Epic

TSP Pro

- Reaction score

- 365

Dang, those insiders are good.

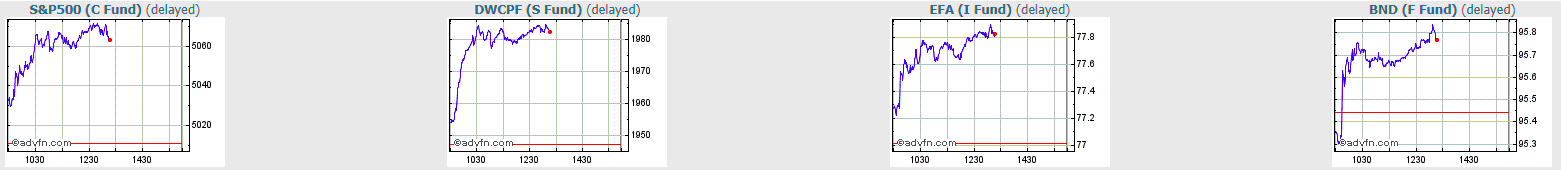

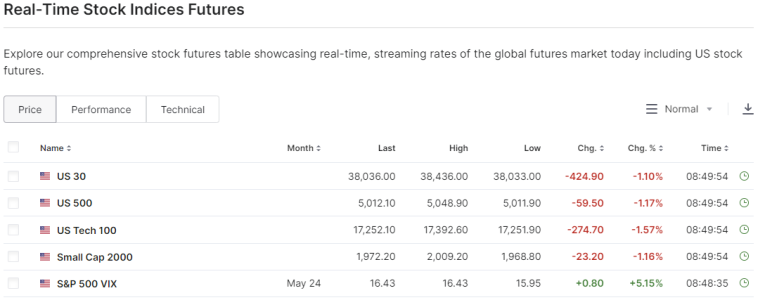

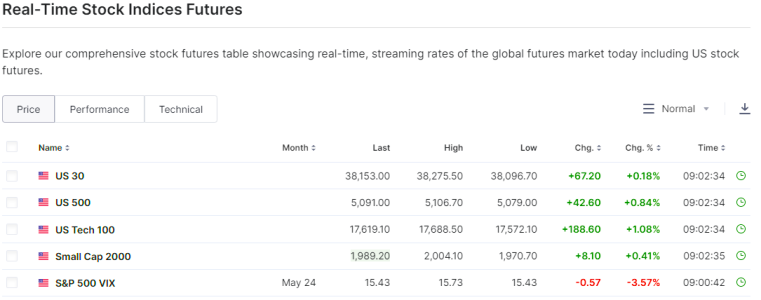

Yeah.....Today looks pretty sweeeeeet so far. My only thought is that since today is Turnaround Tuesday, does that now work inversely and we give it all back and then some over the next three days???

Another thing is that all funds are going up at the same time. That's not "normal" behavior, and always makes me a bit cautious. :worried: