-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Epic's Account Talk

- Thread starter Epic

- Start date

Epic

TSP Pro

- Reaction score

- 365

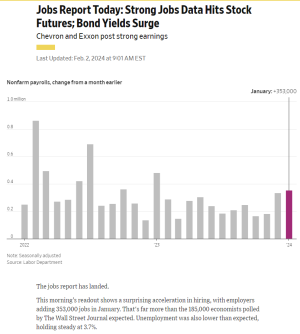

So the rumor now is no Fed Pivot or rate cuts in 2024, or at least a major push back on when that occurs (if at all) with these job numbers ? ? ?

Also (correct me if I'm wrong), every time I read about rate cuts in the past, the market goes down significantly right after, so maybe this isn't such bad news after all.

Who knows :dunno:. I'm not a numbers guy, but I do try to read up and learn as much as I can about it. Should be a crazy day ...... :nuts:

Happy Friday Everybody

wsj.com

..

Also (correct me if I'm wrong), every time I read about rate cuts in the past, the market goes down significantly right after, so maybe this isn't such bad news after all.

Who knows :dunno:. I'm not a numbers guy, but I do try to read up and learn as much as I can about it. Should be a crazy day ...... :nuts:

Happy Friday Everybody

wsj.com

..

Epic

TSP Pro

- Reaction score

- 365

More reinforcement from Tom Lee yesterday......

One of Wall Street's most bullish strategists says a stock market correction is imminent

Fundstrat's Tom Lee says investors should brace for a correction.

One of Wall Street's most bullish strategists says a stock market correction is imminent

Fundstrat's Tom Lee says investors should brace for a correction.

- A stock market correction appears imminent after the S&P 500 rallied 21% over a period of 14 weeks, according to Fundstrat's Tom Lee.

- Lee still maintains a bullish view on stocks for 2024, but said history suggests the market is about to reach a short-term peak.

- "I think we [the S&P 500] might be approaching something close to 5,000, maybe a little higher, and then I think a drawdown follows," Lee said.

Epic

TSP Pro

- Reaction score

- 365

Good Morning.......

