-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Epic's Account Talk

- Thread starter Epic

- Start date

Epic

TSP Pro

- Reaction score

- 365

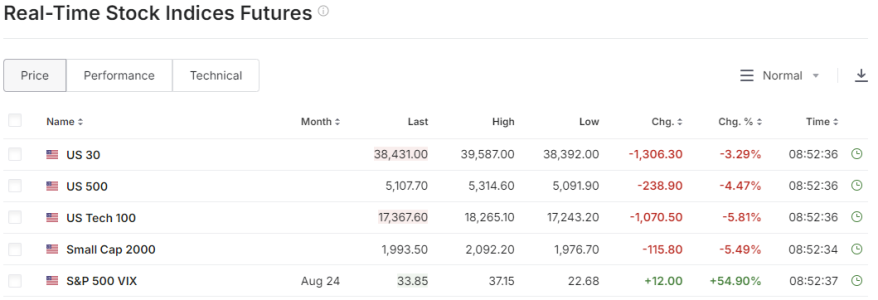

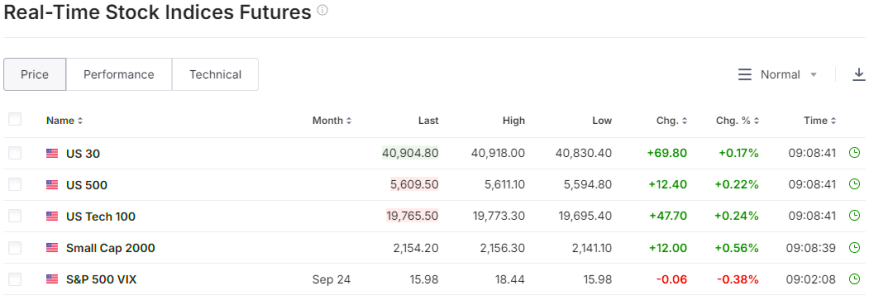

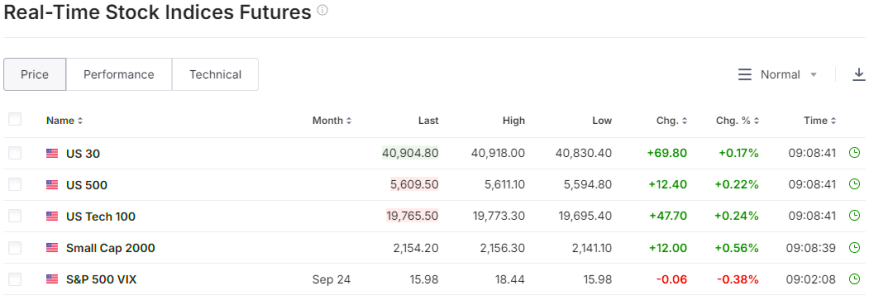

Man-O-Man-O-Man-O-Man............... Just over 30 minutes till the Open.

Hang On ! ! ! ! ! :blink:

Stock Market Futures - Investing.com

Hang On ! ! ! ! ! :blink:

Stock Market Futures - Investing.com

Epic

TSP Pro

- Reaction score

- 365

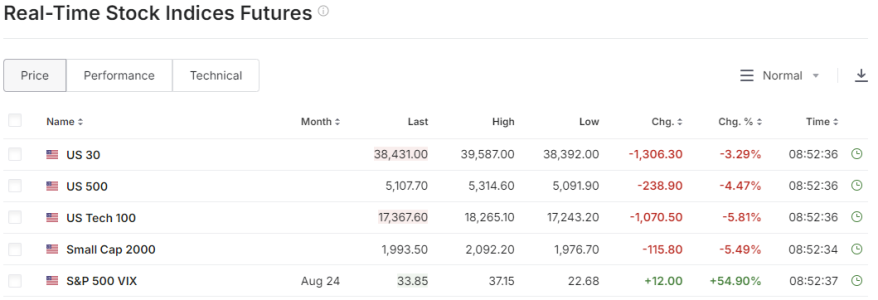

30 minutes till the CPI numbers are released at 8:30, but futures seem fairly calm. (calm before the storm??? :dunno:)

I'm not sensing any overall feeling of nervousness this time around, especially after the the drop and semi-rebound of last week, but we'll see. We've been surprised before.

I'm a bit more concerned of what's going on with Iran and stuff like that as being a trigger for another reason for the market to tank. I think the CPI numbers are already priced in to some extent.......

Steady as she goes

Stock Market Futures - Investing.com

I'm not sensing any overall feeling of nervousness this time around, especially after the the drop and semi-rebound of last week, but we'll see. We've been surprised before.

I'm a bit more concerned of what's going on with Iran and stuff like that as being a trigger for another reason for the market to tank. I think the CPI numbers are already priced in to some extent.......

Steady as she goes

Stock Market Futures - Investing.com

Epic

TSP Pro

- Reaction score

- 365

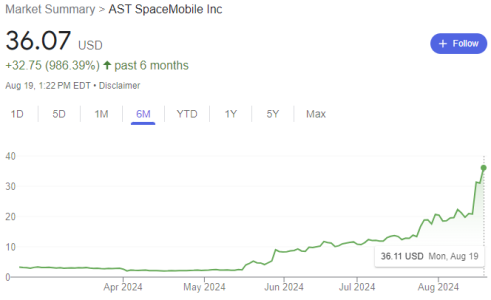

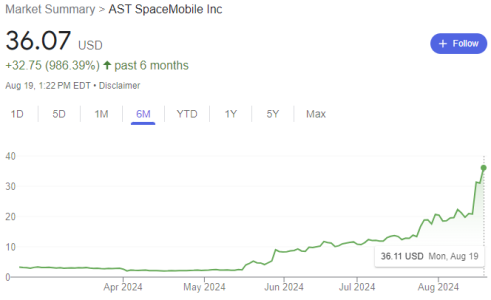

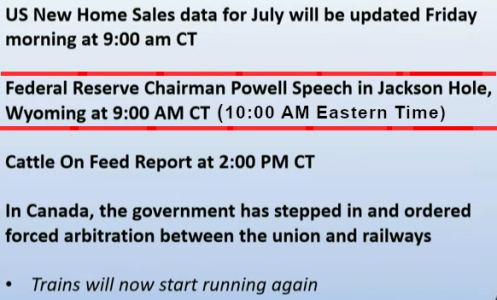

Gonna be a crazy week and J. Pow speaks at Jackson Hole on Friday with possible clues on rate cut..........

Goldman Sachs, JPM see the S&P 500 hitting new highs in coming months By Investing.com

Goldman Sachs, JPM see the S&P 500 hitting new highs in coming months.

U.S. equities could rally over the coming four weeks, Goldman Sachs strategists said Monday, citing positive technical equity dynamics and a tailwind from corporate buybacks.

Also (on a side note), should have held onto ASTS that I was all jacked on months ago, but I'm an idiot. It wasn't going anywhere (at the time), so I bailed and forgot about it for the most part. :banghead:

.

.

Goldman Sachs, JPM see the S&P 500 hitting new highs in coming months By Investing.com

Goldman Sachs, JPM see the S&P 500 hitting new highs in coming months.

U.S. equities could rally over the coming four weeks, Goldman Sachs strategists said Monday, citing positive technical equity dynamics and a tailwind from corporate buybacks.

Also (on a side note), should have held onto ASTS that I was all jacked on months ago, but I'm an idiot. It wasn't going anywhere (at the time), so I bailed and forgot about it for the most part. :banghead:

.

.

Epic

TSP Pro

- Reaction score

- 365

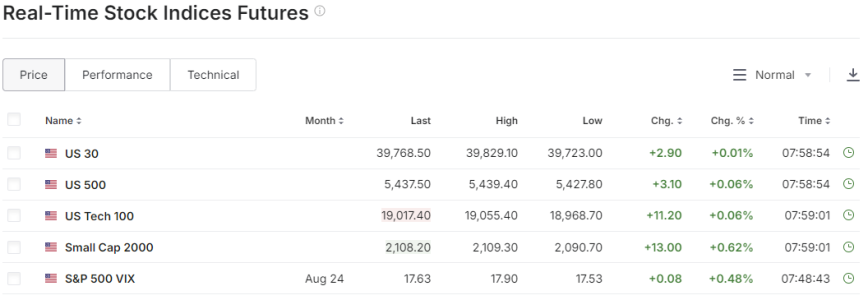

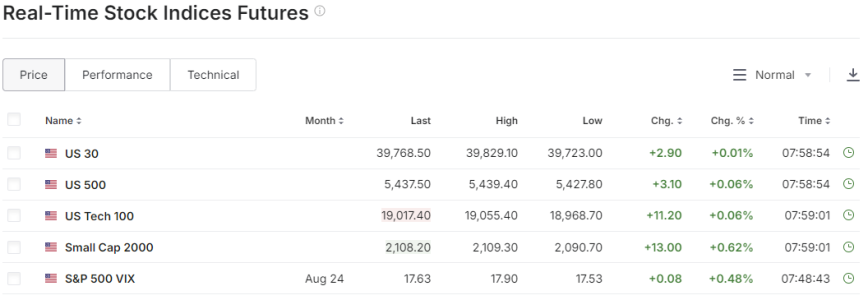

20 minutes till the open. Futures lookin flat, but better than yesterday. :fing02:

Stock Market Futures - Investing.com

Stock Market Futures - Investing.com

Epic

TSP Pro

- Reaction score

- 365

I'm just playin with trying to make notations (Annotate) within the chart, but I don't know what I'm doing. Can't figure out how to save anything, so I'm just learning as I go. This is S-Fund (DWCPF).

