monday morning we'll close down big.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

That will take you a few rungs up the AT!

And looks like you are shooting right into the top 10. I guess my video had you in mind.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Tom had a nice take on this market in his evening wrap-up.

The relentless upward movement brings on a little panic to those who are not yet invested, particularly money managers who must show their results in quarterly reports, and they feel forced to chase the gains. That's how it feels right now. Every little dip is being bought and it will continue until the last investor (metaphorically) gives up (capitulates) and buys into a market that is running away from them. And theoretically that's when the rally will stop and a pullback will ensue - when the metaphorical last buyer buys. That could happen today, or it could be weeks from now.

Might consider using first IFT to "sell the news" Friday and wait for a brief pullback to buy back in. Or not. (lol) Will look at more tomorrow.

The relentless upward movement brings on a little panic to those who are not yet invested, particularly money managers who must show their results in quarterly reports, and they feel forced to chase the gains. That's how it feels right now. Every little dip is being bought and it will continue until the last investor (metaphorically) gives up (capitulates) and buys into a market that is running away from them. And theoretically that's when the rally will stop and a pullback will ensue - when the metaphorical last buyer buys. That could happen today, or it could be weeks from now.

Might consider using first IFT to "sell the news" Friday and wait for a brief pullback to buy back in. Or not. (lol) Will look at more tomorrow.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Given overly good jobs report and approaching "double top" on S&P (from Tom's evening report) I'm about to lock in just under 2% and use first IFT to ext. into -G-.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Given overly good jobs report and approaching "double top" on S&P (from Tom's evening report) I'm about to lock in just under 2% and use first IFT to ext. into -G-.

Whew!!

Exited into G in a nick of time (last Fri COB).

Just saw Sentiment Survey.

I won't tell you what the exact buy/sell ratio signals are, but will say that this recent vote was one of the most bullish (meaning bearish) of the year so far (below).

[TABLE="width: 282"]

[TR]

[TD="align: center"][TABLE="width: 282"]

[TR]

[TD="width: 154, colspan: 3, align: left"]For the week:[/TD]

[TD="width: 64"]Bulls[/TD]

[TD="width: 64"]Bears[/TD]

[/TR]

[TR]

[TD]11/09/15[/TD]

[TD]-[/TD]

[TD]11/13/15[/TD]

[TD]58%[/TD]

[TD]29%[/TD]

[/TR]

[TR]

[TD]11/02/15[/TD]

[TD]-[/TD]

[TD]11/06/15[/TD]

[TD]56%[/TD]

[TD]28%[/TD]

[/TR]

[TR]

[TD]10/26/15[/TD]

[TD]-[/TD]

[TD]10/30/15[/TD]

[TD]46%[/TD]

[TD]37%[/TD]

[/TR]

[TR]

[TD]10/19/15[/TD]

[TD]-[/TD]

[TD]10/23/15[/TD]

[TD]42%[/TD]

[TD]38%[/TD]

[/TR]

[TR]

[TD]10/12/15[/TD]

[TD]-[/TD]

[TD]10/16/15[/TD]

[TD]49%[/TD]

[TD]31%[/TD]

[/TR]

[TR]

[TD]10/05/15[/TD]

[TD]-[/TD]

[TD]10/09/15[/TD]

[TD]39%[/TD]

[TD]46%[/TD]

[/TR]

[TR]

[TD]09/28/15[/TD]

[TD]-[/TD]

[TD]10/02/15[/TD]

[TD]38%[/TD]

[TD]47%[/TD]

[/TR]

[TR]

[TD]09/21/15[/TD]

[TD]-[/TD]

[TD]09/25/15[/TD]

[TD]55%[/TD]

[TD]29%[/TD]

[/TR]

[TR]

[TD]09/14/15[/TD]

[TD]-[/TD]

[TD]09/18/15[/TD]

[TD]42%[/TD]

[TD]40%[/TD]

[/TR]

[TR]

[TD]09/08/15[/TD]

[TD]-[/TD]

[TD]09/11/15[/TD]

[TD]38%[/TD]

[TD]45%[/TD]

[/TR]

[TR]

[TD]08/31/15[/TD]

[TD]-[/TD]

[TD]09/04/15[/TD]

[TD]50%[/TD]

[TD]32%[/TD]

[/TR]

[TR]

[TD]08/24/15[/TD]

[TD]-[/TD]

[TD]08/28/15[/TD]

[TD]35%[/TD]

[TD]49%[/TD]

[/TR]

[TR]

[TD]08/17/15[/TD]

[TD]-[/TD]

[TD]08/21/15[/TD]

[TD]49%[/TD]

[TD]36%[/TD]

[/TR]

[TR]

[TD]08/10/15[/TD]

[TD]-[/TD]

[TD]08/14/15[/TD]

[TD]37%[/TD]

[TD]45%[/TD]

[/TR]

[TR]

[TD]08/03/15[/TD]

[TD]-[/TD]

[TD]08/07/15[/TD]

[TD]50%[/TD]

[TD]35%[/TD]

[/TR]

[TR]

[TD]07/27/15[/TD]

[TD]-[/TD]

[TD]07/31/15[/TD]

[TD]47%[/TD]

[TD]36%[/TD]

[/TR]

[TR]

[TD]07/20/15[/TD]

[TD]-[/TD]

[TD]07/24/15[/TD]

[TD]48%[/TD]

[TD]32%[/TD]

[/TR]

[TR]

[TD]07/13/15[/TD]

[TD]-[/TD]

[TD]07/17/15[/TD]

[TD]44%[/TD]

[TD]42%[/TD]

[/TR]

[TR]

[TD]07/06/15[/TD]

[TD]-[/TD]

[TD]07/10/15[/TD]

[TD]52%[/TD]

[TD]30%[/TD]

[/TR]

[TR]

[TD]06/29/15[/TD]

[TD]-[/TD]

[TD]07/03/15[/TD]

[TD]46%[/TD]

[TD]33%[/TD]

[/TR]

[TR]

[TD]06/22/15[/TD]

[TD]-[/TD]

[TD]06/26/15[/TD]

[TD]45%[/TD]

[TD]34%[/TD]

[/TR]

[TR]

[TD]06/15/15[/TD]

[TD]-[/TD]

[TD]06/19/15[/TD]

[TD]58%[/TD]

[TD]27%[/TD]

[/TR]

[TR]

[TD]06/08/15[/TD]

[TD]-[/TD]

[TD]06/12/15[/TD]

[TD]45%[/TD]

[TD]36%[/TD]

[/TR]

[TR]

[TD]06/01/15[/TD]

[TD]-[/TD]

[TD]06/05/15[/TD]

[TD]43%[/TD]

[TD]34%[/TD]

[/TR]

[TR]

[TD]05/25/15[/TD]

[TD]-[/TD]

[TD]05/29/15[/TD]

[TD]45%[/TD]

[TD]32%[/TD]

[/TR]

[TR]

[TD]05/18/15[/TD]

[TD]-[/TD]

[TD]05/22/15[/TD]

[TD]49%[/TD]

[TD]33%[/TD]

[/TR]

[TR]

[TD]05/11/15[/TD]

[TD]-[/TD]

[TD]05/15/15[/TD]

[TD]41%[/TD]

[TD]39%[/TD]

[/TR]

[TR]

[TD]05/04/15[/TD]

[TD]-[/TD]

[TD]05/08/15[/TD]

[TD]45%[/TD]

[TD]42%[/TD]

[/TR]

[TR]

[TD]04/27/15[/TD]

[TD]-[/TD]

[TD]05/01/15[/TD]

[TD]50%[/TD]

[TD]31%[/TD]

[/TR]

[TR]

[TD]04/20/15[/TD]

[TD]-[/TD]

[TD]04/24/15[/TD]

[TD]54%[/TD]

[TD]29%[/TD]

[/TR]

[TR]

[TD]04/13/15[/TD]

[TD]-[/TD]

[TD]04/17/15[/TD]

[TD]50%[/TD]

[TD]28%[/TD]

[/TR]

[TR]

[TD]04/06/15[/TD]

[TD]-[/TD]

[TD]04/10/15[/TD]

[TD]44%[/TD]

[TD]41%[/TD]

[/TR]

[TR]

[TD]03/30/15[/TD]

[TD]-[/TD]

[TD]04/03/15[/TD]

[TD]40%[/TD]

[TD]42%[/TD]

[/TR]

[TR]

[TD]03/23/15[/TD]

[TD]-[/TD]

[TD]03/27/15[/TD]

[TD]54%[/TD]

[TD]31%[/TD]

[/TR]

[TR]

[TD]03/16/15[/TD]

[TD]-[/TD]

[TD]03/20/15[/TD]

[TD]54%[/TD]

[TD]31%[/TD]

[/TR]

[TR]

[TD]03/09/15[/TD]

[TD]-[/TD]

[TD]03/13/15[/TD]

[TD]50%[/TD]

[TD]33%[/TD]

[/TR]

[TR]

[TD]03/02/15[/TD]

[TD]-[/TD]

[TD]03/06/15[/TD]

[TD]51%[/TD]

[TD]32%[/TD]

[/TR]

[TR]

[TD]02/23/15[/TD]

[TD]-[/TD]

[TD]02/27/15[/TD]

[TD]49%[/TD]

[TD]32%[/TD]

[/TR]

[TR]

[TD]02/16/15[/TD]

[TD]-[/TD]

[TD]02/20/15[/TD]

[TD]55%[/TD]

[TD]28%[/TD]

[/TR]

[TR]

[TD]02/09/15[/TD]

[TD]-[/TD]

[TD]02/13/15[/TD]

[TD]53%[/TD]

[TD]30%[/TD]

[/TR]

[TR]

[TD]02/03/15[/TD]

[TD]-[/TD]

[TD]02/06/15[/TD]

[TD]42%[/TD]

