-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

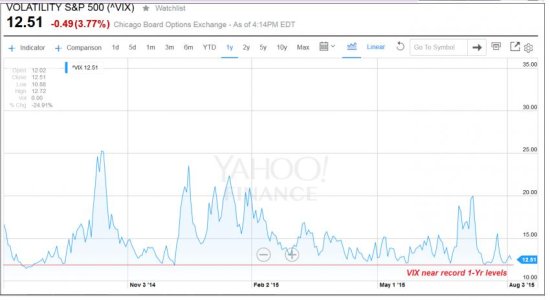

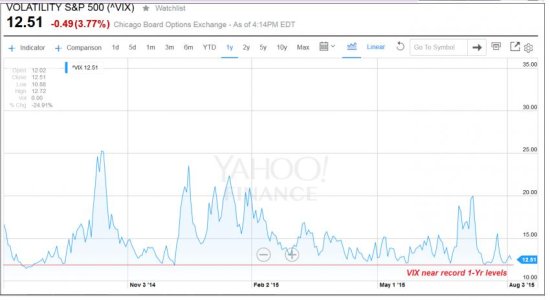

One of the reasons I left was the VIX...still very close to 1-yr record low levels...not in an elevated area where we normally see a breakout pattern in stocks as the VIX descends.

Looks like VIX might be in the early stage of an ascending cycle again. I don't want to go along for that ride.

I think we'll get that stock breakout pattern soon...but it would probably first take a big spike up in the VIX...which an upcoming FED rate hike would certainly do.

So locking in gains for now...will see what happens.

I do feel that once the FED does raise rates and stocks nosedive for 2-3 days...that would be the perfect time to buy in. But we'll see.

Oh yeah, another reason for exiting...this time of year the "smart money" starts becoming visible and they are screaming loud and clear. They have been for a few weeks. Today I listened to them.

Looks like VIX might be in the early stage of an ascending cycle again. I don't want to go along for that ride.

I think we'll get that stock breakout pattern soon...but it would probably first take a big spike up in the VIX...which an upcoming FED rate hike would certainly do.

So locking in gains for now...will see what happens.

I do feel that once the FED does raise rates and stocks nosedive for 2-3 days...that would be the perfect time to buy in. But we'll see.

Oh yeah, another reason for exiting...this time of year the "smart money" starts becoming visible and they are screaming loud and clear. They have been for a few weeks. Today I listened to them.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Khotso

Market Veteran

- Reaction score

- 27

I was hoping the gains would have held. Was gonna lock in as well, however missed the noon deadline. Gonna evaluate tomorrow and see how that goes. Hope the job report will help the market Friday, might go to G then.

Oops!

If it's any consolation, I did the very same thing. Now -- what to do today?!

felixthecat

Analyst

- Reaction score

- 41

- AutoTracker

Normally I would jump in here for some rebound Friday. However...C&S Funds look like they are breaking down with room for bigger slide. I do not really have a good feel on the jobs report but believe jobs will be strong enough to continue with September Rate Hike. Therefore...the slide likely to continue. Too risky for me. Lilly pad.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

One of the reasons I left was the VIX...still very close to 1-yr record low levels...not in an elevated area where we normally see a breakout pattern in stocks as the VIX descends.

Looks like VIX might be in the early stage of an ascending cycle again. I don't want to go along for that ride.

View attachment 34740

I think we'll get that stock breakout pattern soon...but it would probably first take a big spike up in the VIX...which an upcoming FED rate hike would certainly do.

So locking in gains for now...will see what happens.

I do feel that once the FED does raise rates and stocks nosedive for 2-3 days...that would be the perfect time to buy in. But we'll see.

Oh yeah, another reason for exiting...this time of year the "smart money" starts becoming visible and they are screaming loud and clear. They have been for a few weeks. Today I listened to them.