The only way to learn is by trying. :laugh:

:laugh:

I started from the link I had from a while ago that DBA posted >>>>> $DWCPF | SharpCharts | StockCharts.com

.... and then tried to make changes from there. This IS NOT my strong point......:cheesy: (can U tell????) :nuts: ha ha ha . . . .

The only way to learn is by trying.

I started from the link I had from a while ago that DBA posted >>>>> $DWCPF | SharpCharts | StockCharts.com

.... and then tried to make changes from there. This IS NOT my strong point......:cheesy: (can U tell????) :nuts: ha ha ha . . . .

Epic

TSP Pro

- Reaction score

- 365

Today, in just over an hour...........(should be interesting).

For one who's been looking for a new place to live for about a year now, I'm also interested in the Housing Data.

It's brutal out there (and has been for a while) for both New and Pre-Owned homes. Luckily I'm in no rush and have plenty of time. The pricing is insane and keeps climbing, even in some remote areas that you think wouldn't be affected.

UGGHHH . . . .

For one who's been looking for a new place to live for about a year now, I'm also interested in the Housing Data.

It's brutal out there (and has been for a while) for both New and Pre-Owned homes. Luckily I'm in no rush and have plenty of time. The pricing is insane and keeps climbing, even in some remote areas that you think wouldn't be affected.

UGGHHH . . . .

- Reaction score

- 821

Today, in just over an hour...........(should be interesting).

For one who's been looking for a new place to live for about a year now, I'm also interested in the Housing Data.

It's brutal out there (and has been for a while) for both New and Pre-Owned homes. Luckily I'm in no rush and have plenty of time. The pricing is insane and keeps climbing, even in some remote areas that you think wouldn't be affected.

UGGHHH . . . .

View attachment 61614

Jackson Hole is 2 hours behind eastern time. So I guess he starts his speech at 8am MT.

Epic

TSP Pro

- Reaction score

- 365

Epic

TSP Pro

- Reaction score

- 365

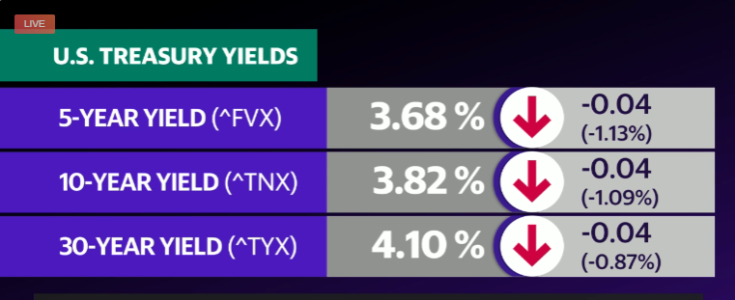

Fed's Powell says 'time has come' to begin cutting interest rates

Fed's Powell says 'time has come' to begin cutting interest rates

Federal Reserve Chair Jerome Powell sent a straightforward message to markets in a key speech on Friday, saying "the time has come" for the central bank to begin lowering interest rates.

Speaking at the Kansas City Fed's annual economic symposium in Jackson Hole, Powell said: "The time has come for policy to adjust."

"The direction of travel is clear," Powell added, "and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

.

Fed's Powell says 'time has come' to begin cutting interest rates

Federal Reserve Chair Jerome Powell sent a straightforward message to markets in a key speech on Friday, saying "the time has come" for the central bank to begin lowering interest rates.

Speaking at the Kansas City Fed's annual economic symposium in Jackson Hole, Powell said: "The time has come for policy to adjust."

"The direction of travel is clear," Powell added, "and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

.

- Reaction score

- 821

Fed's Powell says 'time has come' to begin cutting interest rates

Fed's Powell says 'time has come' to begin cutting interest rates

Federal Reserve Chair Jerome Powell sent a straightforward message to markets in a key speech on Friday, saying "the time has come" for the central bank to begin lowering interest rates.

Speaking at the Kansas City Fed's annual economic symposium in Jackson Hole, Powell said: "The time has come for policy to adjust."

"The direction of travel is clear," Powell added, "and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

.

