-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Epic's Account Talk

- Thread starter Epic

- Start date

Epic

TSP Pro

- Reaction score

- 365

Just an FYI from today >>>>>> Powell: Fed still sees rate cuts this year; election timing won'''t affect decision | AP News

Powell: Fed still sees rate cuts this year; election timing won’t affect decision.

“The recent data do not ... materially change the overall picture,” Powell said in a speech at Stanford University, “which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2% on a sometimes bumpy path.”

..

Powell: Fed still sees rate cuts this year; election timing won’t affect decision.

“The recent data do not ... materially change the overall picture,” Powell said in a speech at Stanford University, “which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2% on a sometimes bumpy path.”

..

Epic

TSP Pro

- Reaction score

- 365

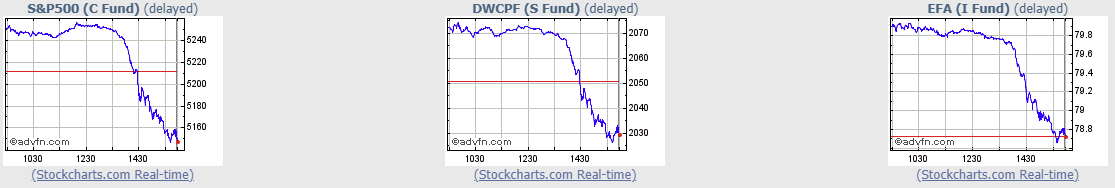

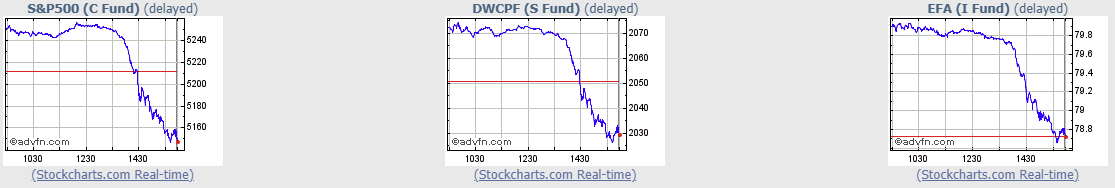

So yesterday's close was rather ugly......

....and for whatever reason, there may be a pattern developing, with a headline from April 2nd saying:

Dow falls nearly 400 points to continue second quarter’s weak start https://www.cnn.com/2024/04/02/investing/dow-falls-q2/index.html

....and another headline from yesterday (April 4th) saying:

Markets News, April 4, 2024: Dow Drops 500 Points as Oil Surges to 5-Month High https://www.investopedia.com/dow-jones-today-04042024-8624640

SO..... I'm wondering if this is the start of that draw down or "Air Pocket" that Tom Lee has been anticipating in Stocks, where he believes there will be a 7 to 10% Drop overall??

It may be lagging a bit (he was predicting it by end of March), but he's been saying that once that occurs, it may be an opportune time to invest in Small Caps for what he still believes to be potentially a 30 to 50% gain for the year.

Could this be what we're seeing?????? :dunno::thinking::06: :scratchchin:

:scratchchin:

....and for whatever reason, there may be a pattern developing, with a headline from April 2nd saying:

Dow falls nearly 400 points to continue second quarter’s weak start https://www.cnn.com/2024/04/02/investing/dow-falls-q2/index.html

....and another headline from yesterday (April 4th) saying:

Markets News, April 4, 2024: Dow Drops 500 Points as Oil Surges to 5-Month High https://www.investopedia.com/dow-jones-today-04042024-8624640

SO..... I'm wondering if this is the start of that draw down or "Air Pocket" that Tom Lee has been anticipating in Stocks, where he believes there will be a 7 to 10% Drop overall??

It may be lagging a bit (he was predicting it by end of March), but he's been saying that once that occurs, it may be an opportune time to invest in Small Caps for what he still believes to be potentially a 30 to 50% gain for the year.

Could this be what we're seeing?????? :dunno::thinking::06:

FAAM

TSP Strategist

- Reaction score

- 117

Thank goodness the Friday charts for CSI didn't look like those you posted for Thursday! I'm not ready for the correction yet... I went from somewhat negative over the new-year into JAN to a little positive now as I incrementally invested more from G to CSI to where I'm mostly aggressive now; the trend is still bull -- and NAIM is still positioned that way too. So here's to hoping and looking up.