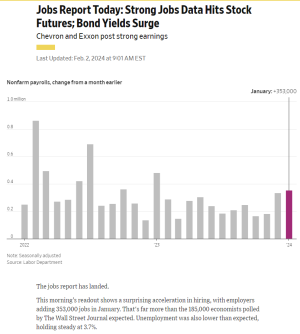

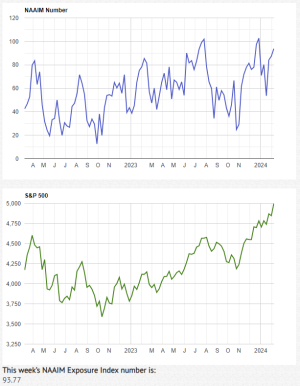

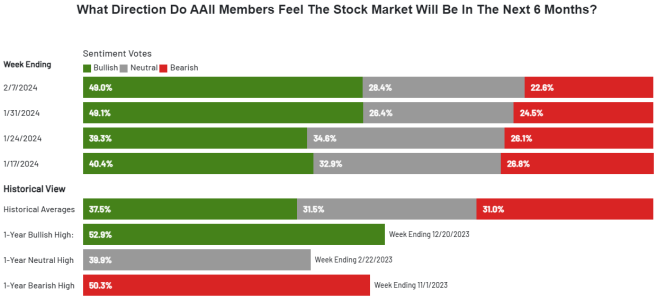

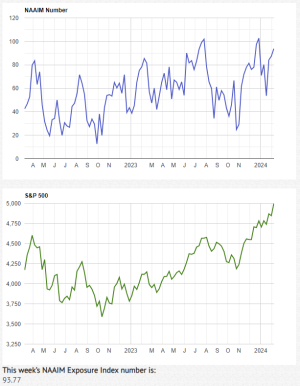

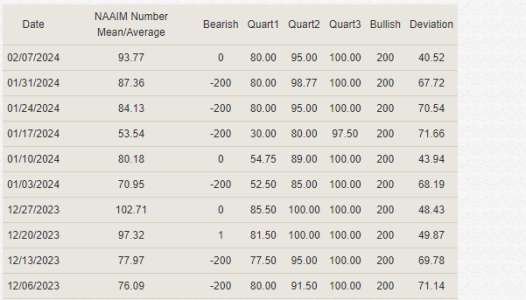

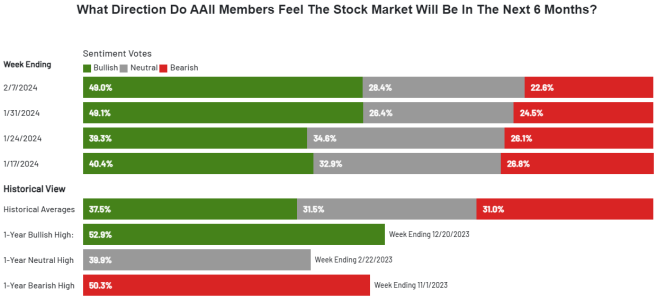

Here you go. Check Coolhand for his analysis of the NAAIM readings.

https://www.naaim.org/programs/naaim-exposure-index/

https://www.aaii.com/sentimentsurvey

..

Here you go. Check Coolhand for his analysis of the NAAIM readings.

https://www.naaim.org/programs/naaim-exposure-index/

https://www.aaii.com/sentimentsurvey

..

Epic

TSP Pro

- Reaction score

- 365

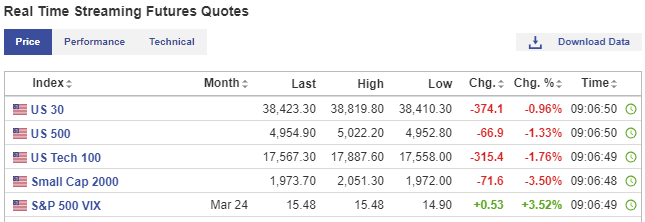

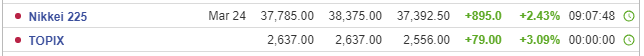

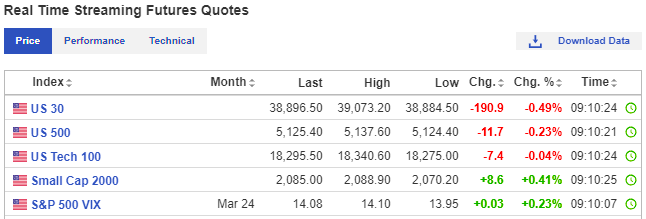

20 min till the Open.... Typical (Turnaround) Tuesday action in futures. Japan is kickin some butt though...... 4 what it's worth.:nuts:

Good luck everybody ! ! ! !

Stock Market Futures - Investing.com

...

Good luck everybody ! ! ! !

Stock Market Futures - Investing.com

...

Epic

TSP Pro

- Reaction score

- 365

Days like this keeps me off on the sidelines, but really how bad was it??? Well about -1.36% in both S&P and the Dow. But if your following the latest & greatest of late, Tom Lee, he's been talking for a while now about a -7% Draw Down by the end of March or shortly there after, so there's still a LONG way to go in another 6 to 8 weeks out. Then he believes that it may be a good buying opportunity, especially in Small Caps for the remainder of the year. That's what I'm going to be keeping my eye on.

So, pull up a stool and grab a cold one. I'll be waiting it out at my favorite watering hole............

.

.

So, pull up a stool and grab a cold one. I'll be waiting it out at my favorite watering hole............

.

.

Epic

TSP Pro

- Reaction score

- 365

Seeing that this is Todays "Hot Topic"......

Link for full document with all the Data >>>>>> SEC.gov | Request Rate Threshold Exceeded

FOR IMMEDIATE RELEASE:

•Record quarterly Data Center revenue of $18.4 billion, up 27% from Q3, up 409% from year ago

•Record full-year revenue of $60.9 billion, up 126%

Link for full document with all the Data >>>>>> SEC.gov | Request Rate Threshold Exceeded

FOR IMMEDIATE RELEASE:

NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2024

•Record quarterly revenue of $22.1 billion, up 22% from Q3, up 265% from year ago

•Record quarterly Data Center revenue of $18.4 billion, up 27% from Q3, up 409% from year ago

•Record full-year revenue of $60.9 billion, up 126%

Epic

TSP Pro

- Reaction score

- 365

Good Morning.....