View attachment 34741

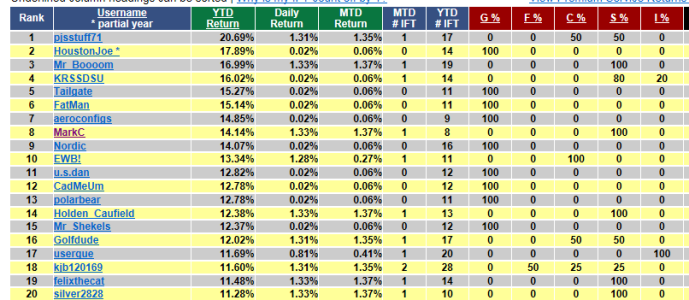

Big changes at the top, as more than half of the "Top 20" has now shifted back into stocks...a far cry from just a few days ago (above). This may change significantly COB today though as many "G-funders" in pole positions 20-30 will be moving up into the top 20 as some stock holders in positions 16-20 might be moving down.

May roll the dice and go in soon...we'll see, but probably only for a quick 1-2 day pop, otherwise I'm still wary of staying in the market until the "day of reckoning" comes in (Fed Sep rate hike decision).

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

July Monthly Wrap Up

A little late for my wrap up...had some other issues going on, but after some backtracking found the data.

Overall for July, my account finished up at +1.55%

The other funds for July: C fund +2.10%.....S fund -0.12%.....I fund +2.08%.....F fund +0.74%

So I beat the S fund (and F-fund) but lost slightly to the C and I funds.

On the Monthly tracker I finished #273 (out of 1437) for July...about the top 19% across the entire Tracker

The more important score...for the year...I was up +8.64%. That was #62 on the Tracker (out of 1072 non-premium folks that I can "see"). That's in at about the top 6% of the Tracker.

Was #62 for the YTD last month so I'm basically "treading water", as I'm hitting the brick wall of the top 50-60, and some of them have truly outstanding numbers.

Any further movement forward will likely have to be "brick-by brick" at this point.

The other funds for the year: C fund +3.39%.....S fund +4.83%.....I fund +8.73%.....F fund +0.79%

So I lost slight ground to the I-fund (ahead of it until the last trading day of the month) but am still well ahead of the rest of the funds for the year.

As for August, into September, these are traditionally the worst months for stocks. And with a possible (or likely) Fed rate hike looming for Sep, and China uncertainties, I might break with my system of "staying invested in stocks 90-95% of the time, and hang on the G-lilly pad. But will wait for new lows and with the increased volatility I might take a 1-2 day buy in and see if I could use the volatility to my advantage for a quick gain. But I do not see any possible surge in stocks to new highs unless a rate hike is off the table, and China issues simmer down.

Good luck to all. :smile:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

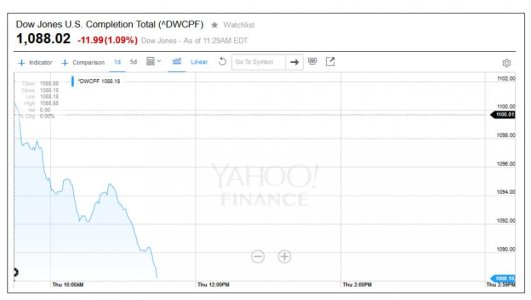

Slept in a bit this morning on the West Coast...turned on CNBC at 850 am and saw a sea of red...and tried getting up, turning on the computer, glancing at financial headline stories, then logged into my tspgov account to IFT into 50% I and 50% S. The transaction ended right at 900am PT (noon ET) and even though I've successfully done this many times, as long as there are still 20-30 seconds left before the clock strikes 1 after the hr...this time it did not take. So I am still 100% G, still likely to move up into the top 50 by days end, but my system calls for me to NOT try to time bottoms but just get in when making a short term gain on the indices (including when that gain is due to their losses).

So maybe a blessing in disguise, since more uncertainty with China currency war, and new uncertainties with Greece, might give an even better buy in price tomorrow or in a few days.

But I'm not liking the current atmosphere from a "buy and hold" perspective. Too much looming, especially the Fed decision coming up in a few weeks. I don't see us going steadily to new highs, I see us in a trading range, and the only way to play that is to buy in at the lower part of that range and exit in the upper part (and not get too greedy).

I hope the Fed hikes rates a tiny bit in September.

A 0.25% hike is nothing, won't hurt the economy one bit as long as we don't do too much too son, and just like unwinding QE, when people realize the sky isn't falling, then its off to the races. So if I get in soon, gaining several percent above all the rest of the plummeting funds, and ride out a great late Sep-Dec fully invested I should do what my system was designed to do...finish in the top 50 on the tracker...namely in the top 5% of the investor population. Anything better than that involves a bit of luck in timing, such as maybe sleeping in and not pulling the buy trigger too soon (lol)

So maybe a blessing in disguise, since more uncertainty with China currency war, and new uncertainties with Greece, might give an even better buy in price tomorrow or in a few days.

But I'm not liking the current atmosphere from a "buy and hold" perspective. Too much looming, especially the Fed decision coming up in a few weeks. I don't see us going steadily to new highs, I see us in a trading range, and the only way to play that is to buy in at the lower part of that range and exit in the upper part (and not get too greedy).

I hope the Fed hikes rates a tiny bit in September.

A 0.25% hike is nothing, won't hurt the economy one bit as long as we don't do too much too son, and just like unwinding QE, when people realize the sky isn't falling, then its off to the races. So if I get in soon, gaining several percent above all the rest of the plummeting funds, and ride out a great late Sep-Dec fully invested I should do what my system was designed to do...finish in the top 50 on the tracker...namely in the top 5% of the investor population. Anything better than that involves a bit of luck in timing, such as maybe sleeping in and not pulling the buy trigger too soon (lol)

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

More internet drama this morning...outage at my house...drove to nearby Starbucks and finished analysis and made IFT fully into equities. Sorry for no advance wording, hit the "confirm" button with 1 minute to spare (lol)

60% I...20% C...20% S COB today.

60% I...20% C...20% S COB today.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Moved into equities 2 days ago. As usual, I tend to be good at timing, but bad at which funds to invest in (went heavy on -I- (60%). Nonetheless a better move than staying in the G.

Original plan was to just squeeze out a percent or so and go back to safety for rest of Aug.

But an interesting breakthrough on the Small Caps (below) as we might be breaking the downward trend line (green icon) if we hold today and perhaps setting up for more of a higher run.

We'll see. Fed minutrs from last meeting due Wed, and I'm quite sure there will be some hawkish rate raising verbiage in there, so I might cash in whatever table scraps I get with this current run by COB tomorrow.

On the other hand, August has a ways to go and I hate exiting this early. My system calls for me to NOT be out of the market that long...but my system also does not look at the macro picture and always assumes a bull market. Will have some decisions to make...

Original plan was to just squeeze out a percent or so and go back to safety for rest of Aug.

But an interesting breakthrough on the Small Caps (below) as we might be breaking the downward trend line (green icon) if we hold today and perhaps setting up for more of a higher run.

We'll see. Fed minutrs from last meeting due Wed, and I'm quite sure there will be some hawkish rate raising verbiage in there, so I might cash in whatever table scraps I get with this current run by COB tomorrow.

On the other hand, August has a ways to go and I hate exiting this early. My system calls for me to NOT be out of the market that long...but my system also does not look at the macro picture and always assumes a bull market. Will have some decisions to make...

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

probably bailing. Quick glance shows top 800 on tracker are about 75% invested in stocks. That's too much.

probably bailing. Quick glance shows top 800 on tracker are about 75% invested in stocks. That's too much.[/QUOTE

I think people are trying to ride this out till maybe early next week. Figure a majority will bail to G maybe then.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I think people are trying to ride this out till maybe early next week. Figure a majority will bail to G maybe then.

Yup.

Most people will bail after the first two 1-2% down days in the market. I don't want to try to stay in for an extra 1/2 percent and catch the down elevator instead.

Bottom line we are 1.5% from new highs on the SP, and the market has told us over and over the past few months that it cannot go higher until the rate hike issue is resolved.

The Fed minutes come out tomorrow, and they are likely to spook markets. Good housing numbers came out today, so most experts I watch on Bloomberg and CNBC see no way that the Fed does not raise rates. In the short term, its just the "fear" of whether they raise or not that I feel will likely influence stock direction.

I jumped in at SP near 2080 a few days ago. Basically breaking even. After our recent low I thought we'd get a bigger pop upwards instead of a minor one. I think we're getting into a trading channel that's getting narrower...and is poised to break big one way or the other. I feel the first break is down. However, after we get the first Fed rate hike out of the way, that is what I'm targeting as a possible "buy and hold" for the last quarter of the year.