Epic

TSP Pro

- Reaction score

- 365

As reputable previous talker who was usually at the top, Birchtree always said " You have to stay in to win"

db

....and he would also close any bullish quote like that with a "Snort"..... :laugh:

I hadn't "Officially" joined back then, but I did enjoy reading his posts and his never wavering Perma-Bullish stance. Hope he's doing well......

Epic

TSP Pro

- Reaction score

- 365

A quick vid (from yesterday) to start the day. (Becky Quick, Tom Lee, Jamie Dimon)

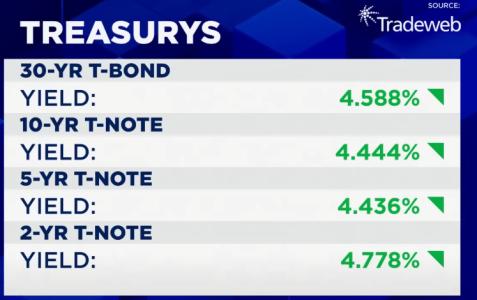

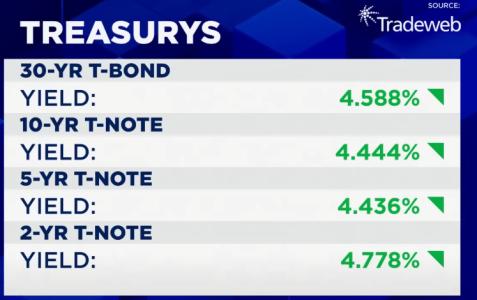

Also, I noticed this graphic (below) in the vid.

The G-fund rate is calculated monthly, based on the average yield of all U.S. Treasury securities with 4 or more years to maturity, so this will be good for G-fund.....right??? I'm asking cause I'm not sure if this is the correct data for that. :dunno:

.

Also, I noticed this graphic (below) in the vid.

The G-fund rate is calculated monthly, based on the average yield of all U.S. Treasury securities with 4 or more years to maturity, so this will be good for G-fund.....right??? I'm asking cause I'm not sure if this is the correct data for that. :dunno:

.

- Reaction score

- 2,450

That sounds about right. Based on recent daily payments the annual G-fund rate is about 4.35% and yields have been up this week so maybe it's inching up into the 4.4's ?

The G-fund rate is calculated monthly, based on the average yield of all U.S. Treasury securities with 4 or more years to maturity, so this will be good for G-fund.....right??? I'm asking cause I'm not sure if this is the correct data for that. :dunno:

View attachment 60614

.

Epic

TSP Pro

- Reaction score

- 365

That sounds about right. Based on recent daily payments the annual G-fund rate is about 4.35% and yields have been up this week so maybe it's inching up into the 4.4's ?

Hey thanks Tom !! I wasn't sure if I was looking at, or if that was the correct data or not.

I'm not really sure if it even affects what's being paid out for this month (since that's been determined), but it will/should have some affect on calculating the G-fund rate for May, which could now be a bump up from the current rate if Treasuries continue to stay elevated. :fing02::fing02:

- Reaction score

- 2,450

I could be wrong about this, but I believe the G-fund return fluctuates daily, and the share price reflects that so we don't know the monthly return until the end of the month.

Probably too much information, but here's how I do it...

Today's price minus yesterday's price / yesterday's price = the daily return.

On Tuesday thru Friday that daily return amount can be multiplied by 365 to get an annualized return. But it can change from day to day.

On Monday's the price reflects the increase from Saturday, Sunday and Monday. That's why multiplying it by 365 doesn't work.

Today that return looks pretty good with the S&P down 1.14%.

Hope that makes sense. I could be wrong but that's always how I looked at it.

Probably too much information, but here's how I do it...

Today's price minus yesterday's price / yesterday's price = the daily return.

On Tuesday thru Friday that daily return amount can be multiplied by 365 to get an annualized return. But it can change from day to day.

On Monday's the price reflects the increase from Saturday, Sunday and Monday. That's why multiplying it by 365 doesn't work.

Today that return looks pretty good with the S&P down 1.14%.

Hope that makes sense. I could be wrong but that's always how I looked at it.