[TD]40%[/TD]

[/TR]

[TR]

[TD]01/26/15[/TD]

[TD]-[/TD]

[TD]01/30/15[/TD]

[TD]55%[/TD]

[TD]27%[/TD]

[/TR]

[TR]

[TD]01/19/15[/TD]

[TD]-[/TD]

[TD]01/23/15[/TD]

[TD]40%[/TD]

[TD]44%[/TD]

[/TR]

[TR]

[TD]01/12/15[/TD]

[TD]-[/TD]

[TD]01/16/15[/TD]

[TD]64%[/TD]

[TD]20%[/TD]

[/TR]

[TR]

[TD]01/02/15[/TD]

[TD]-[/TD]

[TD]01/09/15[/TD]

[TD]57%[/TD]

[TD]28%[/TD]

[/TR]

[TR]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[/TR]

[/TABLE]

[/TD]

[/TR]

[/TABLE]

weatherweenie

TSP Legend

- Reaction score

- 179

Looking like a great call to sell last Friday.

Any insight as to when you are going to be buying?

Any insight as to when you are going to be buying?

Given overly good jobs report and approaching "double top" on S&P (from Tom's evening report) I'm about to lock in just under 2% and use first IFT to ext. into -G-.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Looking like a great call to sell last Friday.

Any insight as to when you are going to be buying?

Analyst on CNBC said that 3% down was a good buying opportunity. 50 and 200 day EMA's get hit at 2.5% down from recent peak. So tentatively waiting for that, but you never know. My system tells me that I've gained nearly 1.5% on S fund and I should just lock that gain and go in today. Thinking of waiting one or two more days and re evaluate.

DreamboatAnnie

TSP Legend

- Reaction score

- 849

Well... you have been doing Great FMW! Congratulations!!!Analyst on CNBC said that 3% down was a good buying opportunity. 50 and 200 day EMA's get hit at 2.5% down from recent peak. So tentatively waiting for that, but you never know. My system tells me that I've gained nearly 1.5% on S fund and I should just lock that gain and go in today. Thinking of waiting one or two more days and re evaluate.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Well... you have been doing Great FMW! Congratulations!!!

Thanks Annie,

Thought of you the other night. On a long overnight drive I stopped at a big truck rest stop, and looked for some cheap CD's to keep me awake. Saw the best of Heart...with Dreamboat Annie as one of the songs. :smile:

Otherwise, I wish I paid more attention to the F-Fund (below).

The chart looks primed for a few days of uptick, and with todays F gains I could have padded the monthly stats a bit in quest of a possible TSP mug (lol).

Oh well, doesn't really matter...the best gains will be timing re-entrance into stocks this month and picking the right fund. Will actually look at I fund as a possibility.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Yeeaawwn...

Was toying with using 2nd IFT to jump in today...as we've been down 4 of 5 days, but overslept this morning (lol).

Might be a blessing in disguise...but we are due for a DCB soon, unless we're seeing more of a critical structural failure in our markets.

Stocks showing a bit of reversal from earlier lows today, that's how the DCB's tend to start.

Speaking of structural failure...big story, major realtors finally succumbing to online retail.

Santa Claus rally's typically revolve around retail numbers going higher, like they've done the past 5-6 years. This year promises to be different, not due to less buying, just less at big box stores, as even Grandpa is starting to figure out how to buy that new fishing rod online with his new Android phone his granddaughter gave him last Christmas.

So our headqinds going into the holidays are:

- Poor Retail Numbers

- Fed Rate Hike Looming

- Falling Oil and Strengthening Dollar.

This years Santa Claus rally might be some lumps of coal in the stockings...:notrust:

Was toying with using 2nd IFT to jump in today...as we've been down 4 of 5 days, but overslept this morning (lol).

Might be a blessing in disguise...but we are due for a DCB soon, unless we're seeing more of a critical structural failure in our markets.

Stocks showing a bit of reversal from earlier lows today, that's how the DCB's tend to start.

Speaking of structural failure...big story, major realtors finally succumbing to online retail.

Santa Claus rally's typically revolve around retail numbers going higher, like they've done the past 5-6 years. This year promises to be different, not due to less buying, just less at big box stores, as even Grandpa is starting to figure out how to buy that new fishing rod online with his new Android phone his granddaughter gave him last Christmas.

So our headqinds going into the holidays are:

- Poor Retail Numbers

- Fed Rate Hike Looming

- Falling Oil and Strengthening Dollar.

This years Santa Claus rally might be some lumps of coal in the stockings...:notrust:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Nnuut has a good playlist of Oscar Carboni Video's, very much liked by Show-Me...who was very liked here.

This latest one was very interesting...remember he's sometimes overly bullish, so when he has a negative market outlook, that's significant.

Another good technical analysis one (again from Nnuut) is this one.

This latest one was very interesting...remember he's sometimes overly bullish, so when he has a negative market outlook, that's significant.

Another good technical analysis one (again from Nnuut) is this one.

Last edited:

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 115