I just wanted to share this with anyone else who may find it as interesting as I did. Just a fantastic conversation covering a variety of general topics that are at the forefront of todays economic situation, both in the States and elsewhere. It's a lengthy discussion (1:44.39) but goes by rather quickly because of how relevant everything is. I found myself saying to myself "Hey yeah......what about that???" throughout the discussion.

One person in the Comments sums up one of my main thoughts and concerns and reflects exactly what I've done by saying:

@RWROW / 1 month ago

We all have to play an end game as we get old and retire. I'm already retired and thought that doing without a lot of goodies other people enjoyed through their lives and putting funds into my 401k instead would make the years of retirement less stressful and more comfortable. The scenario that Ms Pomboy paints terrifies me; I feel that those of us who saved for retirement will pay for the bailouts of those who don't feel obligated to be responsible for their debts.

With that being said, I hope some of you enjoy this:

I just wanted to share this with anyone else who may find it as interesting as I did. Just a fantastic conversation covering a variety of general topics that are at the forefront of todays economic situation, both in the States and elsewhere. It's a lengthy discussion (1:44.39) but goes by rather quickly because of how relevant everything is. I found myself saying to myself "Hey yeah......what about that???" throughout the discussion.

One person in the Comments sums up one of my main thoughts and concerns and reflects exactly what I've done by saying:

@RWROW / 1 month ago

We all have to play an end game as we get old and retire. I'm already retired and thought that doing without a lot of goodies other people enjoyed through their lives and putting funds into my 401k instead would make the years of retirement less stressful and more comfortable. The scenario that Ms Pomboy paints terrifies me; I feel that those of us who saved for retirement will pay for the bailouts of those who don't feel obligated to be responsible for their debts.

With that being said, I hope some of you enjoy this:

JTH

TSP Legend

- Reaction score

- 1,158

One person in the Comments sums up one of my main thoughts and concerns and reflects exactly what I've done by saying:

Thanks, I'm already in much of this ecosystem, I swear if I traded based on my belief system I wouldn't even leave the house.

I'm really curious how post election 2025 will turn out, but even more so 2026. Presidential Year 2 has a 50% yearly win ratio over the past 16 cycles.

Epic

TSP Pro

- Reaction score

- 365

Good Morning.......

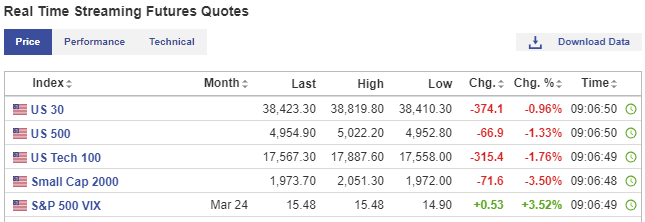

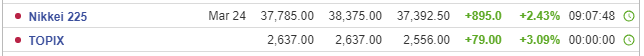

15 minutes till the Open. Not the best way to start a Monday, but at least Small Caps are slightly GREEN (at the moment).:nuts:

Good Luck everybody ! ! ! ! !

Stock Market Futures - Investing.com

15 minutes till the Open. Not the best way to start a Monday, but at least Small Caps are slightly GREEN (at the moment).:nuts:

Good Luck everybody ! ! ! ! !