Epic

TSP Pro

- Reaction score

- 365

The G Fund rate is calculated by the U.S. Treasury as the weighted average yield of approximately 191 U.S. Treasury securities on the last day of the previous month.

I don't believe it is recalculated daily

That's what I kind of thought as well.

I'm going on what they say here https://www.tspfolio.com/tspgfundinterestrate right above the graph.

"As of April 2024, the TSP G Fund interest rate is 4.250%. The rate is calculated monthly, based on the average yield of all U.S. Treasury securities with 4 or more years to maturity. The chart and table below show the recent history of the G Fund rate. The rate has fluctuated in the 0.75% to 5.00% range since 2012:"

:dunno:

- Reaction score

- 2,450

Thanks for clearing it up. Please disregard all of my speculation. I'm a speculator and I like to speculate -- too much.

I did go back and notice that the G-fund has been up exactly 0.012% everyday in recent weeks (except Mondays as I mentioned.)

I did go back and notice that the G-fund has been up exactly 0.012% everyday in recent weeks (except Mondays as I mentioned.)

Epic

TSP Pro

- Reaction score

- 365

Good Morning......

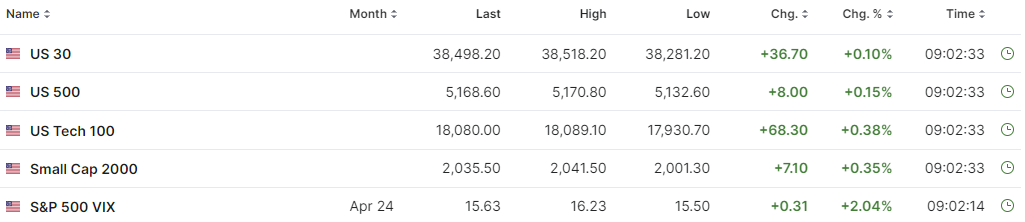

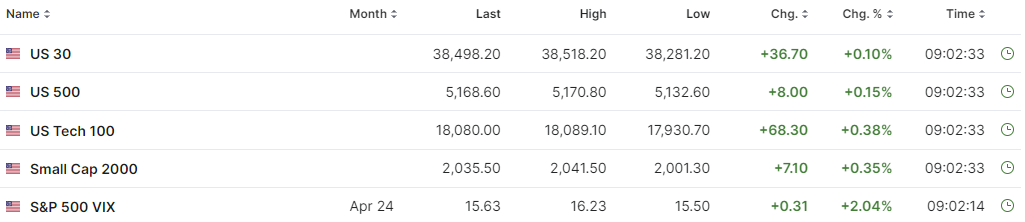

Just some random data from this mornings PPI report. Buckle up for what may be a bumpy ride. Futures have been Up, Down, Up, Down all morning, with US Tech looking the strongest.....

PPI for March came in at +2.1% YoY below expectations of +2.2% YoY

PPI for March came in at +0.2% MoM below expectations of +0.3% MoM

At 2.1%, annual PPI is now back at the highest level since September 2023.

U.S. core PPI rose 2.4% on an annual basis, compared to estimates for an increase of 2.3%, and up from 2.1% in February.

The chance of the Fed cuts this year rapidly abates

Moreover, June rate cut expectations fell from 56% to 15%

https://www.investing.com/indices/indices-futures

Just some random data from this mornings PPI report. Buckle up for what may be a bumpy ride. Futures have been Up, Down, Up, Down all morning, with US Tech looking the strongest.....

PPI for March came in at +2.1% YoY below expectations of +2.2% YoY

PPI for March came in at +0.2% MoM below expectations of +0.3% MoM

At 2.1%, annual PPI is now back at the highest level since September 2023.

U.S. core PPI rose 2.4% on an annual basis, compared to estimates for an increase of 2.3%, and up from 2.1% in February.

The chance of the Fed cuts this year rapidly abates

Moreover, June rate cut expectations fell from 56% to 15%

https://www.investing.com/indices/indices-futures

- Reaction score

- 2,450

Tom Lee: Market is in a good position to rally 'as long as inflation tracks better than expected'

Dang, those insiders are good.

Similar threads

- Replies

- 0

- Views

- 77

- Replies

- 1

- Views

- 234

- Replies

- 0

- Views

- 193