-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FireWeatherMet Account Talk

- Thread starter FireWeatherMet

- Start date

JamesE

TSP Strategist

- Reaction score

- 4

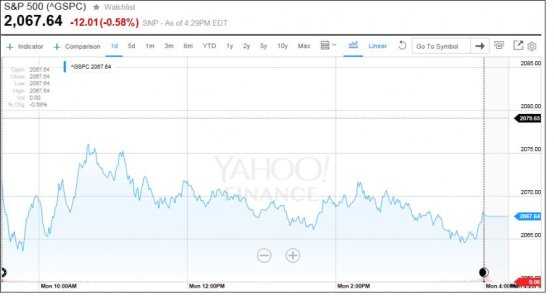

Is it bothering anyone else that the S&P was at this level last November? I can't help but think we are putting in a rounded top. I mean just look at that thing with an un-biased eye.

OK, back to regularly scheduled program of eating losses and waiting for a rebound. I guess China will be the scapegoat for this particular wash-rinse-repeat...

OK, back to regularly scheduled program of eating losses and waiting for a rebound. I guess China will be the scapegoat for this particular wash-rinse-repeat...

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

FWM,

I had a plan to catch you on the tracker. Unfortunately losing less daily was not that plan. :laugh:

Are we racing to Zero? Stop with the redness already.

Speaking of tracker, looks like the two of you are my neighbor. I guess we'll be heading south together today as well. :suspicious:

Well, an analogy to this is the movie "The Perfect Storm". If you're in the storm...been in it for awhile, do you turn around and sail back thru the same many hours of storminess you've gone thru for no gain, or do you stay the course and keep sailing to get to the edge of the storm and into much better weather quicker, to get to port and cash in your fish.

That applies here. Are we well less than halfway down from where we're immediately headed to?

Or is today (and Fri) the bloodbath we always see before we spike up 3 or 4 straight days?

My system requires me to stay with stocks...and only briefly selling near new highs or overextended short term parabolic run-ups. This means that if I missed exiting at a top and am caught in the downturn, I ride it out, whether its 2% down or 8% down, because in a bull market, the snap back is typically stronger in the end. So the S&P can drop 6% this month but could easily go up 8% in Aug-Sep. Its at the top of that 8% run. that I would try to make a quick 1/2 to 1% by stepping aside for 2-4 days.

HOWEVER, if there is a major correction, of over 10%, I think I would consider modifying my plan and sidestep that. The danger is that you miss the bottom, and then suddenly there is a 4% gain upwards in 2 days. Then you end up feeling confused, losing on BOTH ends of that bet....and falling BEHIND the indices instead of remaining ahead of them.

I am (as I believe both of you are) AHEAD of them (except myself slightly behind the I) right now. Whether we have a 25-30% year in the C,S,I funds or a 2-3% year....the goal is to finish at least 1% or preferably more than 2% AHEAD of them. With any downturn, I am still on track of doing that. When I exit the stocks, I am in greater danger of falling behind them.

Last edited:

pmaloney

Analyst

- Reaction score

- 22

Yeah, This hurts but I remember October 16, 2014 year when after taking heavy losses for more than a week I decided to use my second IFT to go to G. I was going to New York City for a fun long weekend and didn't want to be in the market when I couldn't do anything about more losses. I also remember watching the market rise 1% on the train ride to NYC and not being able to do anything about it as the market rose steadily the entire rest of the month because I didn't have another IFT. That was a bummer.

So it's steady as she goes for at least the rest of the month but if China doesn't straiten out soon I might be a lot more cautious in August and especially in September and October.

Good luck! :smile:

So it's steady as she goes for at least the rest of the month but if China doesn't straiten out soon I might be a lot more cautious in August and especially in September and October.

Good luck! :smile:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Is it bothering anyone else that the S&P was at this level last November? I can't help but think we are putting in a rounded top. I mean just look at that thing with an un-biased eye.

OK, back to regularly scheduled program of eating losses and waiting for a rebound. I guess China will be the scapegoat for this particular wash-rinse-repeat...

Being at levels of 7 months ago is not a bother...it is a blessing and gets me excited. It is a strong BUY signal in a bull market.

But, if we are not in a bull market, or more to the point, ending our current 6 1/2 year bull run...then a "rounded top" is a HUGE concern.

A look at the last 20 years of the S&P (gives only monthly values) shows we are at the "flattest" that we've seen during this time. Being at all-time highs with that is troubling.

I've noted flat periods that were followed by a fall (red) or rise (green). Are we currently a red or a green? You decide.

BYW...The "stay with the C,S,I funds" method >90% of time only works in a bull market. Theoretically, in a bear market, the -F- fund becomes the fund of 90% holding.

Haven't back tested that "F-Bear" scenario as well as the "Bull CSI", but am starting to, because sooner or later, it will be needed.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Funny how this level keeps popping up at the close.:suspicious:

I don't want to create controversy, and I read in the Cramer picture that if 2067 doesn't hold we would have another leg down. However, I copied from Cramer's analysis on that day 3 floors of support below 2067:

2048 - 2054

2021 - 2027, and

2000 - 2007

if I am wrong, so be it; but perhaps someone else can go back and check. Tia.