We'll see how it plays out. If I had another IFT I would have gone into the F fund.

FogSailing

Market Veteran

- Reaction score

- 61

Hi FMW. Nice post. I'm just the opposite of you. I do pretty good at picking the funds but I'm TIMING CHALLENGED. ;swear Wish I knew how to trade my fund selection for a little of your timing skills!!!All the best.

FS

FS

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Biggest reason for bailing into safety for the rest of the month....lets look at the charts.

Latest S&P is showing a clear "Symmetrical Triangle" or "Pennant" pattern (below).

These can break strongly either up or down. Tom's discussions also refer to either direction from an inverted head & shoulders pattern perspective. From the source where I "borrowed" the below chat examples, the eventual big break direction is in the direction of the longer term trend. That takes us back to the above chart. What do you see as a trend? Different people see different things, and especially tough in a range-bound market, but I (semi-clearly) see a downward trend from late May thru the start of this triangle.

That pushes me to think "break downward".

Other things on the macro scale that makes me lean to a downward break:

- Big slowdown in Worlds #2 and # 3 economies (China and Japan where Japan is on brink of recession).

- Dow Transports (and Oil), typical leading indicators have been strongly breaking down for several months.

- Lately the small caps have followed downward and the S&P has been the last man standing (barely).

- Threat of dreaded rate hike looms soon...Fed minutes from last meeting (where lots of rate hike talk occurred) to be released tomorrow.

- Another thing...nearly 70% of the Tracker is in stocks. The ratio is even a fraction higher for the bottom 50 (where I used to live-lol). Interestingly similar for top 50, but the top 50 is so far above the indices, they have proven to be very nimble, and at the 1st sign of trouble they can move quickly and in unison, just as they recently moved from safety to stocks.

Guessing/calculating market direction has long been a crapshoot. Even if your guess is wrong, chances are if you wait long enough you'll get your price anyway, as you can be right for the wrong reasons. Being well above the C, S, I, F (and G) funds for the year makes me feel better about this decision, as even if I'm wrong, it would take a 3-5% upward move in the indices to catch me...and that I'm pretty confident (famous last words) won't be happening in the next 10 trading days.

Latest S&P is showing a clear "Symmetrical Triangle" or "Pennant" pattern (below).

These can break strongly either up or down. Tom's discussions also refer to either direction from an inverted head & shoulders pattern perspective. From the source where I "borrowed" the below chat examples, the eventual big break direction is in the direction of the longer term trend. That takes us back to the above chart. What do you see as a trend? Different people see different things, and especially tough in a range-bound market, but I (semi-clearly) see a downward trend from late May thru the start of this triangle.

That pushes me to think "break downward".

Other things on the macro scale that makes me lean to a downward break:

- Big slowdown in Worlds #2 and # 3 economies (China and Japan where Japan is on brink of recession).

- Dow Transports (and Oil), typical leading indicators have been strongly breaking down for several months.

- Lately the small caps have followed downward and the S&P has been the last man standing (barely).

- Threat of dreaded rate hike looms soon...Fed minutes from last meeting (where lots of rate hike talk occurred) to be released tomorrow.

- Another thing...nearly 70% of the Tracker is in stocks. The ratio is even a fraction higher for the bottom 50 (where I used to live-lol). Interestingly similar for top 50, but the top 50 is so far above the indices, they have proven to be very nimble, and at the 1st sign of trouble they can move quickly and in unison, just as they recently moved from safety to stocks.

Guessing/calculating market direction has long been a crapshoot. Even if your guess is wrong, chances are if you wait long enough you'll get your price anyway, as you can be right for the wrong reasons. Being well above the C, S, I, F (and G) funds for the year makes me feel better about this decision, as even if I'm wrong, it would take a 3-5% upward move in the indices to catch me...and that I'm pretty confident (famous last words) won't be happening in the next 10 trading days.

Last edited:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Hi FMW. Nice post. I'm just the opposite of you. I do pretty good at picking the funds but I'm TIMING CHALLENGED. ;swear Wish I knew how to trade my fund selection for a little of your timing skills!!!All the best.

FS

Sitting in the G and F...I think you're in a good place right now. :smile:

Similar threads

- Replies

- 0

- Views

- 115