Epic

TSP Pro

- Reaction score

- 365

Good Morning....... just a couple quick vids that you may like showing that some of the market key players emphasizing a bit of overall general Caution moving forward.

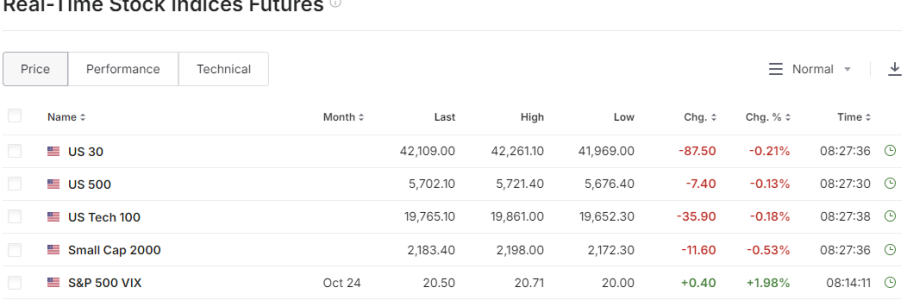

Warren Buffett continues to sell off some of Berkshire assets, and Tom Lee is also equally concerned about a potential 7 to 10 percent pullback.

We shall see ............ :thinking: :dunno:

.

Warren Buffett continues to sell off some of Berkshire assets, and Tom Lee is also equally concerned about a potential 7 to 10 percent pullback.

We shall see ............ :thinking: :dunno:

.