FogSailing

Market Veteran

- Reaction score

- 61

I think you're right FMW. My thinking is that Thursday and Friday (or at least Friday) will be up after China settles down. The caveat: Absent other "startling" news that would negatively impact the market. No telling what's hiding in the closet ready to come out BUT my guess is that if China is down again tomorrow and holds steady on Wednesday; the markets will be clamoring for any positive reason to rise. How much is a question but 2-3% wouldn't surprise me.

Longer term: China's market meltdown has long term implications but that won't hold down a short term rally.

Best wishes to all in your investing.

FS

Longer term: China's market meltdown has long term implications but that won't hold down a short term rally.

Best wishes to all in your investing.

FS

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

I don't want to create controversy, and I read in the Cramer picture that if 2067 doesn't hold we would have another leg down. However, I copied from Cramer's analysis on that day 3 floors of support below 2067:

2048 - 2054

2021 - 2027, and

2000 - 2007

if I am wrong, so be it; but perhaps someone else can go back and check. Tia.

No controversy. You're absolutely right.

Just FYI, that Fib pattern has already finished.

Cramer had an update a few weeks after the initial Fib analysis, confirming it as 2067 was breached BUT giving 2 other levels of support. in the 2040's and 2020's.

Obviously, the 1st support level held and we've retraced well past 50% (more like 90%), so seriously, forget about that previous Fib. worry about the next one.:smile:

I mentioned that about a week ago on this thread that we found support in the 2040's like Cramer said we might. Our retracement settled that score....PROBABLY

I was just making the point that the SP dropped all day today then in the last few minutes, the tiniest of rallies to get back to 2067. Just an observation. Not drawing any conclusions YET.:notrust:

Only thing to worry about, shows itself more on the weekly/monthly charts that these downturns towards 2067 are forming the bottom spikes of what could be a crown top. MAYBE.

Or we're poised for a longer term rise.

Gotta look at all scenarios...but in the short term I think FogSailing is right...the next short term move is probably up.

99percent

TSP Strategist

- Reaction score

- 5

It ain't about the fundamentals anymore kids! It's all news driven and guess what? Foreign stock futures are tanking! China failed! Get ready for a whole new stock market! Eke out what you can from foreign buying of American stocks. Meager as it will be.

And you can throw the Stock Traders Almanac right out the car window. Thus endeth the rant.

And you can throw the Stock Traders Almanac right out the car window. Thus endeth the rant.

userque

TSP Legend

- Reaction score

- 36

It ain't about the fundamentals anymore kids! It's all news driven and guess what? Foreign stock futures are tanking! China failed! Get ready for a whole new stock market! Eke out what you can from foreign buying of American stocks. Meager as it will be.

And you can throw the Stock Traders Almanac right out the car window. Thus endeth the rant.

Do you have/use the Almanac? Just curious as to how serious you're being.:smile:

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Breaking it up a little...a pretty cool story.:smile:

Walmart's Oldest US Employee Celebrates His 103rd Birthday

https://gma.yahoo.com/walmarts-olde...-birthday-190337456--abc-news-topstories.html

Damn, if I'm still a Fed at 103, then I'd be getting ta FERS pension comparable to the current CSRS Max Pension...near 80% of my top 3 years.

Plus already collecting Social Security for near;y 40 years.

And hopefully having 10 million in my TSP Account.:1244:

But this guy seems to have something money cannot buy. Happiness.:smile:

Walmart's Oldest US Employee Celebrates His 103rd Birthday

https://gma.yahoo.com/walmarts-olde...-birthday-190337456--abc-news-topstories.html

Damn, if I'm still a Fed at 103, then I'd be getting ta FERS pension comparable to the current CSRS Max Pension...near 80% of my top 3 years.

Plus already collecting Social Security for near;y 40 years.

And hopefully having 10 million in my TSP Account.:1244:

But this guy seems to have something money cannot buy. Happiness.:smile:

HoustonJoe

First Allocation

- Reaction score

- 1

needs update and correction

Last edited:

HoustonJoe

First Allocation

- Reaction score

- 1

It ain't about the fundamentals anymore kids! It's all news driven and guess what? Foreign stock futures are tanking! China failed! Get ready for a whole new stock market! Eke out what you can from foreign buying of American stocks. Meager as it will be.

And you can throw the Stock Traders Almanac right out the car window. Thus endeth the rant.

And there you have it. This has been going on for at least a year and a half. It's interesting to see month after month key trends that are relied to current world events. They drop and then rise and we declare a new record high. Everyone buys in and a couple of days later, it amazingly drops again. It's a sure bet and easy way to accumulate a lot of wealth or if listing to traditional sources lose a fortune.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

It ain't about the fundamentals anymore kids! It's all news driven and guess what? Foreign stock futures are tanking! China failed! Get ready for a whole new stock market! Eke out what you can from foreign buying of American stocks. Meager as it will be.

And you can throw the Stock Traders Almanac right out the car window. Thus endeth the rant.

The Above is called "A Buy Signal...We've Hit a Short Term Bottom".:smile:

Works in tandem with our Sentiment Survey which in most years kicks @rse.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

In process of briefly bailing to G fund. Plan to reload with I later this month (maybe in a few days).

Similar threads

- Replies

- 0

- Views

- 115