Epic (and others!),

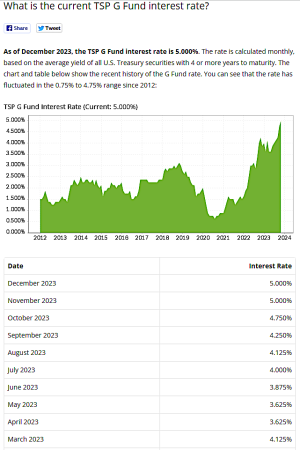

I just joined the forum recently to start reading up on how folks utilize their TSP accounts. I've been active duty since 2012 and have saved up a good bit, but will be separating soon. Since there's been a lot of G fund rate discussion, and it is sitting relatively high right now, I was considering taking out a TSP loan. I'm currently invested in the L2050 lifecycle fund, which is ~11% G fund. The loan amount I'm considering taking out is equal to my account balance * 0.11, and I would then reallocate the remaining balance back into the L2060. This will be my "lazy" way of essentially distributing everything back out to a L2050-ish allocation, since the loan will be treated as the G fund portion of my current L2050 investment. The loan money, meanwhile, will be invested in long term US Treasury bonds (such as 4.3% for the 30 year bond).

What downsides am I not thinking about? It is a $50 application fee for the general purpose loan, I start my next stable career while I'm on terminal leave, and I have a good bit of savings which will allow me to repay the loan after separation. I don't need the loan money for anything, and don't anticipate any need for it in the future. I'm not really interested in taking on extra risk by just converting the entire account balance to L2060, even though I know it can offer a higher reward. For all intents and purposes, I don't see how taking the loan will change my long term account balance, but if someone else has projected out a similar scenario and sees a major loss in value, let me know!

Thanks!