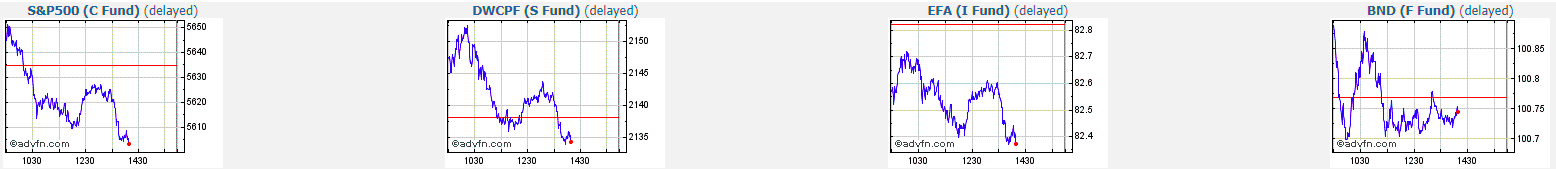

The market has taken a liking to his message. Now we wait and see what happens by 4pm ET.

Epic

TSP Pro

- Reaction score

- 365

The market has taken a liking to his message. Now we wait and see what happens by 4pm ET.

Agreed.......... The Market is getting a boost but Treasuries are taking a small hit, which is not good for the G-Fund Crew when they go to calculate for Sept. rates. Also, lots more data coming out between now and when the Fed makes this change, so it all may be derailed depending...... I guess we'll see... :dunno:

- Reaction score

- 2,455

Agreed.......... The Market is getting a boost but Treasuries are taking a small hit, which is not good for the G-Fund Crew when they go to calculate for Sept. rates. Also, lots more data coming out between now and when the Fed makes this change, so it all may be derailed depending...... I guess we'll see... :dunno:

Interesting take. Maybe adding a little F-fund would help counter any slip in the G-fund rate. As bond yields fall, the F-fund moves up.

Epic

TSP Pro

- Reaction score

- 365

Interesting take. Maybe adding a little F-fund would help counter any slip in the G-fund rate. As bond yields fall, the F-fund moves up.

Hmmmmm........ :scratchchin: That's a good point. I didn't think of that.

That may not be such a bad idea if this chart thingy that I saw this morning somewhere is accurate and if history does indeed repeat itself.

If it does and things tank shortly after the Fed cut like in 2007, then maybe F-fund would be the place to be. :dunno:

Epic

TSP Pro

- Reaction score

- 365

Still sitting in G-Fund with nothing much to post, so for all you Techy's and NVDA fanboys (and girls) out there, I found this to be pretty cool, even though I don't understand most of it (like what's a Token??).

Still a privately held Company, so nothing to invest in..................yet. :23:

Maybe Tom or some of you others can understand all this stuff. It just sounds like this is going to be some crazy hyper fast AI technology that could take out NVDA as Top Dawg.

Today, we are announcing Cerebras inference – the fastest AI inference solution in the world. Cerebras inference delivers 1,800 tokens per second for Llama3.1 8B and 450 tokens per second for Llama3.1 70B, which is 20x faster than NVIDIA GPU-based hyperscale clouds. Cerebras inference offers the industry’s best pricing at 10c per million tokens for Lama 3.1 8B and 60c per million tokens for Llama 3 70B. Cerebras inference is open to developers today via API access.

Powered by the third generation Wafer Scale Engine, Cerebras inference runs Llama3.1 20x faster than GPU solutions at 1/5 the price. At 1,800 tokens/s, Cerebras Inference is 2.4x faster than Groq in Llama3.1-8B. For Llama3.1-70B, Cerebras is the only platform to enable instant responses at a blistering 450 tokens/sec. All this is achieved using native 16-bit weights for the model, ensuring the highest accuracy responses.

Links (2 of them):

Homepage | Cerebras

Introducing Cerebras Inference: AI at Instant Speed - Cerebras

...

Still a privately held Company, so nothing to invest in..................yet. :23:

Maybe Tom or some of you others can understand all this stuff. It just sounds like this is going to be some crazy hyper fast AI technology that could take out NVDA as Top Dawg.

Today, we are announcing Cerebras inference – the fastest AI inference solution in the world. Cerebras inference delivers 1,800 tokens per second for Llama3.1 8B and 450 tokens per second for Llama3.1 70B, which is 20x faster than NVIDIA GPU-based hyperscale clouds. Cerebras inference offers the industry’s best pricing at 10c per million tokens for Lama 3.1 8B and 60c per million tokens for Llama 3 70B. Cerebras inference is open to developers today via API access.

Powered by the third generation Wafer Scale Engine, Cerebras inference runs Llama3.1 20x faster than GPU solutions at 1/5 the price. At 1,800 tokens/s, Cerebras Inference is 2.4x faster than Groq in Llama3.1-8B. For Llama3.1-70B, Cerebras is the only platform to enable instant responses at a blistering 450 tokens/sec. All this is achieved using native 16-bit weights for the model, ensuring the highest accuracy responses.

Links (2 of them):

Homepage | Cerebras

Introducing Cerebras Inference: AI at Instant Speed - Cerebras

...

Similar threads

- Replies

- 0

- Views

- 82

- Replies

- 1

- Views

- 235

- Replies

- 0

- Views

- 194