Stock Market Futures - Investing.com

Epic

TSP Pro

- Reaction score

- 365

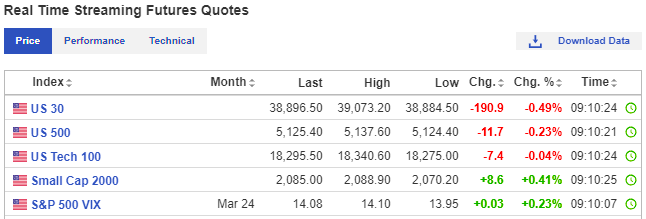

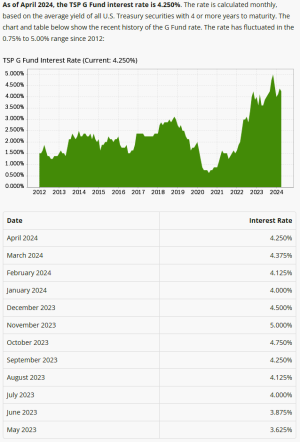

Good Morning...... So we fell back for this month -.125% in G to 4.250%, but that still enough to net me more than enough a month and do it completely STRESS FREE. :aargh4::crazy::dunce::crying:

Once you leave your career in Federal Service, it changes the game a bit. You make decisions more based on self preservation. That's why I can't emphasize enough that while your still working, do whatever it takes to MAX OUT your TSP. Contribute as much as possible till it hurts. In the end, when it's all said & done, you can sit back, relax, and be very happy with what you've accomplished. Works for me........ :fing02:

What is the current TSP G Fund interest rate?

Once you leave your career in Federal Service, it changes the game a bit. You make decisions more based on self preservation. That's why I can't emphasize enough that while your still working, do whatever it takes to MAX OUT your TSP. Contribute as much as possible till it hurts. In the end, when it's all said & done, you can sit back, relax, and be very happy with what you've accomplished. Works for me........ :fing02:

What is the current TSP G Fund interest rate?

PessOptimist

Market Veteran

- Reaction score

- 67

Has been higher and lower. Low 0.97% in 2020. More:

2002 5.00% 2001 5.39% 2000 6.42% 1999 5.99% 1998 5.74% 1997 6.77% 1996 6.76% 1995 7.03% 1994 7.22% 1993 6.14% 1992 7.23% 1991 8.15% 1990 8.90% 1989 8.81% 1988 8.81%

2002 5.00% 2001 5.39% 2000 6.42% 1999 5.99% 1998 5.74% 1997 6.77% 1996 6.76% 1995 7.03% 1994 7.22% 1993 6.14% 1992 7.23% 1991 8.15% 1990 8.90% 1989 8.81% 1988 8.81%

- Reaction score

- 2,450

Good Morning...... So we fell back for this month -.125% in G to 4.250%, but that still enough to net me more than enough a month and do it completely STRESS FREE.

Just so everyone's on the same page here, you're saying the G-fund's 12-month annualized return is 4.25%. It paid 0.38% in March, right? Just checking. :smile:

Epic

TSP Pro

- Reaction score

- 365

Just so everyone's on the same page here, you're saying the G-fund's 12-month annualized return is 4.25%. It paid 0.38% in March, right? Just checking. :smile:

I'm not saying anything...... LOL :laugh:. (deny, deny, deny....)

I'm simply offering the information from the link provided >>> What is the current TSP G Fund interest rate? so that others like myself who currently hang out in G-Fund know what the current rate is overall from month to month. I would imagine you are correct in the true monthly dividend that G-Fund actually pays for that monthly timeframe. I've just never mathematically broken it down to that level.

What I AM saying to anyone who wants advice and or insight from real life experience is that if you stay focused and sacrifice (even just a little) in order to put as much as you possibly can into your TSP, it will pay off.

My Gov. pay was "middle of the road" at best. It was never on the high end of things like others around me, but that just motivated me more.

Right now, sitting in G-Fund with the current rate, I'm pulling in 5K a month in complete safety. If I can do it, anyone here can do it too.

I hope this inspires others out there to push hard and do well, even in these crazy times we're in at the moment. Best of luck to everyone :fing02:

WorkFE

TSP Legend

- Reaction score

- 516

I'm pulling in 5K a month in complete safety.

I think you did pretty good in your working years.

- Reaction score

- 2,450

I think you did pretty good in your working years.

I concur. Well done!

Similar threads

- Replies

- 0

- Views

- 77

- Replies

- 1

- Views

- 234

- Replies

- 0

- Views

- 193